How Enterprise AI Developers are Building the Next Wave of Finance Chatbots

In 2025, more than 70% of financial institutions will be using or testing AI-driven chatbots to improve customer service and cut costs. These smart assistants work around the clock. They give users fast help, answer questions, and bring real-time financial data into conversations. But building a finance chatbot isn’t just about making things chatty. It means feeding the system live market feeds, training it on domain-specific knowledge, and making sure it follows rules and stays secure. This is where skilled enterprise AI chatbot developers make the real difference.

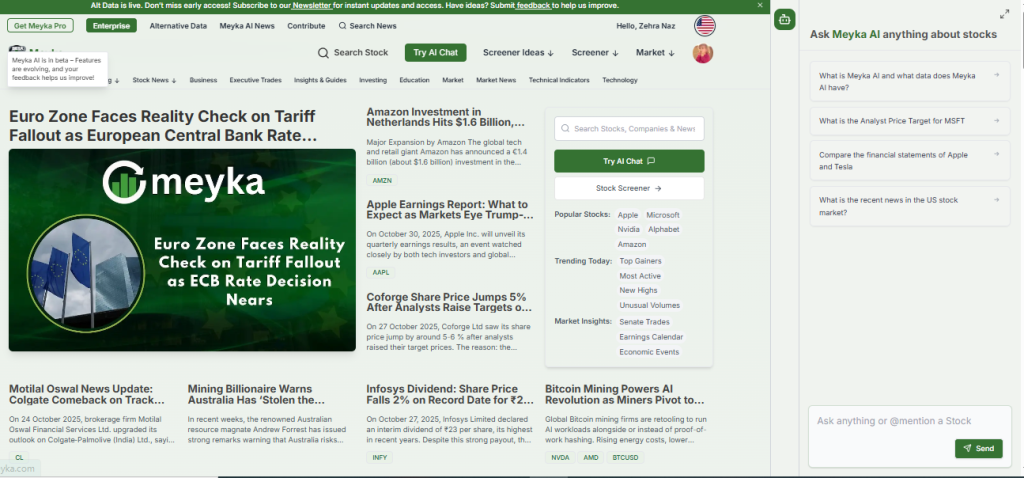

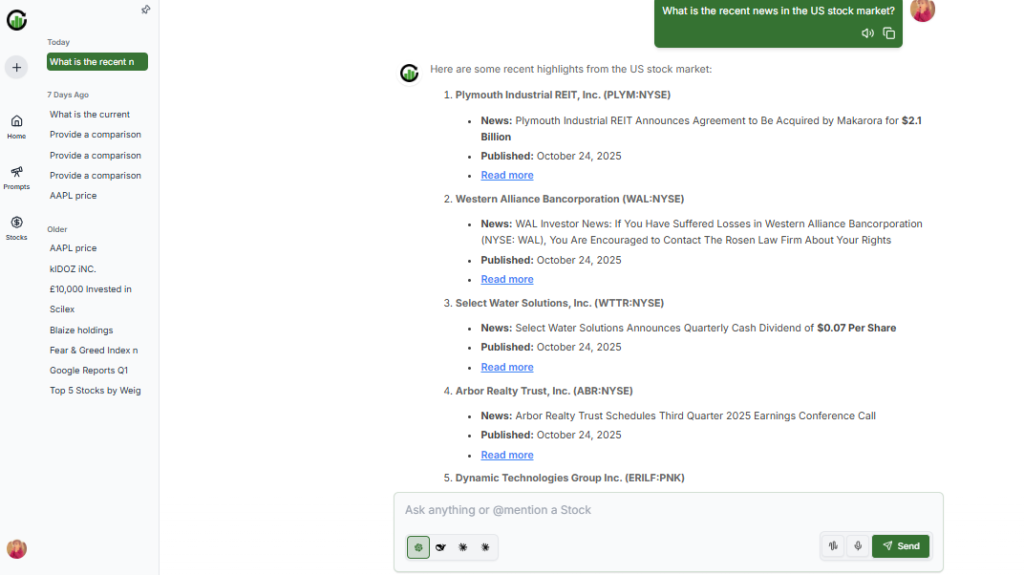

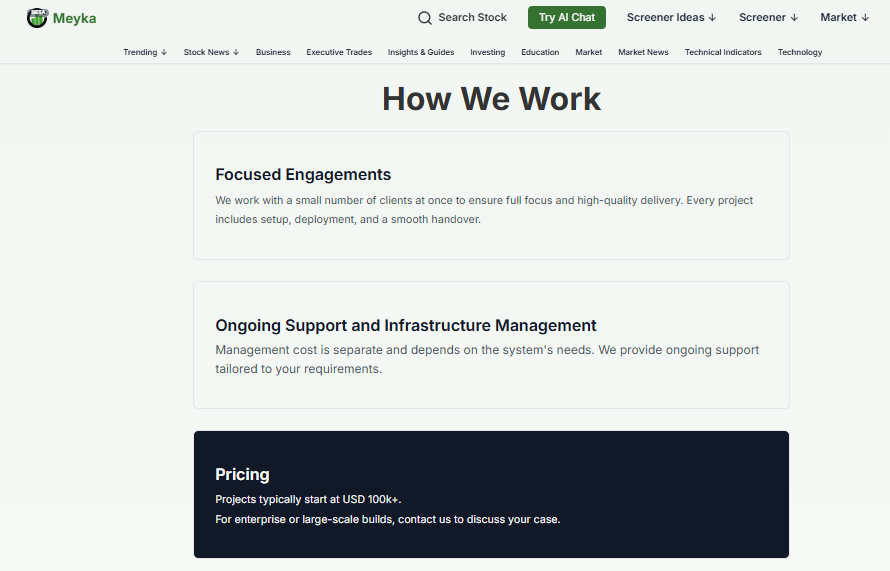

At Meyka, our expert enterprise AI chatbot developers designed a finance-first AI platform that ties together data streams, language models, and audit logs so institutions can deliver intelligent, trustworthy support. Let’s explore how today’s developers build the next wave of finance chatbots and how Meyka helps make it real.

Why Finance Needs Specialized Chatbots?

Finance is full of fast moves and strict rules. Market prices change by the second. Clients demand clear answers and proof. Generic chatbots miss the mark. They lack live market feeds, do not keep detailed audit logs. They often fail on financial language and ratios. Real solutions must combine live data, domain knowledge, and traceable reasoning.

Meyka’s platform focuses on these needs. It connects market data, financial models, and document trails to make answers relevant and verifiable.

Core Architecture that Powers Trustworthy Assistants

Modern finance chatbots use layered designs. The data layer ingests market feeds, news, and accounting tables. The model layer runs domain-tuned language models and risk engines. The integration layer connects to CRMs, trading systems, and vaults.

The governance layer logs queries and enforces access rules. Each layer must be observable. That means monitoring data quality, model outputs, and latency. Meyka’s stack shows how these parts work together. Its pipelines update stock signals in real time and attach source IDs to every claim. This design lets firms answer fast without losing control.

Enterprise AI chatbot Developers & Engineering Workflows

Engineers build finance assistants by creating tight feedback loops. They start with small, realistic test cases. These tests include earnings summaries, peer comparisons, and compliance checks. Subject matter experts review outputs. Metrics track correctness and hallucination rates. Teams run continuous evaluations to detect model drift. They also log prompts, outputs, and source documents for audits.

Performance tuning cuts latency for time-sensitive queries. Some teams add an explainability layer that extracts the key data points used to form each answer.

UX and Product Design for Finance Users

Clarity is the most important UX rule. Users need short answers with clear evidence. Each claim should show a source and a timestamp. Complex explanations should collapse into short summaries with links for deep dives. Escalation must be simple. One click should hand the conversation to a human advisor. Cross-channel consistency matters too.

The same bot voice should work on web portals, mobile apps, and trading terminals. Good designs keep workflows tight. They remove friction for analysts. They keep clients confident in the results. Meyka markets features that deliver concise, source-backed research and smooth handoffs to human teams.

Security, Compliance, and Auditability

Regulators treat decisions, not technologies. Firms must show how advice was formed. That requires tamper-proof logs, role-based access, and strong encryption. Models need regular validation and bias checks. Red-team tests should probe failure modes and misuse. Storing query-response hashes and source IDs makes post-hoc reviews possible.

A formal risk framework also helps. It aligns AI use with existing financial rules and consumer protections. The OECD and industry guides stress rigorous documentation and model risk governance. Enterprise platforms now bake audit trails into every API call.

Monitoring, Observability, and Model Risk Management

Operational AI demands observability. Teams must watch data pipelines, model inputs, and outputs. Alerts should trigger on drift, latency spikes, or unusual answer patterns. Observability covers data quality and model behavior. It ties business metrics to model performance. Root cause tools must show whether a bad answer came from stale data, a prompt error, or model decay.

Automated retraining helps, but only when retraining is safe. Human review gates remain critical for high-impact outputs. Recent tools emphasize end-to-end visibility so incidents can be diagnosed quickly and fixes deployed with trace.

Real-world Use Cases and Measurable ROI

Finance chatbots can speed onboarding and cut support costs. They can summarize research and free analysts from repetitive tasks. Consumers get faster answers to account questions and simple advice. Institutional users get quick peer comparisons and risk flags.

Firms report efficiency gains and faster client response times after deploying assistants. Large banks and asset managers are moving from pilots to broad rollouts. For example, major firms are deploying internal assistants to support thousands of staff for document search and summarization. The result is measurable time saved and clearer audit records.

Practical Implementation Tips for Teams Starting Now

Begin with a narrow, high-value use case. Connect trusted data sources first. Add logging and access controls before scaled rollout. Involve compliance early and test with real workflows. Use human review for anything that can affect money or reputation. Automate low-risk tasks, but gate high-risk decisions. Maintain a cadence of evaluation and retraining. Prioritize transparency: always show sources and dates for facts. These steps reduce risk and build trust with users and regulators.

Closing Note

The next wave of finance chatbots will succeed on accuracy, traceability, and speed. Enterprise AI chatbot developers must combine healthy data pipelines, tuned models, and strong governance. Good design and clear audit trails make advice actionable and defensible.

Vendors that integrate finance-grade research, live signals, and enterprise controls will win trust. For teams planning a rollout, start small, log everything, and keep humans in the loop. The market is moving fast, and clear evidence will decide who earns long-term client trust.

Frequently Asked Questions (FAQs)

In 2025, AI chatbots will help banks and investors save time. They give quick answers, handle customer support, and analyze data faster, improving decisions and client service.

An enterprise finance chatbot is an AI system built for large firms. It automates financial tasks, gives real-time data, and supports teams with fast, accurate insights every day.

Yes, most finance chatbots in 2025 use encryption and audit logs. They follow strict rules to keep user data private and meet global compliance standards.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.