Vedanta Share Price: Company Raises $500 Million via Bonds to Tackle Near-Term Debt

On 26 October 2025, Vedanta Limited announced it had raised US$500 million through a bond issue. The money is meant to help the company repay short-term debt and ease pressure on its balance sheet. This move is a key step for Vedanta as it works to rebuild investor trust and stabilise its financial outlook. With global commodity prices still volatile and debt loads heavy, the market is watching closely. The question now is: how will this raise affect the company’s share price and its long-term position?

Recent Development: the $500 million Bond Issue

On 26 October 2025, Vedanta announced that it had raised US$500 million through a dollar-denominated bond offering to tackle near-term obligations. Company filings and market reports indicate the deal was completed in mid-October and was well-received by investors. The proceeds are earmarked to repay upcoming maturities and bolster liquidity. This marks another step in a year when the group has tapped the overseas bond market more than once.

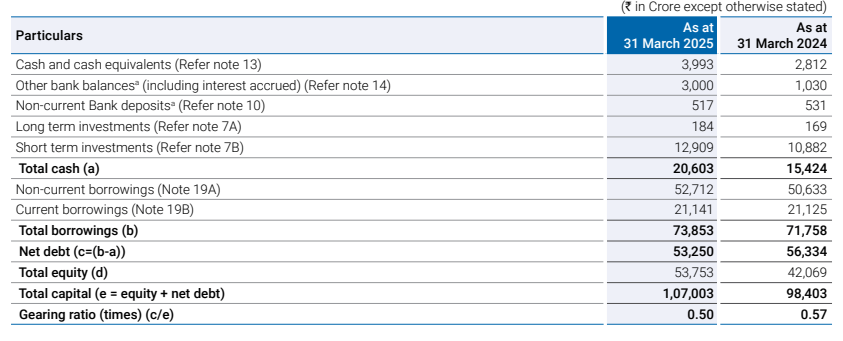

Vedanta’s Debt Profile

Vedanta’s consolidated gross debt stood at about ₹73,853 crore as of 31 March 2025. The company carried a mix of long-term debt, short-term borrowings, and working capital facilities. Management has said average debt maturity is roughly three years, but some near-term repayments have created pressure. The $500 million bond helps cover immediate maturities, but material deleveraging remains a medium-term task for the group.

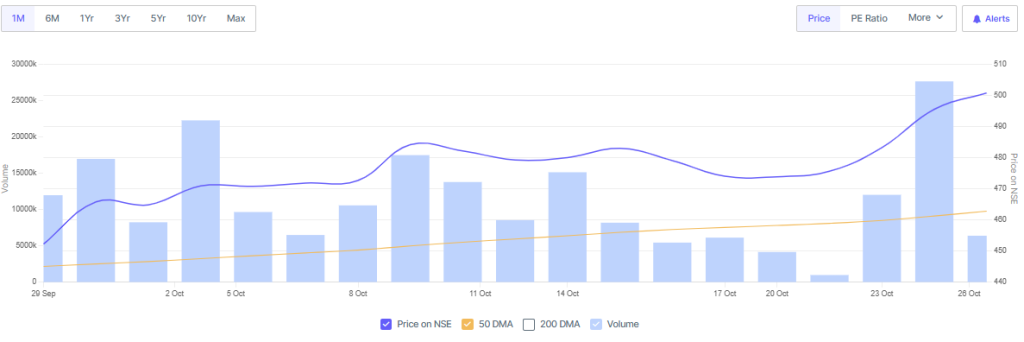

Market Reaction: Vedanta Share Price and Sentiment

Markets reacted to the bond news with cautious relief. Vedanta’s shares rose modestly in late October 2025 as investors priced in eased short-term risk. Trading volumes ticked up as traders reassessed the company’s liquidity path. Earlier in 2025, headlines about stake sales and bond taps had driven sharp swings. The latest move cut some tail risk, but volatility is still likely while debt targets and asset sales remain in play.

Credit Ratings and Financial Health

Rating agencies have given Vedanta non-investment grade marks in 2025, reflecting the company’s leverage and complexity. S&P, Fitch, and Moody’s have issued ratings that signal elevated default risk compared with investment-grade peers. The bond raise may stabilize short-term liquidity. However, the ratings will only improve if the company cuts net debt meaningfully and sustains stronger cash generation. Analysts are watching the balance between refinancing and real deleveraging.

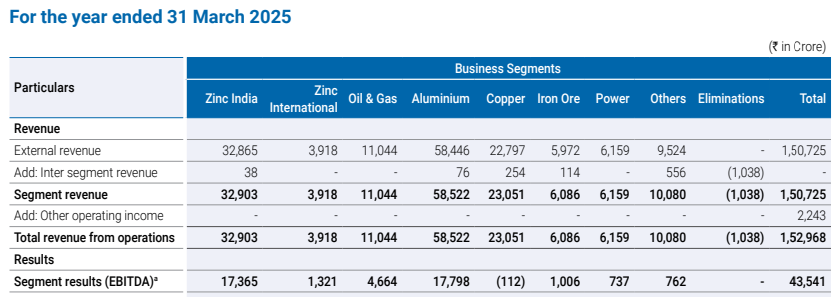

Business Outlook by Segment

Vedanta runs diverse assets. Hindustan Zinc has solid cash flow and steady demand. Aluminium and power face cyclical pressures from energy costs and global metal demand. Oil and gas through Cairn remains an important earnings driver when crude prices are favorable.

The group is splitting into sector-specific entities and planning big expansion projects. Those moves aim to unlock value, but they also require capital and clearer governance of inter-company flows. Commodity cycles will determine near-term profits.

Debt Reduction Strategy

Deleveraging has two legs: monetise assets and improve free cash flow. In June 2025, Vedanta sold a small stake in Hindustan Zinc to raise funds. Management has signalled plans to sell or monetize further holdings and to pursue a demerger into focused businesses. The company also plans to rein in discretionary payouts and steer cash to debt cuts. Execution risk is real. Approvals, buyer interest, and pricing could slow any large asset sale.

Governance, Controversies, and Counterparties

Critical short-seller reports earlier in 2025 added scrutiny to group finances and parent-subsidiary flows. Vedanta responded with public rebuttals and a restructuring plan aiming to reduce debt by targeted amounts by FY27.

Lenders and bond investors have demanded clearer encumbrance limits on assets and improved transparency. Some of the recent bond documentation reportedly includes restrictions on further encumbrances and share transactions. Those clauses matter for creditor confidence.

Investor Risks and Key Triggers

Investors should view the bond issue as a risk-reducing step, not a cure. Key risks remain: commodity price swings, interest rate moves, execution delays in asset sales, and group-level cash transfers. Triggers that could push the share price higher include successful asset dispositions, sustained commodity demand, and visible cuts to net debt.

Negative triggers would include fresh liquidity squeezes, legal or regulatory setbacks, or weaker metal prices. One practical tool for traders is to monitor upcoming maturities and covenant language in new bond documents. An AI tool scan of public filings can speed that work.

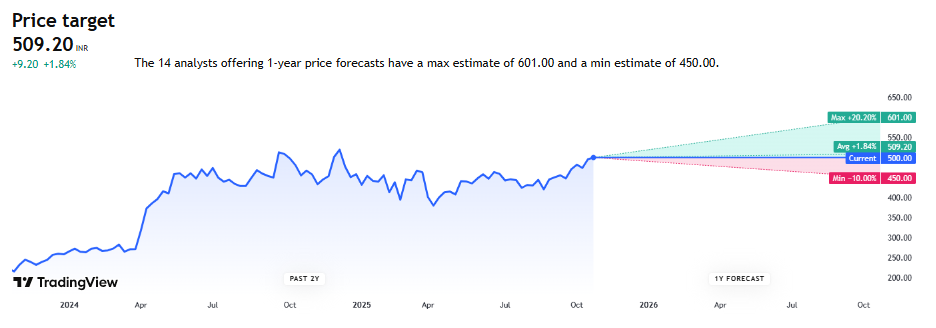

Analysts’ Views and Price Outlook

Brokerage notes show mixed views. Some analysts welcome the bond as a pragmatic liquidity fix that reduces the immediate rollover risk. Others highlight that unless net debt sees a structural decline, the share can remain range-bound and volatile. Forecasts vary.

Short-term consensus tends to be neutral to mildly positive if commodity prices hold. Longer-term upside depends on successful de-leveraging and the outcome of the corporate split plan. Keep an eye on quarterly cash flow statements and any fresh guidance from management.

Wrap Up

The $500 million bond placement in October 2025 buys Vedanta breathing room. It lowers immediate refinancing risk. But it does not erase the deep leverage that has built up over the past years. Investors should watch actual debt reduction, asset sale progress, and commodity trends. The move is constructive. Yet the path to a safer balance sheet and a less volatile Vedanta share price will require consistent execution and clearer proof of lower net debt.

Frequently Asked Questions (FAQs)

On 26 October 2025, Vedanta raised US$500 million via bonds. The money will be used to repay upcoming loans and ease pressure on its debt.

Vedanta has had large debts for several years and faced high interest costs. It must refinance and reduce debt to avoid future stress.

The bond move improves short-term debt risk. But the long-term share price will depend on metals demand, debt reduction, and business execution.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.