Vodafone Idea Shares in Focus Ahead of Supreme Court Hearing on AGR Dues

On October 6, 2025, the Supreme Court of India will hear a critical plea from Vodafone Idea Ltd (Vi) that could change the company’s future. Vi is challenging an additional demand of around ₹9,450 crore in so-called AGR (Adjusted Gross Revenue) dues raised by the Department of Telecommunications (DoT). Investors are watching closely because the hearing will affect Vi’s finances, its ability to raise funds, and its very survival in a tough telecom market. The Vodafone Idea shares have been volatile in recent weeks as the company battles heavy liabilities and uncertainty.

Vi must either succeed in getting relief or face potentially severe consequences. And that makes this hearing a make-or-break moment not just for Vi, but for India’s telecom landscape too. Let’s have a look in detail.

Background: What are AGR Dues?

Adjusted Gross Revenue (AGR) is the government’s way to compute the revenue base for licence fees and spectrum charges. The term grew into a legal battle after the DoT adopted a wider definition. In 2019, the Supreme Court upheld that broader definition. That decision meant telcos had to pay huge sums.

The dues include licence fees, spectrum charges, and interest and penalties. The accounting rules and retrospective adjustments are at the heart of the fight. Many companies argued that the demand was unfair. The government maintained its legal right to recover the amounts.

Vodafone Idea’s AGR Burden

Vodafone Idea has faced multiple AGR demands over the years. Recent litigation centers on additional demands for specific years. The company has contested claims, such as a demand of about ₹5,606 crore for 2016-17. On other fronts, DoT has at times raised demands near ₹9,450 crore in related notices. These sums come on top of earlier liabilities and large debts.

The firm also saw part of its liabilities converted into government equity earlier in 2025. That equity move aimed to ease near-term cash stress. Still, the AGR issue keeps returning to the courts. The exact outstanding figure changes with each order and reassessment.

Supreme Court Hearing: What’s at Stake?

On October 27, 2025, the Supreme Court heard Vodafone Idea’s plea to quash certain additional AGR demands. The telco argued that some of the additional demands were not part of earlier SC directions. The Centre asked for time in the past to examine records and responses. The bench’s view could reshape how the DoT pursues reassessments. A court order could mean waiver, rework, or confirmation of dues. Any such outcome will directly affect liquidity, lenders’ confidence, and investor sentiment.

Market Reaction and Vodafone Idea Shares Performance

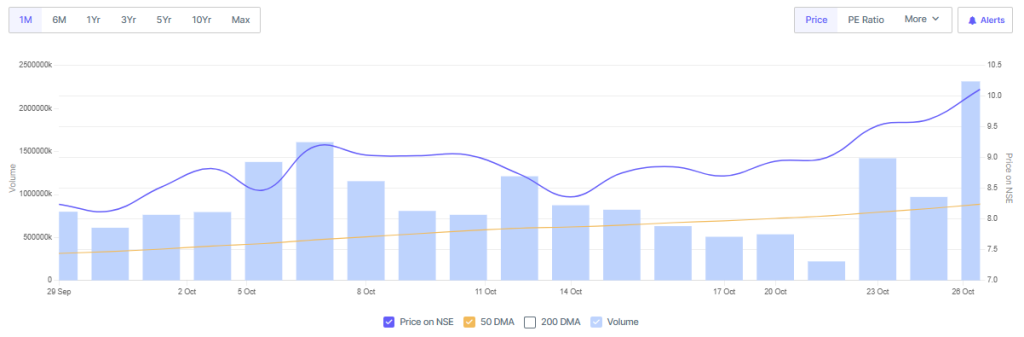

Stocks moved sharply ahead of the hearing. The market often prices in possible relief or stricter enforcement. Vodafone Idea shares have shown both spikes and falls in recent sessions. On some days, the stock rose after reports of court listings and possible reassessment by the Centre. On other days, it slipped on fresh demands and regulatory uncertainty.

Trading volumes rose as investors watched updates. Short-term traders reacted to headlines. Long-term investors weighed survival scenarios and policy support. An AI stock research analysis tool flagged the case as a high-impact event for the stock’s risk profile.

Financial Health and Revival Efforts

The company’s balance sheet remains stressed. Quarterly losses and negative free cash flow have kept pressure on management. The government converted large spectrum dues into equity earlier in 2025. That move raised the state’s stake and cut immediate cash outflows. Vodafone Idea has also tried to raise fresh capital and cut costs.

Network upgrades and focus on average revenue per user (ARPU) have been part of the plan. Still, lenders remain cautious. Any favourable court outcome on AGR could open a path to further funding. If the court rejects key claims, debt servicing pressure would ease.

Broader Industry Context

The AGR episode reshaped India’s telecom market. Several smaller players exited or merged. Consolidation followed years of intense competition and low tariffs. The government has offered policy fixes at times. These included deferred payments and spectrum conversions. Regulators face a balancing act. Too much relief could set a precedent. Too little could push a major operator to the brink. Keeping at least three large players active matters for competition and consumer choice.

Analyst Views and Market Outlook

Analysts lay out clear scenarios. In a relief scenario, ratings could improve and the stock could rally. In a strict scenario, lenders could demand tighter covenants or faster resolution. Some brokerages place conditional buy ideas if the court limits interest or penalties.

Others remain skeptical until legal clarity arrives. Near term, volatility is likely. Over the long run, the company’s ability to raise sustainable capital and improve ARPU will determine its fate. Investors should watch for official court orders and DoT actions after the hearing.

Wrap Up

The Supreme Court’s handling of AGR claims on October 27, 2025, is a pivotal moment. The decision could ease Vodafone Idea’s burden or confirm more payments. Either outcome will shape funding options and market confidence. The telecom story now hangs on legal clarity and firm steps on business revival. Close attention to the court order and follow-up actions by DoT and lenders is essential. For investors, the case is a classic mix of legal risk and business turnaround potential.

Frequently Asked Questions (FAQs)

On October 27, 2025, the Supreme Court reviewed Vodafone Idea’s plea on extra AGR dues. The case is still pending, and the final decision is awaited.

As of October 2025, Vodafone Idea’s AGR dues are around ₹5,600 crore in dispute. The company has already paid most of its earlier confirmed liabilities.

Yes. The Supreme Court’s AGR verdict will affect investor mood and share prices. A positive outcome may lift shares, while a strict order could cause a drop.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.