ICICI Bank Q2 Report: PAT Up 14.5%, Loan Book Shows Strong Momentum

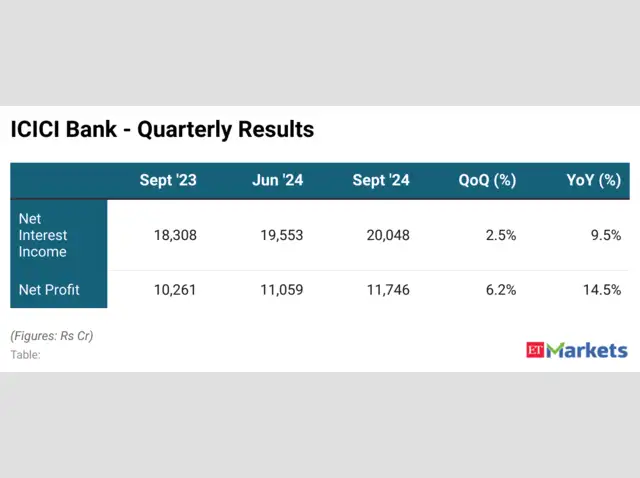

On 26 October 2024, ICICI Bank reported a standalone profit after tax (PAT) of ₹11,746 crore, marking a robust 14.5% year-on-year rise. This surge came as the bank’s loan book grew steadily and core lending income gained momentum. In a market where margins are under pressure, ICICI’s performance signals strong operational execution. While the lending business expanded, the bank also kept a close watch on asset quality and provisions.

This quarter puts the bank in a stronger position heading into the second half of the fiscal year. Let’s explore what underpinned the growth, where the momentum lies, and what it means for stakeholders going ahead.

ICICI Bank Q2: Key Financial Highlights and Margins

ICICI Bank posted a standalone profit after tax (PAT) of ₹11,746 crore for Q2, reported on 26 October 2024. The PAT rose 14.5% year-on-year. Net interest income (NII) improved to about ₹20,048 crore. Fee income also grew and added to core revenue. Operating expenses rose, but operating profit still widened. Provisioning rose versus the prior year. That trimmed some of the bottom-line gains.

Net interest margin (NIM) came under pressure. It fell from the year-ago level. The bank attributed the decline to tougher competition for deposits. Still, loan yields and higher volumes kept interest income rising.

Loan Book Growth and Credit Momentum

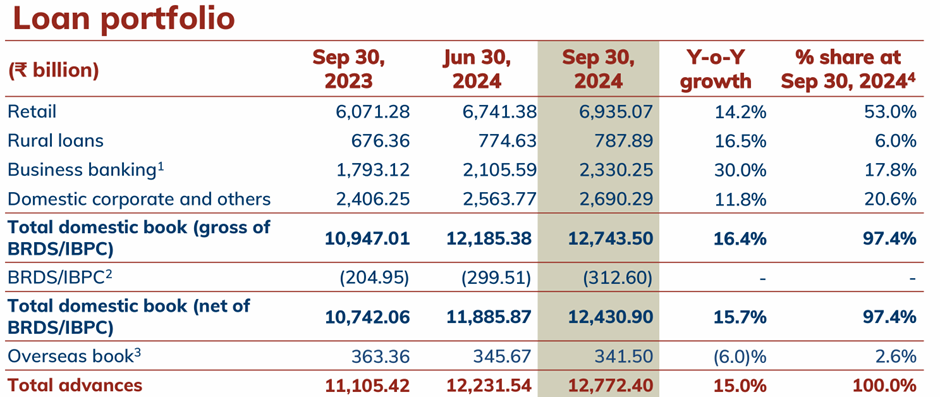

The loan book showed strong momentum in the quarter. Domestic advances expanded by around 15.7% year-on-year. Retail and business banking were key drivers. Growth was broad-based. Home loans, vehicle loans, and business banking each gained traction. Corporate lending also rose, but at a measured pace. This mix helped diversify risk. The rise in loans underpinned interest income and the PAT jump.

Rising credit demand reflected the wider economic recovery. Consumer spending rose. Firms resumed investment. Credit growth outpaced many peers in the quarter. That allowed the bank to capture market share in several segments.

Asset Quality, NPAs, Recoveries, and Provisions

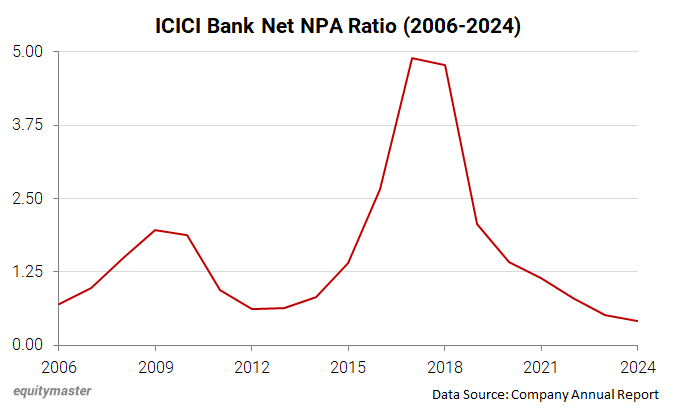

Asset quality improved on several fronts. The gross NPA ratio was 1.97% as of September 30, 2024. Net NPA stood at 0.42% for the same period. These metrics improved sequentially from June 2024 levels.

Fresh slippages were reported, but recoveries and upgrades partly offset them. The bank reported higher provisioning in the quarter compared with the prior year. That reflected prudent risk management despite healthier asset ratios. Analysts noted that sustained recoveries will be important to keep credit costs low.

Deposits, CASA, and Funding Mix

Deposits rose strongly in the quarter. Total deposits were up about 15.7% year-on-year. CASA growth helped keep the cost of funds under control. The CASA ratio remained healthy compared with many private peers. This position allowed the bank to fund loan growth without over-relying on expensive wholesale borrowings. Still, deposit competition tightened, which pressured margins.

Capital Position and Balance Sheet Strength

Capital ratios remained comfortable. The bank reported a solid Tier-1 and total capital adequacy ratio in line with regulatory norms. Liquidity metrics were sound. The strong deposit base and retained earnings supported the balance sheet. These buffers provide room for further credit growth.

Digital Banking and Operational Drivers

Digital platforms continued to support growth, and Digital loan disbursements rose. Mobile and internet channels accounted for a growing share of new accounts and transactions. The bank’s digital investments helped cut processing time. That boosted retail loan sourcing and fee income. One analyst noted that data analytics and AI models were increasingly used to speed credit decisions.

Technology also reduced unit servicing costs. This allowed the bank to scale retail operations without a matching rise in staff costs. Digital distribution now plays a clear role in the bank’s growth story.

Management Commentary and Outlook

Management spoke of steady credit demand and cautious optimism. The bank signalled continued focus on retail and business banking. It also highlighted close monitoring of asset quality. The tone in the conference call was balanced. Management said provisioning will remain prudent while pursuing growth.

Guidance emphasized sustainable growth. The bank plans to grow high-quality loans. Cost control and digital adoption were listed as priorities. Capital buffers and a strong deposit base were positioned as supports for the lending push.

Market Reaction and Investor View

Markets showed mixed responses. The stock rose in early trade on the earnings beat, then saw short-term volatility amid margin concerns. Reuters reported the shares closed higher ahead of the results announcement.

Analysts largely praised the loan growth and fee income strength. Some noted the dip in NIM and higher provisioning as reasons for caution. Valuation debates centered on whether current earnings trends justify premium multiples. Overall sentiment leaned positive for long-term growth, but near-term margin and treasury income swings were flagged.

Key Takeaways for Stakeholders

The quarter showed clear strengths. Loan growth was strong. PAT rose 14.5% on higher NII and fees. Asset quality stayed under control. Deposits and CASA supported the lending push.

Watch items remain. NIM compression from deposit competition could persist. Provisioning trends need monitoring. Treasury income can swing quarterly PAT. Investors should track sequential trends in margins and recoveries. Analysts using models and the occasional AI tool will watch upcoming quarters for confirmation of the recovery.

Wrap Up

ICICI Bank delivered a quarter of solid growth on 26 October 2024. The bank combined strong loan growth with improved fee income. Asset quality stayed healthy. Margins faced headwinds from market competition. The next quarters will show if the bank can keep growing and protect margins while maintaining low credit costs. The results set a positive base. Future performance will depend on deposit trends, loan mix, and economic demand.

Frequently Asked Questions (FAQs)

ICICI Bank posted a net profit of ₹11,746 crore in Q2 FY2025, reported on October 26, 2024, showing a 14.5% yearly growth from stronger lending.

In Q2 FY2025, ICICI Bank’s total loan book increased about 15.7% year-on-year, supported by steady growth in retail, business, and small enterprise loans.

As of September 30, 2024, ICICI Bank’s gross NPA stood at 1.97%, and net NPA was 0.42%, showing steady improvement in its overall asset quality.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.