MCX Gold Price Today: Gold Falls Below ₹1.23 Lakh, Silver Near ₹1.46 Lakh per Kg

As of October 27, 2025, the Multi Commodity Exchange (MCX) gold price slipped below the ₹1.23 lakh mark per 10 grams, while silver hovered close to ₹1.46 lakh per kilogram. The sudden dip caught the attention of both traders and long-term investors. Many are now wondering if this fall signals a buying opportunity or a warning of deeper correction ahead.

Experts say the decline is linked to a stronger U.S. dollar and rising bond yields, which often make precious metals less attractive. Global gold prices have also eased as investors shift focus to upcoming U.S. economic data and the Federal Reserve’s policy outlook. Back home, a slightly stronger rupee and lower festive demand have added to the pressure.

Still, many analysts believe this drop could invite short-term buying, especially with the wedding season approaching. After all, in India, every dip in gold is not just a price move, it’s an opportunity.

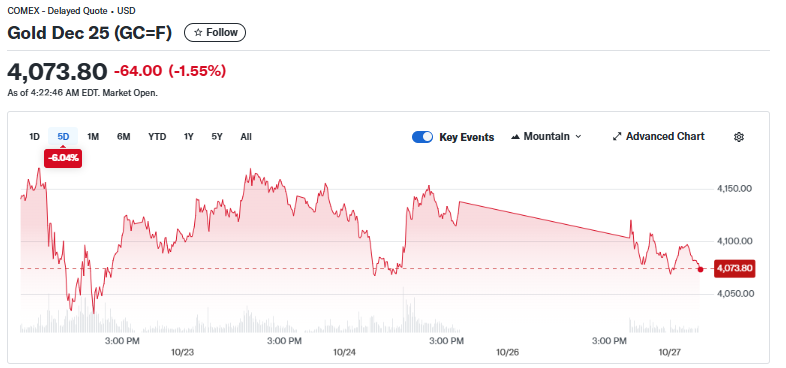

Latest MCX Price Update

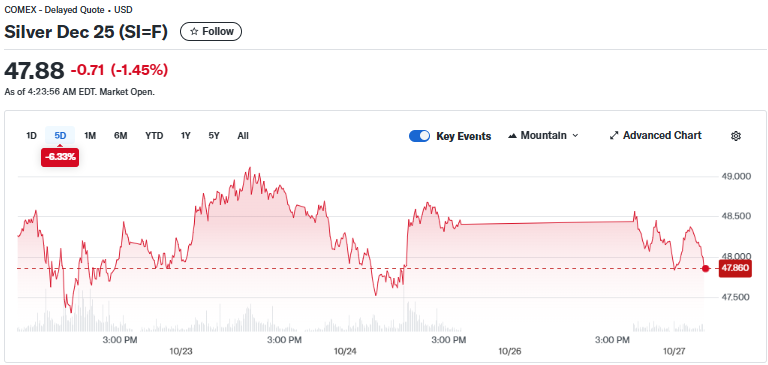

MCX December gold futures traded below ₹1.23 lakh per 10 grams on October 27, 2025. The contract opened around ₹1,22,500 and fell about 0.7-0.9% from the previous close. At mid-morning trade, price prints showed roughly ₹1,22,490 per 10 gm. Silver December futures moved lower as well. Silver traded near ₹1.46 lakh per kilogram, down about 1% from recent highs. These moves followed strong profit-booking after a sharp rally earlier in October.

Global Gold Market Trends

International gold eased on October 27 as the dollar gained strength. U.S. Treasury yields rose slightly. Markets priced in a stronger dollar and higher yields. That dynamic reduced bullion’s safe-haven appeal in the short term. COMEX futures showed mild weakness. Traders also watched incoming U.S. economic data and Fed commentary for cues. The global tone helped push local MCX contracts lower.

Key Reasons behind the Price Drop

Several clear drivers pushed prices down. First, the U.S. dollar firmed. A stronger dollar makes gold costlier for non-dollar buyers. Second, bond yields in the U.S. moved up. Higher yields raise the opportunity cost of holding non-yielding assets like gold. Third, there was profit-booking. Traders locked gains after gold’s sharp October run. Fourth, the rupee strengthened a bit versus the dollar. A firmer rupee eases import inflation for India. Finally, seasonal demand failed to keep pace with earlier buying. All these factors combined to trim prices on MCX on October 27, 2025.

Silver Price Movement and Market Insights

Silver moved in tandem with gold but showed extra volatility. Industrial demand worries weighed on silver. Slowdowns in manufacturing and mixed data from China reduced bullish sentiment. Silver’s extra sensitivity to industrial growth means it fell more sharply at times.

However, physical buying in India and investment demand can limit drops. Analysts noted that silver’s recent swings attract traders who seek short-term gains. Opinion pieces also flagged a domestic “silver rush” and supply tightness in certain markets.

Investor and Trader Sentiment

Traders reacted with quick position changes. Some funds trimmed long bets. Others added short positions to protect profits. Retail buyers and jewellers paused new large purchases on October 27. Many awaited clearer signals from global markets and the Fed. Short-term charts showed support around ₹1.20-1.22 lakh for gold. Volume on MCX suggested active intraday trading rather than fresh long commitments. Commentary from brokers underlined caution and selective buying on dips.

Expert Views and Market Forecast

Experts offered mixed near-term views. Some expected more consolidation before a new trend appeared. Others saw the drop as a corrective pullback inside a larger bullish phase that began earlier in October. Key support for gold on MCX was noted near ₹1.20 lakh per 10 gm.

Immediate resistance sat around prior highs near ₹1.27-1.28 lakh. Analysts said that major triggers to watch include U.S. inflation prints, Fed remarks, and any sharp rupee moves. Using an AI stock research analysis tool can help quantify short-term scenario probabilities.

Impact on Indian Investors and Consumers

Price dips change behaviour in three groups. Long-term investors view the fall as an entry point. Short-term traders may use volatility for quick trades. Jewelers and retail buyers weigh purchases for weddings and festivals. Lower rates can boost physical demand for ornaments.

ETFs and gold funds saw mixed flows as investors rebalanced holdings. For silver, lower industrial activity may keep prices pressured until data improves. Consumers should compare immediate needs with the risk of further short-term swings.

Conclusion and What to Watch Next?

On October 27, 2025, the MCX gold price slipped under ₹1.23 lakh, and silver hovered near ₹1.46 lakh per kg. The decline reflects global and domestic forces. Traders must watch U.S. economic data, Fed signals, and rupee moves. Physical demand around festivals and weddings will also matter for India. Short-term volatility may persist. Keep an eye on daily MCX prints and major macro updates to time decisions.

Frequently Asked Questions (FAQs)

On October 27, 2025, gold prices fell because the U.S. dollar grew stronger, bond yields increased, and local festive demand stayed weak in India.

On October 27, 2025, silver traded close to ₹1.46 lakh per kilogram on MCX, slightly lower than last week’s level due to global market pressure.

Experts say buyers should wait for market stability. Gold prices may drop further, but dips like this often bring short-term buying opportunities for investors.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.