Apple Earnings Report: What to Expect as Markets Eye Trump-Xi Meeting and Fed Rate Decision

On October 30, 2025, Apple Inc. will unveil its quarterly earnings results, an event watched closely by both tech investors and global markets. The report arrives at a time of heightened tension between the U.S. and China, as well as a looming policy decision from the Federal Reserve. Apple’s performance in smartphone sales, services growth, and China revenue will offer clues about how one of the world’s most valuable companies is navigating trade headwinds and shifting consumer demand.

With the meeting between Donald Trump and Xi Jinping coming soon, markets feel tense. Interest rates are still not clear. Apple’s earnings will show more than iPhone sales. They will help reveal the direction of the global economy.

Apple’s Recent Performance Snapshot

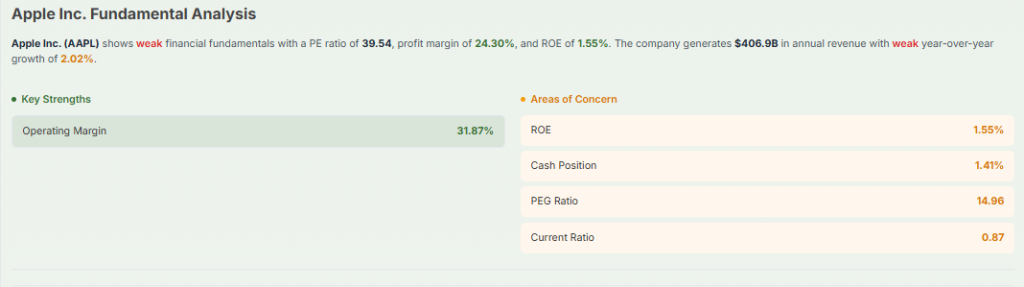

Apple entered the quarter with steady momentum. Revenue rose in services even as hardware growth slowed earlier in the year. The iPhone still drives the bulk of sales. Wearables and services have become reliable profit engines. The company kept share buybacks flowing. Investors have watched margins closely as component costs and foreign-exchange swings reshape profits. Apple’s investor calendar confirms the company will report fourth fiscal quarter results on October 30, 2025.

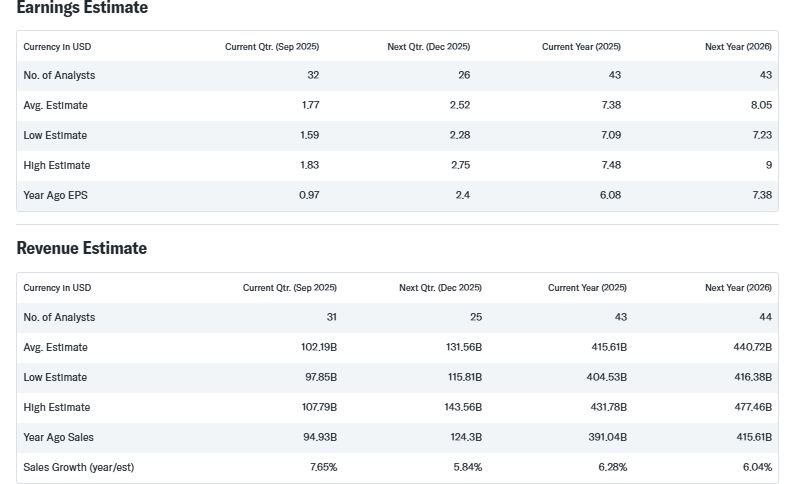

What Analysts Expect in This Report?

Analysts expect a solid quarter but not a blowout. The consensus EPS estimate sits near $1.74-$1.77 per share. Revenue forecasts cluster around $101 billion. Wall Street is looking for year-over-year growth in services and modest iPhone revenue gains. Margin guidance will matter. Growth in subscription services could offset softer hardware cycles. These estimates come from recent analyst pools and financial calendars ahead of the October 30 release.

iPhone Demand and Product Mix

The iPhone cycle is the central story in this quarter. Unit trends matter more than headline revenue. If average selling prices hold up, Apple can post healthy top-line numbers even with flat volumes. Supply chain notes show Apple adjusted production for new models during the year. Investors will read guidance for clues about the holiday season.

Also, watch Mac and iPad sales. Any sign of recovery there would help the narrative that Apple is broadening growth beyond phones. Industry previews have flagged iPhone demand as the key lever for the quarter.

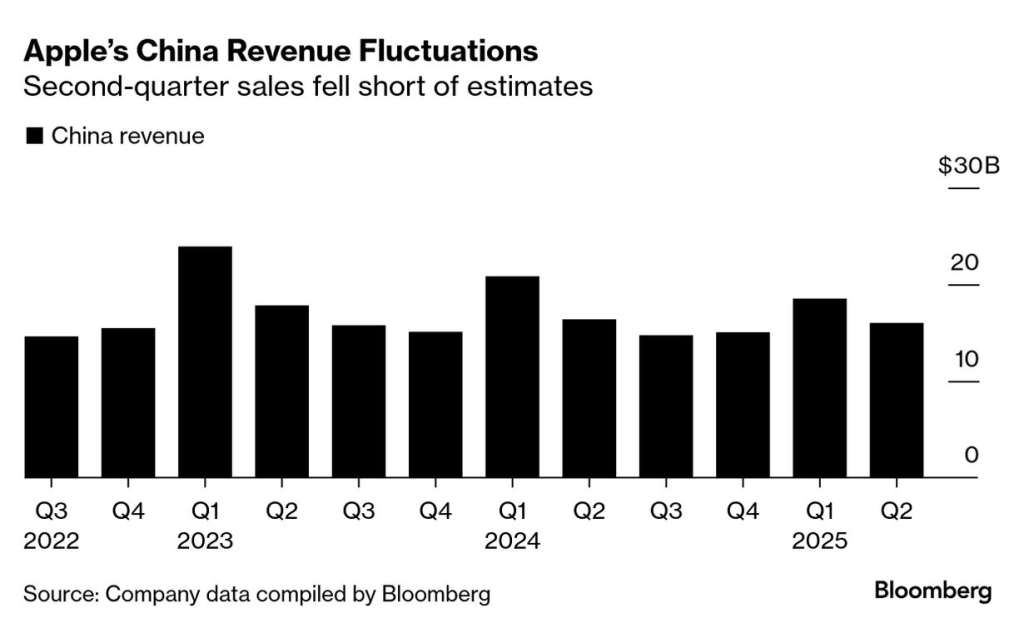

China Risk and the Trump-Xi Meeting

China matters more to Apple than most markets. It is the company’s second-largest revenue market. The bilateral meeting between Donald Trump and Xi Jinping on October 30, 2025, adds a political overlay to the earnings release. Market observers note that trade statements or tariff moves from that meeting could change investor sentiment fast.

Geopolitical tension can also affect supply chains, regulatory access, and consumer demand inside China. Any explicit wording about tariffs, export rules, or technology controls will be parsed for its likely effect on Apple’s China business.

Fed Rate Decision and Market Context

The Federal Reserve meets on October 28-29, 2025. Markets expect policy signals from that meeting. Many economists forecast a further easing of rates or at least a softer stance. Lower rates typically lift high-growth tech stocks. That can change how investors price Apple’s future earnings. Conversely, a hawkish surprise would tighten valuations and could pressure the stock after the report. Look for bond yields and risk appetite to shape the initial market reaction to Apple’s numbers.

Key Metrics to Watch in the Report

The quarter will hinge on a few measurable items. iPhone revenue and unit trends. Services revenue and subscription growth. Gross margin expansion or contraction. Wearables and accessories sales. Capital return and buyback pace. Forward guidance for the December quarter. Each metric offers a clear read on demand and pricing power. Analysts will model how these pieces fit into longer-term growth for the stock. Consider running the numbers through an AI stock research analysis tool to test multiple scenarios quickly.

Supply Chain and Margin Considerations

Cost pressure has eased in some components. Yet risks remain from tariffs, freight rates, and currency swings. Apple sources many parts from China and Asia. Any clampdown or export control could raise costs or delay shipments. Margins will reveal whether cost changes are being passed to consumers or absorbed by Apple. Investors will watch gross margin and operating margin closely. Clear commentary from management about supplier health will be important.

Investor Priorities and Market Reaction

Investors want clarity. Clear guidance on holiday demand matters most. A confident outlook could lift the stock. Cautious guidance could cause a pullback even if the quarter beats estimates. Buybacks and dividend policy also influence sentiment.

Short-term volatility is likely because the earnings call coincides with major geopolitical and monetary events on October 28-30, 2025. Traders will trade on headlines first and parse the numbers later.

Analyst Risks and Downside Scenarios

Several risks could spoil a positive print. A sharper-than-expected demand slowdown in China. New tariffs or export controls from the U.S. or China. Accelerating competition from phone makers leaning into AI and new form factors. Regulatory actions against the App Store or services. Finally, management’s forward guidance could prove overly conservative or overly optimistic. Each of these would shape how investors view Apple beyond the quarter.

What To Expect Immediately After the Report?

Expect fast moves. Markets will react within minutes. Traders will focus on guidance, unit trends, and services cadence. Analysts will update models and issue notes. Coverage will highlight any change in tone about China or capital returns. Given the Fed meeting just days earlier and the Trump-Xi meeting on the same day as the report, expect cross-market volatility. Short-term price swings may not reflect long-term fundamentals.

Final Take

Apple’s quarter will offer a snapshot of demand, pricing power, and margin dynamics. The report lands at a volatile moment for markets. Monetary policy and geopolitics will shape how investors read the numbers. Watch iPhone mix, services growth, margins, and forward guidance. Those items will set the tone for Apple stock heading into the holiday season and beyond

Frequently Asked Questions (FAQs)

On October 30, 2025, Apple will report its quarter results. We will watch iPhone sales, service growth, and profit margins. Clear guidance on the holiday quarter is also important.

On October 30, 2025, the meeting between Trump and Xi Jinping may affect trade rules in China. Apple’s business there could face new tariffs or export limits. This would matter for Apple.

On October 28-29, 2025, they will meet. If rates go up, growth stocks like Apple could suffer. If rates ease, tech stocks may gain support.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.