AMD Stock Today: Will AMD be Able to beat NVDA After Its Stunning 58.6% Monthly Gain?

In October 2025, Advanced Micro Devices (AMD) achieved a remarkable 58.6% surge in its stock price, closing at $252.92, marking a 109.7% year-to-date gain. This impressive rally was fueled by strategic partnerships and advancements in artificial intelligence (AI) technology.

AMD’s Recent Performance

AMD’s stock surge was propelled by a significant multi-year agreement with OpenAI to supply 6 gigawatts of processing power for AI data centers, starting with 1 gigawatt in 2026. This partnership positions AMD as a key player in the AI infrastructure market, challenging established competitors.

Nvidia’s Market Position

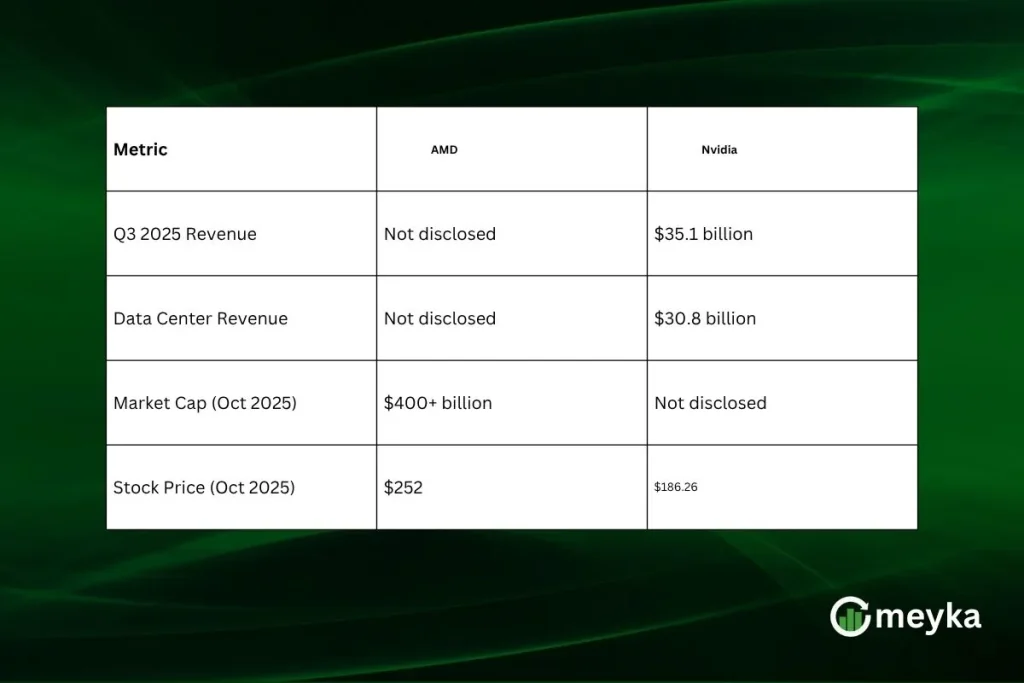

Nvidia reported a record $35.1 billion in revenue for Q3 2025, with its data center segment contributing $30.8 billion, up 112% year-over-year. This growth underscores Nvidia’s dominance in the AI hardware market, driven by its Hopper and Blackwell GPU architectures.

Comparative Analysis: AMD vs. Nvidia

Note: AMD’s Q3 2025 revenue figures are not publicly disclosed as of October 27, 2025.

Analyst Perspectives

Analysts view AMD’s partnership with OpenAI as a significant step toward competing with Nvidia. Some suggest that this deal could pave the way for a $300 price target for AMD. However, it’s essential to consider that Nvidia’s established market position and ongoing innovations present formidable competition.

Challenges Ahead

Despite AMD’s recent gains, challenges remain. The execution of the OpenAI partnership and the successful rollout of AMD’s Instinct MI450 GPUs will be critical. Additionally, Nvidia’s continued advancements in AI hardware and its strong customer base pose ongoing competition.

Conclusion

AMD’s recent performance and strategic partnerships indicate a promising future in the AI chip market. However, surpassing Nvidia will require sustained innovation and successful implementation of its agreements. Investors should monitor these developments closely to assess AMD’s potential to challenge Nvidia’s dominance in the industry.

FAQS:

AMD is gaining ground in AI chips with a new deal with OpenAI. However, Nvidia still leads the market, holding about 80% of the AI accelerator space.

Analysts predict AMD’s stock could rise to between $252.20 and $332.39 in 2025, depending on market conditions and company performance.

Yes, AMD is making a comeback with strong partnerships and new products. Its recent deal with OpenAI has boosted investor confidence and stock value.

Disclaimer:

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.