US Stock Market Oct 28 Update: Dow, S&P 500, Nasdaq Futures Gain After Record Highs

The US Stock Market extended gains on Oct 28, as futures for the Dow, S&P 500, and Nasdaq moved higher after record closing highs. Investors cheered strong tech earnings and renewed optimism on US-China talks, while Treasury yields eased and traders priced in Fed easing. This upbeat mix kept risk appetite high and set the tone for the week.

Why does this matter? Market moves now shape portfolio rebalancing, earnings expectations, and the near-term Fed outlook.

US Stock Market Rallies After Record Highs

The US Stock Market built on two days of record closes. Reuters reported the S&P 500 and Nasdaq hit fresh highs as investors looked ahead to big tech reports and a possible US-China framework that could ease trade tensions.

Tech led the gains, with chipmakers and software names rallying on AI spending hopes. Lower short-term Treasury yields also helped lift growth stocks.

What happened in the indexes? The Dow, S&P, and Nasdaq futures all rose, tracking the record closes and strong pre-market signals.

Why Is the US Stock Market Rising?

Traders cite two main forces: better-than-expected tech earnings, and optimism about a US-China trade pause that could ease tariffs and export curbs.

How are global cues shaping investor mood? Global talks and calmer inflation data have shifted odds toward a Fed rate cut this cycle, reducing pressure on high multiple names. Reuters noted investors now await corporate reports from megacaps to confirm AI-driven revenue gains.

Key Factors Driving Today’s US Stock Market Performance

The US rally rests on several clear drivers:

- Tech earnings momentum, where software and chip results can swing market direction.

- U.S.-China optimism which eases supply chain risk and raises demand forecasts.

- Treasury yields soar, which supports long-duration assets like tech.

- Fed expectations, as cooler inflation data pushed markets to price in easing sooner.

Analysts now blend data with model output. AI Stock research tools are used by some desks to parse earnings transcripts and spot revenue signals quickly, improving reaction time to corporate beats.

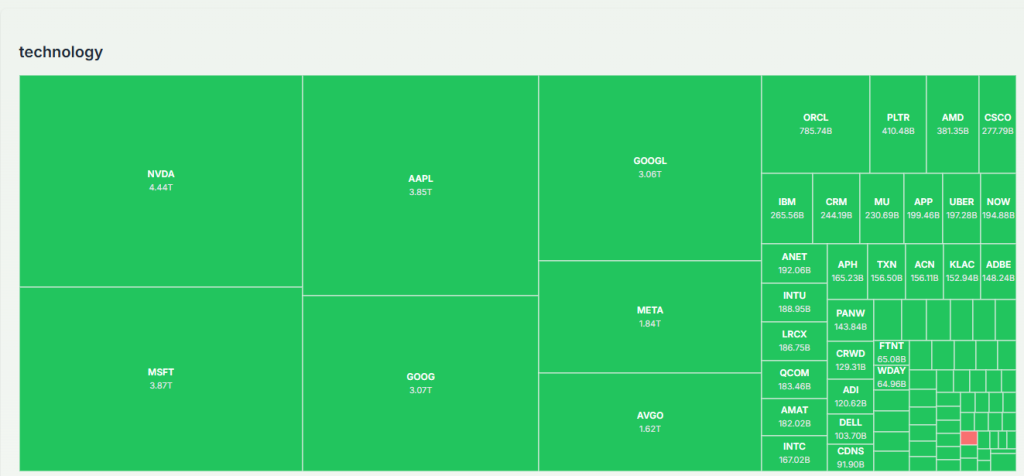

Tech Stocks Lead the US Stock Market Surge

Tech led the charge. Nvidia (NVDA), Microsoft (MSFT), and Apple (AAPL) drove much of the upside as investors priced strong AI capital expenditure across cloud and chip cycles. Social sentiment mirrored the rally: see these market posts for live reaction and momentum tracking.

Which tech names mattered most? Nvidia rose on chip demand news; Microsoft and Apple led software and device optimism ahead of earnings.

US-China Relations Boost Global Market Optimism

Good news on US-China talks lifted risk appetite. Reuters reported President-level engagement and trade discussions that could reduce tariffs and ease rare earth export tensions. That created a tailwind for exporters and cyclical names on Wall Street. Global indices followed; Asian markets showed strong gains after the headlines.

Does trade optimism matter long-term? Yes, because it lowers supply chain risk and supports margins for multinational firms.

Analysts’ Take: Expert View on the US Stock Market

Wall Street strategists caution that while momentum is real, the market still needs confirmation from corporate guidance. AI-related investment is central to forecasts. Firms now combine traditional models with automated tools, and AI Stock Analysis platforms help institutional desks parse large volumes of earnings data for signs of durable AI revenue growth. Analysts will watch guidance from the Magnificent Seven closely.

What are analysts most focused on? Data center and cloud revenue, AI tooling spend, and margin commentary from tech leaders.

Sector-Wise Performance and Economic Indicators

Sector winners included technology, communication services, and consumer discretionary, while defensive sectors lagged. Bond markets were calm as 10-year Treasury yields dipped, supporting equity valuations.

Oil prices and energy names were mixed, while financials tracked the curve movement. Trading Economics shows broader market indicators remain supportive for risk assets under current macro assumptions.

What macro readings matter next? Upcoming inflation prints, payroll data, and Fed remarks will be key for yields and sector rotation.

How the US Stock Market Compares to Global Indices

Are global markets following Wall Street’s trend? Many global indices rose on the same cues, though regional performance varied. European stocks gained on trade optimism, and Asian markets rallied pre-open on hopes of smoother US-China ties.

Trading Economics data shows correlated gains, with local drivers adding nuance across regions.

What’s happening in Asia and Europe? Asian export and semiconductor plays outperformed, while Europe focused on energy and industrial exposure to trade flows.

Market Sentiment and Social Media Trends

Traders on X shared bullish sentiment as momentum built. Short-term chatter reflected optimism and active rotation into AI and chip names. Embed this social feed to view trader sentiment:

How are social tools used? Many traders and analysts use social cue aggregation combined with AI Stock tools for quick signal extraction and position sizing.

Future Outlook for the US Stock Market

Looking ahead, the market will hinge on a few clear items:

- Earnings from major tech firms will test whether AI investment translates into revenue now.

- Federal Reserve guidance on the timing of rate cuts, which influences yields and multiples.

- U.S.-China developments, where any tangible framework could sustain risk appetite.

- Economic data, especially inflation and jobs, will shape policy and flows.

Investors increasingly rely on advanced tools for insight, as AI Stock research methods become part of normal analysis. These tools help parse transcripts, detect revenue signals, and flag risk factors faster than manual review.

Conclusion

The US Stock Market rallied on Oct 28 after record highs, driven by tech strength, Fed expectations, and US-China optimism. Futures for the Dow, S&P 500 and Nasdaq held gains as investors awaited earnings and macro cues.

The near term looks constructive, though traders must watch corporate guidance and policy signals closely. For now, the market shows resilience, and AI-driven analytics will continue to shape how investors read earnings and price risk.

FAQ’S

October is often seen as a volatile but historically positive month for the US stock market, with many rallies starting during this period. Investors view it as a potential turning point for year-end gains.

The Dow Jones Industrial Average recently hit a record high in late October 2025, supported by strong tech earnings and easing inflation expectations. It marked one of the best monthly performances of the year.

The 7% rule means investors should sell a stock if it falls more than 7% below their purchase price to limit losses. It’s a key risk management strategy used by traders to protect capital.

As of October 28, the US stock market is up, with the Dow, S&P 500, and Nasdaq futures gaining after record highs. Strong corporate results and trade optimism boosted investor sentiment.

Stocks tend to rally in October because investors position for the year-end and major companies release earnings. Historically, market confidence improves after September’s weakness.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.”