NVDA Stock News Today: Sax Wealth Advisors Boost NVIDIA Holdings

NVDA Stock made headlines today after Sax Wealth Advisors LLC significantly increased its holding in NVIDIA. The fund raised its stake by 45.9%, to 87,192 shares, buying 27,412 shares in the quarter, worth about $13.78 million, per MarketBeat. This move is another sign of institutional faith in NVIDIA’s AI momentum and market leadership.

Why does this matter? Institutional buying often signals confidence and can support stock momentum. For traders and long-term investors, it is a vote of trust in NVIDIA’s future.

NVDA Stock: Sax Wealth Advisors’ Buying Details

What happened: Sax Wealth Advisors boosted its NVDA position by 45.9% during Q2. The firm now holds 87,192 shares of NVIDIA, equal to about 0.8% of its portfolio and ranked as the fund’s 27th largest holding. The new stake was worth roughly $13.78 million at filing time.

Why did Sax buy more NVDA Stock? They likely see continued AI chip demand, strong revenue trends, and durable market share for NVIDIA.

The numbers that matter

- Increased stake: 45.9%

- Total shares after buy: 87,192.

- Shares added: 27,412.

- Reported value: $13,776,000.

NVDA Stock and NVIDIA’s Market Position

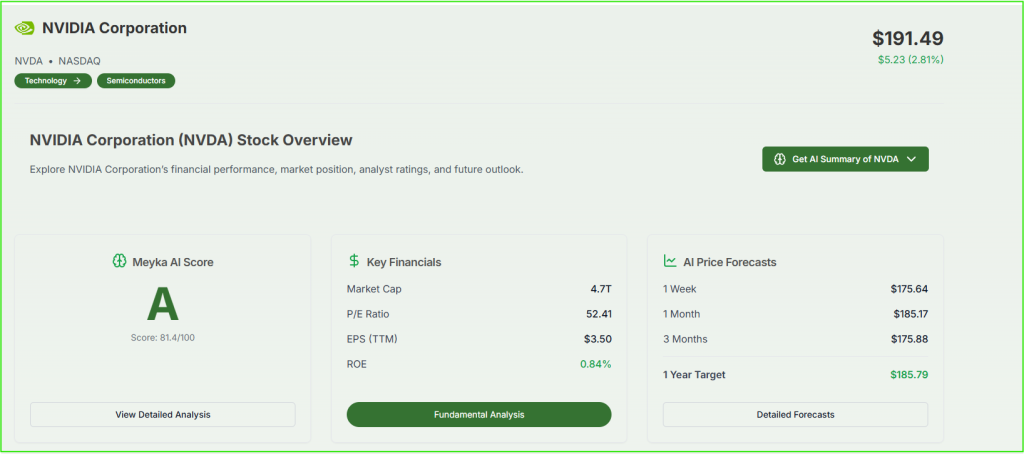

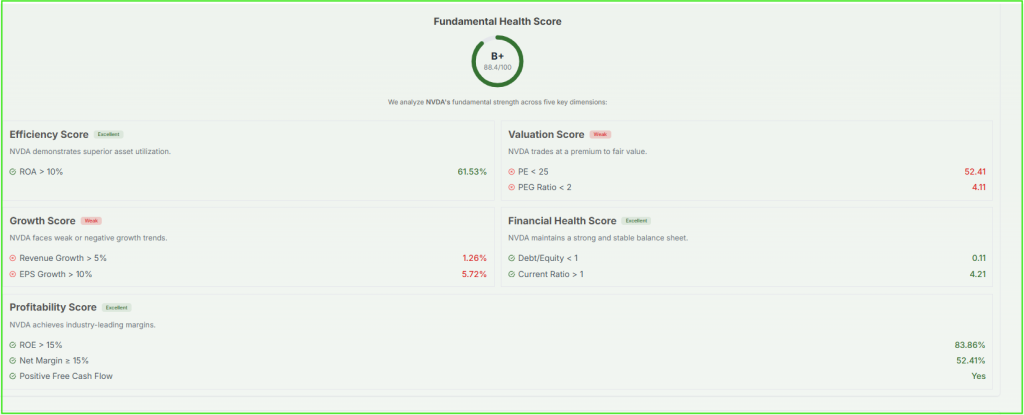

NVDA Stock sits at the center of the AI hardware boom. NVIDIA reported $46.74 billion in revenue in its latest quarter, up 55.6% year over year, showing robust demand.

The company is the leader in GPUs for AI training and inference, and it powers many cloud and enterprise AI deployments. These fundamentals underpin many institutional buys like Sax’s.

How strong is NVIDIA’s market edge? Very strong: NVIDIA dominates high-performance AI chips, which drives both revenue and pricing power.

NVDA Stock: Investor Sentiment and Analyst Moves

Investor sentiment around NVDA Stock is bullish. Several analysts raised price targets after recent results, reflecting optimism about continued AI spending. Institutions adding shares often follow macro and company-specific signals. Sax’s purchase aligns with a wave of funds repositioning toward AI leaders.

Are analysts raising targets? Yes, multiple houses have recommended higher targets, citing sustained AI adoption and data center strength.

NVDA Stock: A Closer Look at AI Demand

NVIDIA’s chips are central to modern AI ecosystems. Demand from cloud providers, enterprise AI projects, and data center capacity expansion fuels earnings growth. That is why AI Stock research models increasingly flag NVDA as a top play in AI infrastructure.

How does AI demand affect NVDA Stock? Higher AI spending lifts GPU sales and recurring software revenue, boosting cash flow and investor confidence.

NVDA Stock: Performance, Risks, and Volatility

While NVDA Stock has shown strong returns, it also carries valuation risk and cyclical exposure to chip demand. Traders watch guidance, supply conditions, and macro factors like interest rates. Institutional buying can temper volatility, but NVDA still moves fast on news and earnings.

What are the main risks? Rising competition, supply chain shocks, and shifts in AI spending patterns can affect the stock.

NVDA Stock: How Professionals Use Modern Tools

Large investors pair traditional analysis with tools for scale. AI Stock Analysis tools help parse earnings transcripts, SEC filings, and channel checks faster than manual methods. Sax’s move may have been informed by such multi-layer analysis.

Do funds use AI to pick stocks? Increasingly, yes. Data-driven models and AI analytics complement human judgment for firms analyzing NVDA Stock.

NVDA Stock: Social and Market Signals

Social chatter and institutional filings often move markets. MarketBeat’s alert about Sax’s 13.78 million dollar stake brought attention to NVDA Stock today, and traders reacted in pre-market activity. Watching 13F filings and fund moves helps investors spot shifts before broader sentiment follows.

Should retail investors follow institutional buys? They can consider them as signals, but should also do their own due diligence on valuation and risk.

NVDA Stock: What to Watch Next

Key indicators to follow for NVDA Stock include upcoming earnings commentary, data center demand, GPU shipment trends, and analyst revisions. Also, watch institutional filings, as more funds adding positions can sustain momentum.

What should traders focus on? Guidance from NVIDIA, cloud capex plans from hyperscalers, and supply chain updates.

Conclusion

NVDA Stock gained renewed attention after Sax Wealth Advisors boosted its stake significantly. The move underscores institutional faith in NVIDIA’s role in the AI revolution and its strong data center performance.

That said, NVDA remains a high conviction, high volatility equity. Investors should weigh the company’s leadership in AI chips against valuation and macro risks before deciding to buy or add. For many, Sax’s action is a timely reminder that institutional flows still matter when reading NVDA Stock headlines.

FAQ’S

Analysts expect Nvidia stock to rise in the long term due to strong demand for AI chips, data center growth, and expanding partnerships in artificial intelligence.

Nvidia stock fell 17% after weaker-than-expected guidance and concerns about slowing GPU demand, prompting profit-taking among investors.

Yes, Nvidia briefly lost around $279 billion in market value in a single trading session, marking one of the largest one-day losses in U.S. stock market history.

Yes, reports suggest that about 78% of Nvidia employees became millionaires, mainly due to the company’s soaring stock price and generous stock-based compensation packages.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.