HSBC Q3 Profit Falls £898 Million Amid Rising Costs and Loan Losses

HSBC, one of the world’s largest banks, reported a sharp drop in profit for Q3 of 2025. On October 28, 2025, the bank announced that its profit fell by £898 million, showing how rising costs and growing loan losses are squeezing global lenders. The financial hit comes at a time when HSBC is already under pressure from weak demand in China and rising legal expenses. Operating costs increased, and the bank also set aside more money to cover possible loan defaults, especially in the struggling property markets of Hong Kong and mainland China.

This decline is a reminder that even major banks are not immune to the ripple effects of global economic uncertainty. From slower growth in Asia to inflation-driven expenses in Europe, HSBC faces challenges on multiple fronts. Yet, the bank remains focused on reshaping its business to stay strong in its key Asian markets while balancing risks in its global portfolio.

HSBC Q3 Profit: Key Numbers and Context

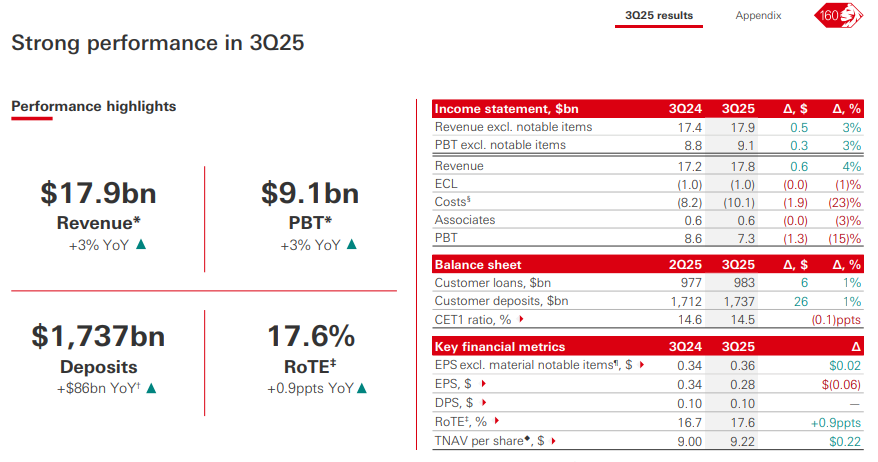

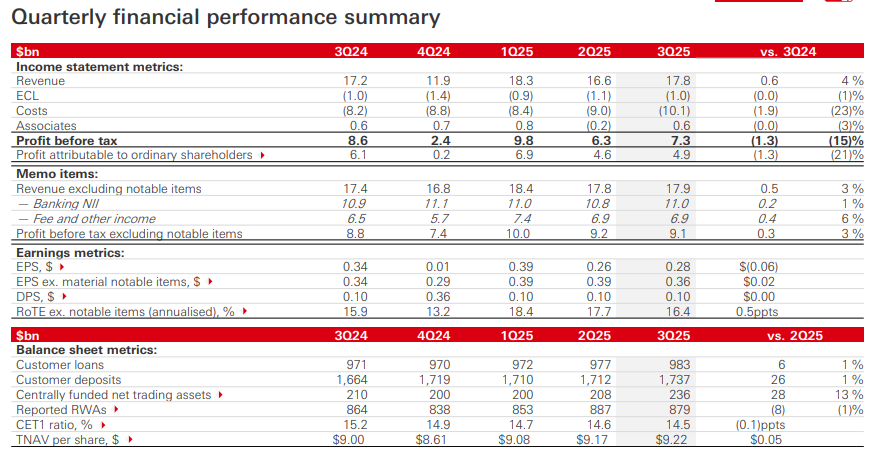

The HSBC reported pre-tax profit of $7.3 billion for the third quarter of 2025. That is down from last year’s figure by $1.2 billion, about £898 million. The bank published the results on 28 October 2025. Revenue held up at roughly $17.8 billion for the quarter. But costs and one-off charges dragged the bottom line. The figures fell a little short of some analyst expectations. The company’s official results pack and earnings release provide the full line-by-line breakdown.

Why Profit Fell: The main Drivers

Three big factors explain the drop. First, large legal provisions hit the quarter. HSBC booked a roughly $1.1 billion charge tied to a lawsuit connected to the Bernard Madoff affair and other legal items. Second, loan-loss provisions rose.

About $900 million was added to cover bad loans. Much of that relates to stress in Hong Kong commercial real estate and broader China exposures. Third, operating expenses climbed. The bank has spent heavily on a global simplification program and on restructuring. Those cost items were partly one-off. But they still lowered reported profit for the quarter.

Segment and Regional Performance

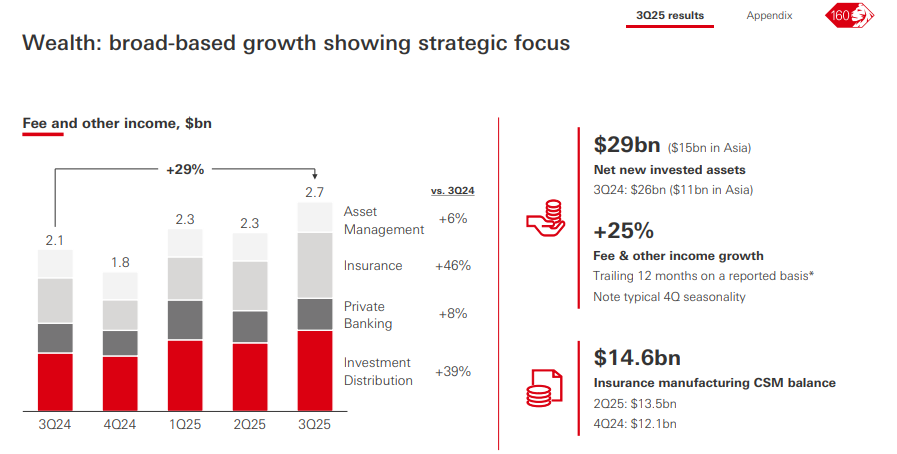

Investment banking fees cooled, as HSBC scaled back some dealmaking work. Fees from capital markets and advisory fell versus the prior year. Corporate and institutional banking showed mixed results. Wealth management performed relatively better and helped offset some pressure from trading and fees.

Regionally, Asia remained central to HSBC’s revenue mix. But losses tied to Chinese bank writedowns and Hong Kong property weighed on results. The UK and Europe showed steadier net interest income, supported by higher average rates. The split shows a bank still pivoting toward Asia while managing legacy risks elsewhere.

Management Reaction and Strategic Moves

HSBC’s leadership framed the quarter as a short-term hit with longer-term progress. Management raised full-year net interest income guidance, pointing to slower-than-expected rate cuts in some markets. The bank also confirmed continued work on simplifying its operations. That includes exits from certain countries and further consolidation of business lines.

To protect capital, the bank paused share buybacks and kept its dividend policy under review as part of capital management. CEO and CFO comments in the earnings release emphasized stability and a focus on the Asian franchise.

Market and Analyst Reaction

Markets reacted in a mixed way. Shares ticked up after the results in some trading sessions. Investors focused on the upward revision to net interest income and on signs that the bank’s core margins are improving.

Analysts noted concern about litigation and China-related writedowns. Some analysts said that, excluding notable items, underlying profit rose, which softened the headline drop. Overall, commentary balanced immediate legal and credit worries against improving margin dynamics.

Short-term Implications for Stakeholders

The quarter tightens near-term choices for management. Higher provisions and legal charges reduce distributable profits. That can limit payouts or share buybacks until the picture clears. Loan-loss provisions may lead to tighter credit appetites in exposed markets.

For customers, this can mean slower loan growth in areas like commercial real estate in Hong Kong. Regulators and rating agencies will watch capital ratios closely. The bank kept capital ample for now, but the mix of charges means careful capital planning is needed.

Longer-term Implications and Strategic View

HSBC’s strategy remains focused on Asia. The group sees higher long-term returns from wealth and corporate flows in that region. Still, the China and Hong Kong setbacks show that pivoting brings risk. Ongoing simplification aims to cut costs and sharpen focus.

If management can capture higher net interest income and reduce structural costs, the bank could restore stronger profit growth. The Madoff-related legal hit and other one-off items complicate the near-term narrative. But the structural plan has not changed.

What to Watch Next?

Watch four things over the next quarter. First, net interest income trends. The bank raised guidance, and actual NII will show whether margins hold. Second, any further legal developments tied to current lawsuits. Third, credit trends in Hong Kong and mainland China commercial property. Fourth, progress on cost savings from the simplification program. Independent models and an AI stock research analysis tool can help track these items, but direct company updates remain the primary source.

Wrap Up: The Takeaway

HSBC’s third-quarter 2025 results show resilience in revenue. But legal charges, higher provisions, and rising costs cut reported profit by about £898 million. The bank looks set to rely on stronger net interest income and cost cuts to recover momentum. Close attention to China-related credit losses and legal outcomes will shape investor confidence in the months ahead.

Frequently Asked Questions (FAQs)

HSBC’s profit fell in Q3 2025 due to higher legal costs, rising loan losses, and weak growth in China and Hong Kong’s property market.

On October 28, 2025, HSBC reported a pre-tax profit of about $7.3 billion, showing a fall of £898 million compared to the same quarter last year.

HSBC plans to cut costs, focus more on Asian markets, and improve margins. The bank also paused share buybacks to protect capital and manage future risks.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.