PayPal Q3 Earnings: Analysts Expect Strong Revenue Growth Amid Cost Controls

PayPal Holdings, Inc. (PYPL) is set to release its Q3 2025 results on October 28, 2025. Wall Street is keenly watching, with expectations pointing to around $8.2 billion in revenue and roughly $1.21 in earnings per share.

What makes this report important is not just the headline numbers but also how PayPal manages costs and shifts toward higher-margin services. Analysts believe revenue growth plus tighter expense control could mark a turning point.

Let’s explore how PayPal performed, what pushed growth, how costs were controlled, and what investors should keep their eyes on going forward.

What PayPal Management Reported and Official Results?

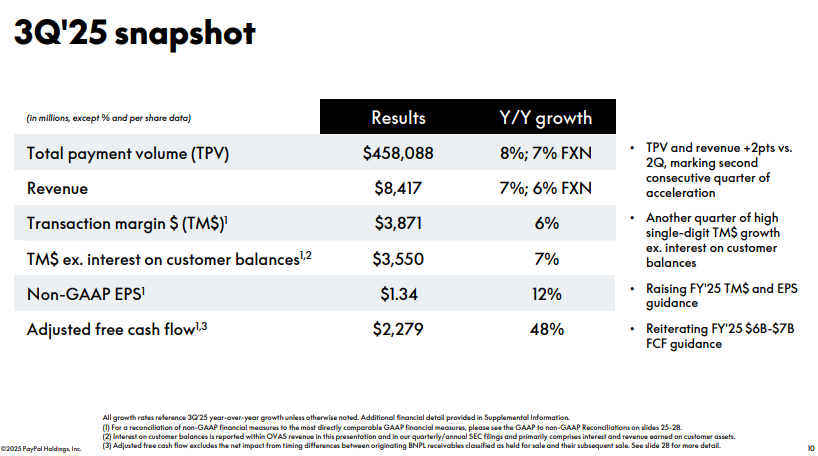

PayPal Q3 results were reported for the period ended September 30, 2025, on October 28, 2025. The company posted net revenue of $8,417 million, up about 7% year-over-year. GAAP net income rose to $1,248 million, driving diluted earnings per share of $1.30. Operating income improved to $1,520 million, lifting the operating margin to roughly 18.1%.

Total payment volume (TPV) grew to $458.1 billion, an 8% increase from the same quarter last year. Management also announced a 14-cent per share dividend and reiterated its $6 billion buyback plan. These figures show both top-line momentum and clearer profit leverage after the firm’s multi-quarter efficiency push.

Paypal Q3 Results: Drivers Behind Revenue Growth

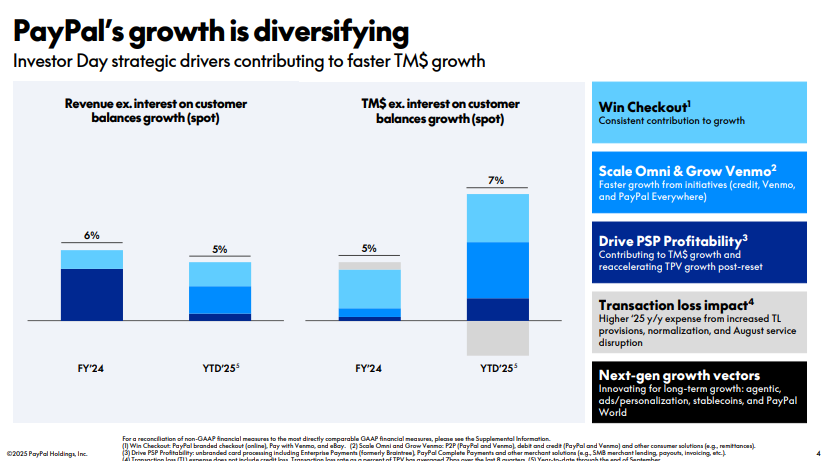

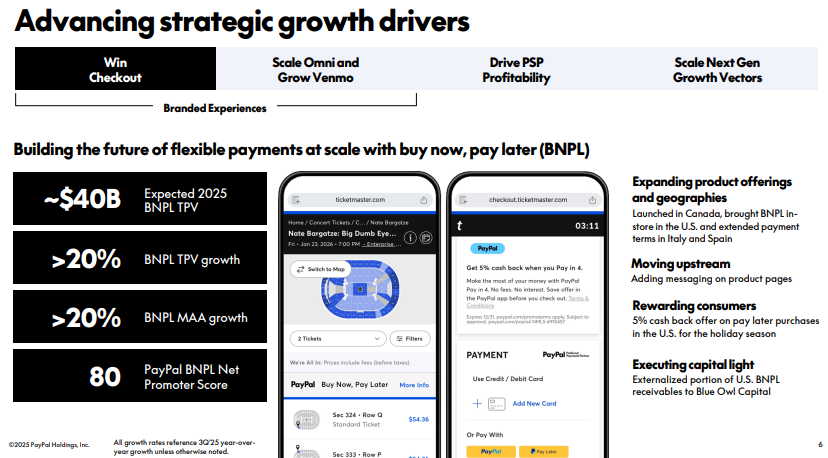

Revenue rose for two main reasons. First, higher-margin products gained share. Branded checkout and merchant services expanded. Venmo monetization also accelerated. PayPal disclosed that Venmo revenue is tracking higher as card use, purchases, and faster transfer fees grow. Second, TPV growth helped transaction revenue.

Consumers spent more with PayPal’s merchant partners. Partnerships and integrations also played a role. Notably, PayPal announced an OpenAI/ChatGPT checkout tie-in that could boost merchant conversions over time. These shifts point to a structural change in revenue mix toward services that carry better margins.

Cost Controls and Profitability

Cost discipline was a clear theme. PayPal trimmed operating expenses and focused on higher-margin activity. The result was a meaningful rise in operating income and a 33-basis-point gain in operating margin year-over-year.

Management attributed the improvement to headcount optimization, targeted technology investments, and cuts to lower-return projects. Analysts say these efforts have created room for reinvestment in growth areas without hurting profitability. Investors should still watch for one-time items or restructuring costs that could mask the underlying trend.

Analysts’ View and Street Expectations

Before the release, Wall Street expected revenue near $8.2 billion and adjusted EPS around $1.20-$1.21. Many analysts framed the quarter as a test of PayPal’s ability to marry growth with margin expansion.

After the results, several firms revised forecasts higher for 2025 profit guidance. Some kept cautious ratings because branded checkout volume remains mixed in parts of Europe and other markets. Overall, the consensus now places more weight on transaction margin dollars and Venmo monetization as the chief drivers of future earnings.

Risks and Headwinds to Watch

Several risks could slow the positive momentum. Competition is intense. Big tech and nimble fintechs keep launching checkout and wallet offerings. A shift back to volume-focused, low-margin transactions could pressure margins.

Geopolitical and regulatory issues also pose risks, especially in markets where cross-border flows and data rules are changing. Currency swings may weigh on reported growth. Finally, investor patience may be tested if branded checkout and international expansion fail to scale fast enough. Monitoring TPV mix and transaction margin dollars will be essential.

Market Reaction and Investor Takeaways

Markets reacted positively to the beat and the clearer profit picture. Shares jumped after the release as investors cheered the margin lift, the Venmo disclosure, and the OpenAI integration news. The dividend announcement added a signal of confidence from management. For investors, the quarter suggests a transition from cost-cutting to selective reinvestment.

However, the core thesis still depends on sustainable growth in branded checkout and improved monetization of Venmo. The quarter tilted the scales in PayPal’s favor, but the company must show repeatable gains in the next two quarters to fully change sentiment.

What to Watch Next Quarter?

Key metrics to track next are branded checkout volumes, Venmo revenue growth cadence, total payment volume trends, and transaction margin dollars. Also, watch guidance for full-year transaction margin dollars and any updates on international expansion.

PayPal’s commentary on merchant adoption of Instant Checkout and early metrics from the OpenAI tie-in will be especially important. Analysts will be listening for whether higher margins persist without sacrificing growth. Using an AI tool to monitor real-time merchant conversion data and TPV mix could give investors an early read on execution.

Final Words

The PayPal Q3 2025 showed real progress. Revenue rose and margins improved. Venmo moved closer to being a reliable revenue source. Strategic partnerships added a potential long-term tailwind. Still, competition and regional challenges remain. The next two quarters will test whether margin gains are durable and whether branded checkout can scale. Investors should focus on the KPIs management highlights. These will tell whether the company has shifted from recovery to sustainable growth.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.