Cameco Stock Today Gains as Westinghouse, Brookfield Join $80B Nuclear Project

The Cameco Stock rally on Wednesday reflects fresh optimism after Cameco, Brookfield, and Westinghouse announced a strategic partnership with the U.S. government to deliver at least $80 billion in new nuclear reactors. Investors cheered the plan’s potential to boost uranium demand, rebuild supply chains, and power large data centers that support AI growth.

Cameco Stock: Market reaction and numbers

How did markets move today?

Cameco Stock (CCJ) jumped sharply on the news, with reports showing strong intraday gains as traders priced in higher long-term fuel demand for reactors. Different market outlets recorded significant percentage moves, reflecting high retail and institutional interest in nuclear names.

Why did Cameco Stock surge today? The headline, a government-backed program to deploy Westinghouse reactors, signals guaranteed future demand for uranium and fuel services, which is directly positive for Cameco’s earnings outlook.

Social signals showed a quick investor response, with early sentiment captured on social feeds:

Traders and chart-watchers also shared activity screenshots and hot takes

Cameco Stock: What the $80B partnership is and who’s involved

What does the deal include?

The agreement, framed as a strategic partnership, will channel at least $80 billion into constructing new Westinghouse reactors across the U.S. The plan includes government-facilitated financing, permitting support, and measures to accelerate procurement and construction of long-lead items.

Brookfield and Cameco, owners of Westinghouse, will lead deployment and supply-chain revitalization.

What does the $80 billion nuclear deal mean for the U.S.? It aims to rebuild the domestic nuclear industrial base, create jobs, and provide low-carbon, reliable power, including the electricity needs of large-scale AI data centres. Officials position it as a national and climate-security infrastructure.

Industry optimism was visible online as traders voiced bullish views on uranium demand and sector upside.

Cameco Stock: Why this matters for uranium and energy security

How does Cameco fit into the supply chain?

Cameco is one of the world’s largest uranium producers and a major supplier of fuel services. The company’s role in a Westinghouse-led buildout positions it to supply more uranium and services over decades, a structural tailwind for Cameco Stock (CCJ) and the broader uranium market.

How will this partnership shape the future of nuclear energy? By combining government financing, Westinghouse reactor designs, Brookfield’s capital, and Cameco’s fuel capabilities, the partnership could speed reactor deployment and restore long-term demand confidence for uranium supply chains.

Retail investors also chimed in on energy sector momentum and trading flows related to the deal.

Cameco Stock: Financial outlook and analyst views

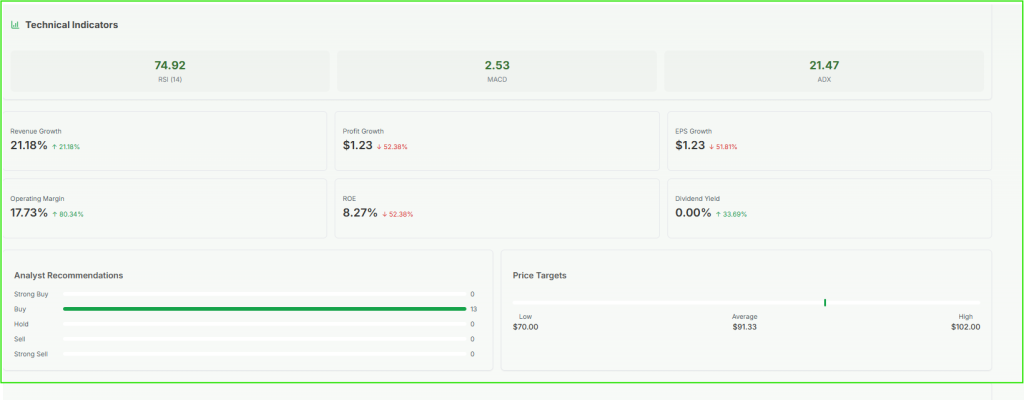

What are analysts saying?

Experts point to improved long-term demand for uranium and higher potential cash flows from Cameco as reactors move from planning into execution. Some analysts warn that execution and regulatory approvals will take time, but the direct government participation significantly lowers project risk compared with a purely private program.

How will this affect Cameco’s valuation? If projects proceed, Cameco’s revenue base could expand materially over the next decade. That said, market pricing will also consider capital intensity, timing of orders, and global uranium prices. Investors using AI Stock research tools may find new datasets showing increasing reactor build commitments.

In the short term, AI Stock analysis platforms and quant services may help traders model demand curves and price trajectories for Cameco Stock and peer energy names.

Cameco Stock: Broader implications for energy and markets

What does it mean for U.S. energy independence?

The program is pitched as a way to reduce reliance on foreign fuel and strengthen domestic manufacturing for reactors and supply chains. Broad-scale nuclear buildout supports deep decarbonization and adds a stable baseload to complement renewables.

How does this affect other stocks? The news lifted other nuclear-related equities and resource names, and it nudged infrastructure and engineering suppliers higher as markets priced in large construction pipelines. The move also adds momentum to broader nuclear and energy transitions in investor portfolios.

Cameco Stock: Risks and caveats

What could go wrong?

Key risks include regulatory hurdles, construction delays, supply-chain bottlenecks, and potential political shifts that might change funding or timelines. While government backing reduces some risks, execution at scale remains complex and capital-intensive.

How should investors weigh the news? Long-term investors may view the partnership as a positive structural shift for Cameco Stock, but near-term traders should watch contract awards, permitting timelines, and uranium-price moves. Use diversified exposure if you’re concerned about execution risk.

Cameco Stock: The role of nuclear in the AI-era power demand

Why is nuclear tied to AI growth?

Large AI data centres need massive, reliable power. The $80B reactor program explicitly references data-centre and compute demand as part of the rationale for new generation, a sign that energy infrastructure is being planned with high-performance computing in mind. This linkage helps explain why investors see added optionality for Cameco’s long-term fuel business.

Multimedia: Watch the announcement

For a quick visual summary, watch the partnership briefing and market reaction on video: “US Government Announces $80B Nuclear Reactor Partnership with Brookfield & Cameco | Westinghouse”. This clip summarizes the terms and explains how the buildout could proceed.

Quick takeaways for investors

- Immediate: Cameco Stock jumped on the announcement as traders priced future uranium demand.

- Medium term: If executed, the $80B build program will require expanded uranium supply and fuel services, benefiting Cameco.

- Long term: The partnership could reshape U.S. nuclear capacity and anchor a new industrial cycle for reactors, supply chains, and associated services.

Conclusion

The Cameco Stock move reflects market confidence that a U.S.-backed, large-scale Westinghouse reactor program will increase uranium demand and strengthen Cameco’s strategic role.

While execution risks remain, government participation and the combination of Brookfield’s capital and Cameco’s supply expertise create a compelling long-term narrative for nuclear energy’s comeback.

As the world seeks reliable clean power, Cameco’s expanding role may not just fuel reactors but help power the next phase of the energy transition.

FAQ’S

Yes, Cameco owns a 49% interest in Westinghouse, through a joint acquisition completed with Brookfield Renewable Partners/Brookfield’s energy platform.

Many analysts view Cameco as well-positioned thanks to its stake in Westinghouse and rising uranium demand. However, “strong buy” depends on individual risk tolerance and timing; always assess fundamentals and market conditions.

Cameco’s upside comes from growing nuclear reactor builds, fuel-cycle services, and its Westinghouse stake, which could boost earnings, but projections vary widely and depend on execution, regulation, and uranium prices.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.