Google Stock Earnings: Alphabet Surges as Q3 Results Smash Expectations

Google Stock jumped following an exceptional third-quarter performance by Alphabet Inc. (NASDAQ: GOOGL), as the tech giant delivered results that exceeded Wall Street expectations. Investors cheered robust ad revenue, strong Cloud growth, and accelerated monetisation of AI initiatives, sending the stock higher in after-hours trading.

Google Stock: Why the rally happened

What drove the upside today?

Alphabet reported revenue of $102.35 billion in Q3 2025, up approximately 16% year-over-year. Adjusted earnings per share (EPS) reached $2.87, also beating expectations. Key growth was driven by a rebound in ad spending, expanding Cloud business, and growing AI-powered product monetisation.

“We are investing to meet customer demand and capitalise on the growing opportunities across the company,” said CEO Sundar Pichai, signalling management confidence in the AI era.

Why did Google Stock surge after the earnings call? Because the quarter showed that Alphabet’s core Search and advertising model is stable, its Cloud business is scaling, and AI monetisation is real, a trifecta that removed key investor concerns.

Google Stock: Ad business shows resilience

Search and advertising performance

Alphabet’s advertising business, including Search and YouTube, posted strong results. The “Search & Other” segment reported $56.57 billion in revenue, up about 14.5% YoY.

Meanwhile, the overall ad unit (as per some reports) achieved ~$74.18 billion, up approximately 12.6%. These numbers allayed fears that Google’s advertising machine was slowing amid AI disruption.

What role did ad revenue play? It was central, and growth drove the headline beat, reassured investors about core business health, and supported the premium valuation of Google Stock.

Google Stock: Cloud business accelerates

Cloud business and enterprise momentum

Alphabet’s Cloud division posted $15.16 billion in revenue, growing roughly 33–34% YoY, outpacing many competitor segments. Importantly, the Cloud backlog grew to ~$155 billion, showing strong future contract demand.

As enterprises shift toward AI infrastructure, Google Cloud is gaining traction.

How did the Cloud update affect stock sentiment? It reinforced that Google isn’t just surviving but thriving in the AI transition, a major positive for Google Stock’s long-term story.

Google Stock: AI monetisation and strategy

AI investments begin to pay off

Alphabet emphasised monetisation of its AI platform, including the Gemini model and related infrastructure (Tensor Processing Units, etc.). Gemini now reportedly serves hundreds of millions of users, aiding ad engagement and cloud uptake. This shift from R&D to revenue is attracting investor interest.

What role did AI play in Alphabet’s growth? It’s the “next leg” , not only for Cloud and enterprise but also for ads and consumer offerings. This potential helps justify a premium valuation for Google Stock.

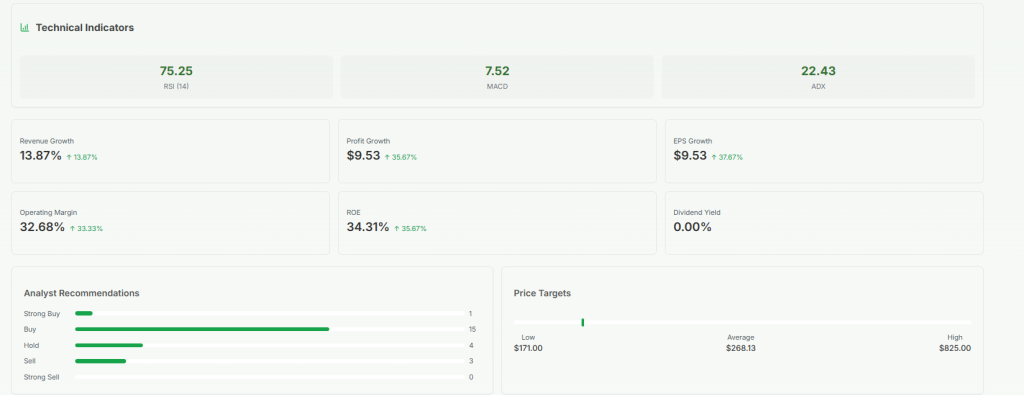

Google Stock: Market reaction and analyst outlook

Analysts and market response

After the earnings release, shares of Google Stock were up around 5–6% in after-hours trading. Analysts at firms like JPMorgan and KeyBanc had already raised price targets ahead of the print. Investor social sentiment also amplified the beat:

noted the earnings beat and implications for tech stocks.

illustrated investor reaction via chart movement.

highlighted analyst views on the AI play.

Broader market implications

Google Stock’s (GOOG) strong quarter helped lift the Nasdaq Composite and other mega-cap tech names. The results also boosted optimism for other AI-driven stocks, as the market sees a large-cap validation of the AI investment thesis.

Google Stock: Risks and things to watch

What could go wrong?

Despite strong results, risks include:

- Slowing ad spending if macro conditions deteriorate.

- Heavy CapEx (Alphabet raised its 2025 projection to $91–$93 billion).

- Cloud margin pressures and intensifying competition.

What will investors monitor next?

- Q4 guidance, especially around ad growth and cloud margin.

- Execution of AI product monetisation, especially how Gemini and other tools translate into revenue.

- Capital-spending discipline and cost control, as elevated CapEx could compress margins in future quarters.

Google Stock: Conclusion

The impressive Q3 results have provided a fresh catalyst for Google Stock — stronger than expected revenue, solid ad and cloud growth, and a clearer path toward AI monetisation. While near-term risks remain, the longer-term story looks compelling.

For investors focused on technology, innovation, and monetisation of artificial-intelligence infrastructure, Alphabet stands out. If the company continues to execute and capitalise on its AI and cloud momentum, Google Stock may be well-positioned for further upside as we head into 2026.

FAQ’S

Google Stock has risen after Alphabet’s strong Q3 2025 earnings beat expectations, driven by higher ad revenue, rapid AI adoption, and strong Cloud growth. Investor confidence grew as profits and revenue outperformed forecasts.

Alphabet reported $102.35 billion in revenue and $2.87 earnings per share (EPS) for Q3 2025, both above Wall Street estimates. The company saw solid growth in advertising, YouTube, and its Cloud business.

Analysts are cautiously optimistic about Riot Platforms’ earnings, expecting modest growth in Bitcoin production and efficiency gains. However, performance depends heavily on crypto prices and energy costs.

If you had invested $10,000 in Google 10 years ago, it would be worth over $60,000 today, depending on reinvested returns and stock splits. Alphabet’s consistent growth in ads, Cloud, and AI has fueled long-term gains.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.