Property Loss Crisis: The Calculated Risk Wiping Out Investor Fortunes

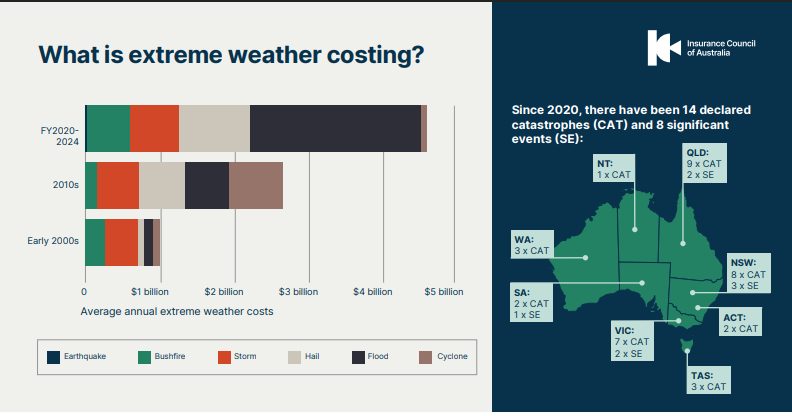

As of October 30, 2025, Australia’s property market faces one of its toughest tests. Floods, fires, and soaring insurance premiums are shaking investor confidence. The Insurance Council of Australia reports over $12 billion in weather-related claims since 2023. Rising climate risks and interest rates are turning what was once a “safe” investment into a risky bet.

Cities like Brisbane, Sydney, and Townsville are seeing repeated property damage and shrinking insurance cover. Many owners can’t afford premiums, leaving homes uninsured. The growing gap between insured and uninsured properties is now a national concern.

This article explores how predictable risks like flood zones, climate exposure, and high leverage are wiping out fortunes and what investors can do to protect themselves.

Background and Context of Property Loss

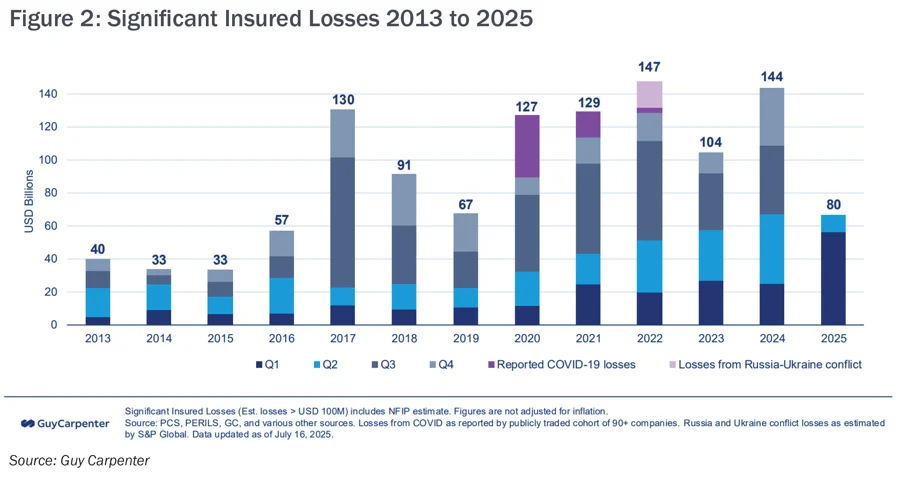

Australian property now faces new and clear risks. Floods, cyclones, and coastal erosion have pushed insured losses higher in recent years. The Insurance Council of Australia reports about $22.5 billion in insured extreme-weather costs over the past five years, with sharp rises into 2025. Accurate rebuild costs and rising claims are making insurers tighten cover and lift premiums across many regions.

Property, once seen as a safe hedge, is not immune. Cheap debt and steady rents powered price gains in the 2010s. That model broke as rates moved and climate events rose. Local hazards now shape value more than national house-price trends. The Reserve Bank of Australia highlights how changing rates affect leverage and market stress.

The “Calculated” Nature of Risk

Many losses were not random. Flood maps, cyclone tracks, and erosion studies often show repeat exposure. Planning maps and insurer notices flag trouble in advance. Investors who ignore such data can face predictable surprises. High loan-to-value loans make small income or price drops destroy equity. Insurers have also altered policies to exclude repeated flood damage or to add large excesses. These contract changes shift the cost back to owners and buyers.

Pricing errors add to the problem. Builders’ and materials’ costs have climbed since 2019. That rise pushed rebuild costs up by large amounts. Where rebuild costs are far above pre-event estimates, owners face gaps between insurance payouts and actual repair bills. That gap often forces special levies, expensive out-of-pocket fixes, or property write-downs.

Key Drivers behind Recent Property Losses

Climate hazards lead the list. Australia has had repeated flood and cyclone events since 2022. These events caused many claims and strained insurer capacity. The ICA and other analysts note that extreme events have become more frequent and costlier, concentrating risk in flood plains and some coastal suburbs.

Rising costs and interest-rate shifts are critical. Higher rates shrink borrowing capacity and raise debt service. Many investors face tougher refinancing in 2025. The RBA’s Financial Stability Review warns that credit and rates can quickly change asset prices and stress leveraged owners.

Insurance market shifts are another driver. Premiums rose sharply for many households in 2024-25. Some insurers hiked prices by 20-40% at particular addresses. Insurers’ retreat from high-risk postcodes makes homes harder to sell and harder to finance. The ACCC monitoring and consumer groups report rising premiums and affordability concerns.

Regulatory shocks and local policy changes also matter. City councils adding new flood controls, or states changing development rules, can cut redevelopment value. Rent controls or sudden planning limits reduce future income and narrow buyer pools. These shocks can turn a stable cashflow asset into a troubled one within months.

Real-world Examples and Lessons

A coastal unit complex in northern Queensland suffered repeated storm surges and roof damage across several seasons. Insurers limited coverage and added exclusions. The complex struggled to obtain reasonable cover. The owner group faced special levies to rebuild communal assets. This shows how repeated events and insurer exclusion can force owners into equity losses and forced sales.

An inner-city office tower saw vacancy rise after hybrid work reduced demand. The owner had short-dated, high-leverage debt. Refinancing came at higher rates and with stricter covenants. Lenders required repairs and tenant incentives, which cut cash flows. The building’s valuation fell fast. The case highlights tenant-demand risk and the danger of concentrated cashflow reliance.

A suburban landlord in New South Wales found premiums spiked after a local flood event. Tenants could not pay higher rents. Maintenance lagged. The property traded below market value when the owner sought an exit. This example underlines how insurance cost rises can feed into deferred maintenance and lower asset valuations.

How Investors Get Caught?

Many investors repeat the same errors. Overreliance on past growth blinds judgment. High leverage leaves little margin for stress. Local risk checks sometimes get skipped in favour of national market metrics. Dated valuation models fail to include modern hazard scenarios or rising rebuild costs. Herd buying in hot suburbs amplifies downside when conditions reverse.

Information gaps widen the problem. Some buyers assume cover will always be available and affordable. That assumption fails where insurers withdraw or impose tight limits. Finance approvals that ignore local hazard loadings create fragile loans. These structural gaps cause sudden losses when a claim or refinance shock hits.

Practical Risk-mitigation Steps

Start with location-level research. Check flood maps, erosion risk, and local council hazard plans. Stress test cash flows for higher interest costs and lower rents. Favor longer, fixed-rate debt and lower loan-to-value ratios. Build a repair and insurance reserve to cover excesses and short-term gaps. Shop insurers and compare excesses, exclusions, and claims service.

Consider targeted retrofits such as raised flooring, flood-proof doors, and drainage upgrades to reduce future claims and premiums. Use an AI research analysis tool to cross-check data sets like hazard maps, rent trends, and loan maturities for hidden correlations.

Diversify across regions and asset types. Consider shifting part of a portfolio into less climate-exposed areas or into different property classes. Keep a clear exit plan for underperforming assets. Where possible, negotiate covenant flexibility with lenders before stress appears. These steps limit forced sales and protect liquidity.

Policy and Market Responses

Markets and regulators must act. Better disclosure of hazard risk and clearer insurance pricing will help. Public programs can support reinsurance capacity and resilience upgrades. Lenders and rating agencies need transparent stress testing. Such steps reduce surprises and protect broader financial stability.

Conclusion and Action Point

As of 30 October 2025, Australia’s property market must adapt to a new reality. Climate risk, higher rebuild costs, and shifting insurance coverage now shape value at the street level. Investors must act early. Check local hazard data. Lower leverage. Review insurance terms. Upgrade resilience where possible. Treat hazard exposure and insurance clarity as central parts of any valuation. Doing so reduces the chance of joining the next round of forced sales and steep losses.

Frequently Asked Questions (FAQs)

Property loss risk means the chance of losing money or assets due to damage, falling prices, or legal changes. It affects many owners in 2025.

In 2025, investors lose money because of high interest rates, rising costs, climate damage, and new property laws that reduce income or property value.

To avoid loss in 2025, investors should study market trends, buy insurance, use less debt, check local rules, and plan for rising repair and loan costs.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.