Vodafone Idea Shares Crash 10% After SC Order on AGR Dues; Airtel Also in Focus

On October 29, 2025, Vodafone Idea’s shares fell sharply by nearly 10% after the Supreme Court of India issued its written order on the Adjusted Gross Revenue (AGR) dues case. The judgment shocked investors who were expecting broader relief for the telecom company. Instead, the court allowed a limited review of the government’s AGR demand, only up to the financial year 2016-17. This narrow scope disappointed the market, sending Vodafone Idea’s stock into a free fall.

The news also dragged Bharti Airtel shares lower as the entire telecom sector came under pressure. The ruling once again highlighted the long-standing burden of AGR dues that has haunted Indian telecom firms for years. For Vodafone Idea, which is already facing heavy debt and financial stress, the order added fresh worries about survival. Investors now wonder if government support or new policy relief can still help the company recover from this major blow.

Background: What AGR means and Why it Matters?

Adjusted Gross Revenue (AGR) is the base that the Department of Telecommunications uses to calculate licence fees and spectrum charges. AGR includes core telecom income and a range of non-core receipts. The Supreme Court’s broad interpretation since 2019 dramatically raised the dues for carriers. This legal change has been a heavy burden for Indian telcos. Vodafone Idea (Vi) entered the dispute with a deeply leveraged balance sheet. The AGR liability became an existential worry for the company and its investors.

What the Recent Supreme Court Order Actually Said?

On October 27, 2025, the Supreme Court allowed the Union government to revisit certain AGR demands raised against Vodafone Idea. The court limited this permission to the additional AGR demand up to fiscal year 2016-17. The judgment did not wipe out broad AGR liabilities. Many investors had hoped for wider relief. The narrow wording changed the market’s expectations.

Why the Market Swung so Hard?

The market moves reflected a change in what traders expected. Earlier, news that the government might reconsider AGR dues had lifted Vodafone Idea shares. That optimism peaked on October 27 when the court signalled a path for the Centre to act.

But the written order’s confined scope disappointed many. The share price then swung sharply. Intraday falls of around 10-12% were reported as traders digested the fine print. Short sentences and hard numbers hit investor sentiment fast.

Impact on Vodafone Idea’s Finances

Vodafone Idea already faces severe pressure from debt and low margins. The firm has large outstanding obligations from past AGR demands and heavy borrowings. Even with limited relief, the company must still raise funds and manage big scheduled payments. The government converted some dues into equity earlier and now holds a near-majority stake. But conversion alone did not erase the structural cash-flow shortfall. Creditors and lenders remain cautious.

How Airtel and the Sector Reacted?

Bharti Airtel and other operators moved with the market. Airtel did not face new legal relief, but its stock felt the sectoral ripple. Traders tightened positions across telecom names. The order’s selective nature raised questions about precedent. If relief is strictly case-by-case, each firm must still defend its own position. This uncertainty prompted investors to focus on stronger balance sheets.

Analyst Views and What They are Watching?

Analysts gave mixed reactions. Some saw the ruling as a step toward clarity. Others warned that clarity is not the same as solvency. Broker notes pointed to three triggers to follow:

- any fresh government package or restructuring plan;

- Vodafone Idea’s ability to secure bank funding, and

- quarterly operating performance.

Research houses also stress subscriber trends and ARPU (average revenue per user). Market watchers are using models and an AI stock research tool to test funding scenarios and stress cases.

Possible Scenarios Ahead

One scenario is limited policy action. The Centre could offer targeted relief only for the period the court allowed. That would ease near-term cash flow but leave long-term risk. Another scenario is a broader intervention. The government could craft a wider package to stabilise the sector. A third, darker outcome is continued strain that forces consolidation. Any of these routes will shape investor returns and the competitive map in India’s telecom market.

What Investors Should Focus on Now?

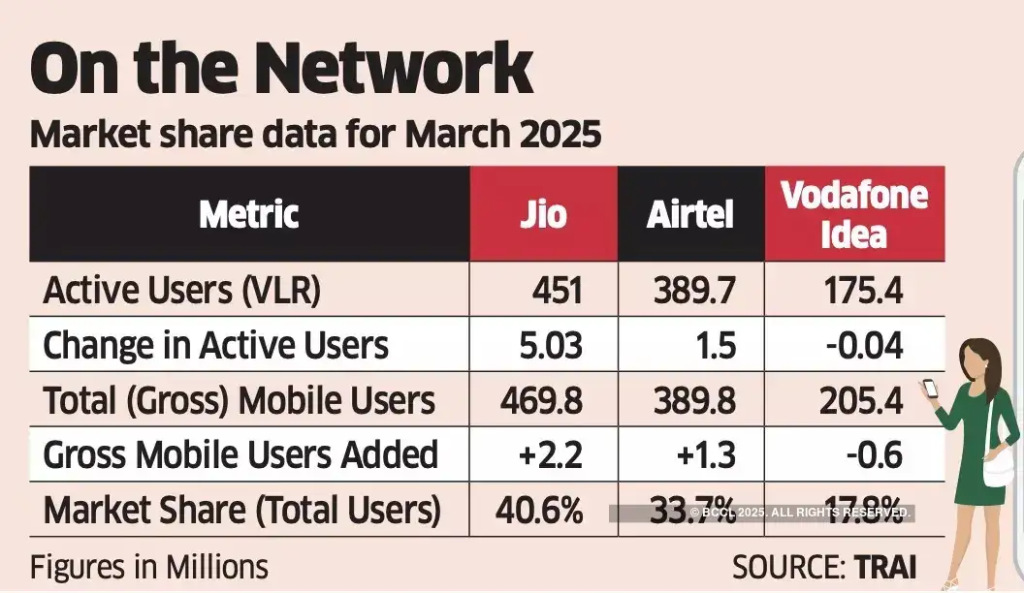

Watch official government statements closely. Look for formal timelines and the exact terms of any rethink on dues. Track Vodafone Idea’s fundraising moves and debt refinancing. Monitor quarterly revenue, subscriber churn, and network investment cadence. Compare Vodafone Idea’s metrics with Airtel and Reliance Jio. Companies with healthy cash flow will likely win market share if consolidation picks up.

Wrap Up

The October 27, 2025, order gave legal room for the Centre to act. But it did not erase the heavy AGR overhang. Vodafone Idea still faces a fragile balance sheet and urgent funding needs. The market reaction shows how fine legal language can swing investor sentiment. The coming weeks are critical. The industry needs clearer policy steps to remove uncertainty and enable stable investment.

Frequently Asked Questions (FAQs)

Vodafone Idea shares fell approximately 10% on October 27, 2025, following the Supreme Court’s AGR order, which provided only limited relief, disappointing investors who had expected broader support.

The AGR order on October 27, 2025, allows review of dues only till 2016–17. It means Vodafone Idea still owes large payments and faces major financial pressure.

As of October 30, 2025, the government has not announced any new relief plan. Officials said they will study the Supreme Court’s order before taking further action.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.