Adani Green Energy Shares Surge 11% After Strong Q2 Results

On 28 October 2025, Adani Green Energy Ltd. announced its Q2 results, and the market took notice. The company posted a net profit of ₹644 crore for the quarter ended 30 September, up around 25 % compared with the same period a year earlier. Investors responded enthusiastically: shares jumped more than 11 %, with a peak of 14 % in early trading.

Behind the numbers, the firm’s strong performance came from higher power‑sales volumes and improved project output, even though overall revenue held mostly flat. This result signals that Adani Green is ramping up its operational strength in the renewable energy sector. Let’s dig into what drove this surge, what it means for the company and the sector, and what to keep an eye on going forward.

Adani Green Energy, Q2 FY26: The Numbers that Mattered

The Adani Green Energy reported strong quarterly results that grabbed attention on October 28-29, 2025. The company posted a consolidated net profit of ₹644 crore for the July-September quarter. Power-supply revenue rose to about ₹2,776 crore. Total income showed only a small change. The firm said operational capacity stood at 16.7 GW as of September 30, 2025. The market reacted fast. Shares jumped more than 11% and spiked as high as ~14% during trading on October 29, 2025.

What Drove the Jump in Profit?

Higher energy sales were the main driver. The company reported a large rise in energy produced and sold. Energy sales for the half-year rose sharply. Improved capacity utilization helped, too. Solar and wind plants ran at better efficiency. EBITDA from the power supply also expanded. These operational gains lifted margins. Analysts pointed to both volume growth and tighter costs as the twin engines behind the profit rise.

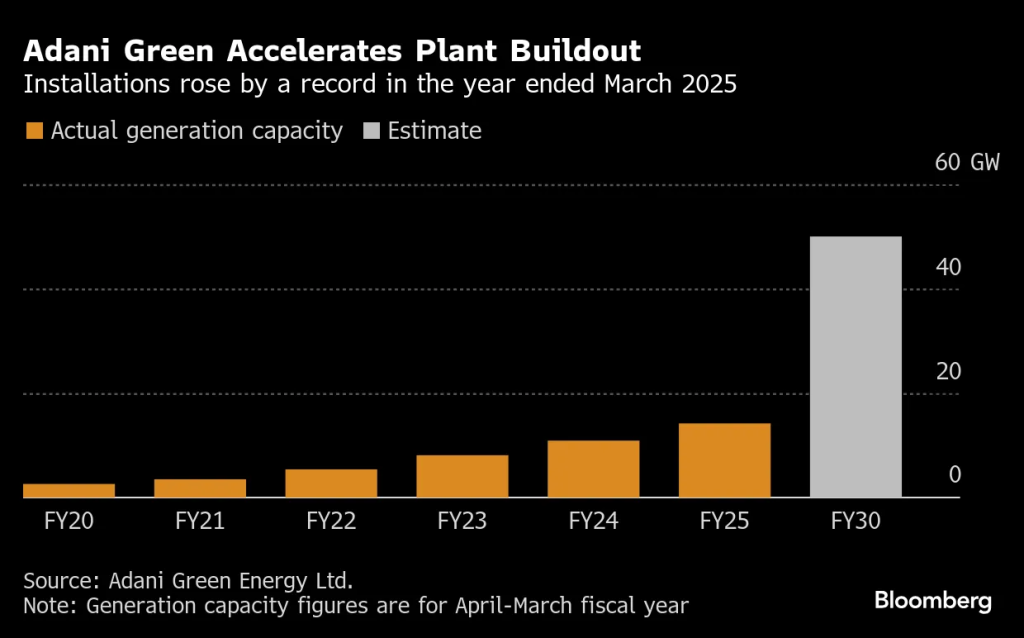

Capacity and Execution: The Backbone of Growth

Adani Green expanded its capacity quickly. Operational capacity climbed nearly 49% year-on-year to 16.7 GW by September 30, 2025. New additions and faster project commissioning added scale. The company continues to work on large projects, including the Khavda energy park in Gujarat. Such projects anchor long-term output and can cut unit costs as scale rises. Execution speed matters. Faster commissioning converts backlog into revenue.

Market Reaction and Investor View

The stock rally reflected more than one good quarter. Investors rewarded visible delivery. The surge reversed a short-term slide and set a fresh near-term high. Some traders saw the results as proof that growth can be profitable. Others warned that single-quarter beats do not erase longer-term risks. Short sellers and momentum players helped amplify intraday swings. Market commentary noted that the renewable sector’s positive sentiment also helped AGEL’s move.

Financial Quality: What to Watch in the Numbers?

Profit growth is welcome. But revenue moved less dramatically. That gap suggests margins and non-operating items will be watched closely. Cash profit (or quarterly cash flow) improved. Debt and capex plans remain central. The company has large capital needs to hit its 50 GW by 2030 target.

Continued margin strength depends on keeping capex disciplined and securing low-cost funding. Analysts using an AI stock research analysis tool flagged financing cost and project timelines as the key sensitivity points for valuations.

Strategic Implications for Adani Green

The company now sits among India’s largest renewable producers. Scale helps win long-dated contracts. Larger capacity also improves bargaining power with suppliers and lenders. If execution continues smoothly, the firm can convert growth guidance into recurring cash flows. That will matter for investor confidence. However, big projects bring execution risk. Grid integration, land clearances, and equipment lead times can slow delivery. Policy shifts and auction dynamics will also influence future returns.

Sector Context and Tailwinds

India aims to increase non-fossil capacity sharply by 2030. That policy push creates strong structural demand. Corporations and utilities also sign long-term power purchase agreements. Falling equipment costs, improved storage options, and hybrid project designs add optionality. These industry trends make the long-term outlook constructive for large, well-run renewable players. Still, competition for projects and capital can be intense.

Near-term Risks and Red Flags

Execution delays are the main operational risk. Rising interest rates or tighter credit could raise financing costs. Regulatory changes or transmission bottlenecks could hit dispatch and revenues. Market sentiment can swing quickly, especially for stocks that already have high expectations priced in. Monitor quarterly cash flow, project completion schedules, and debt metrics closely in the coming reports.

Adani Green Energy: What to Watch Next?

First, track capacity additions and the company’s update on Khavda and other large projects. Second, follow quarterly energy sales and capacity utilization figures (CUF). Third, monitor financing plans and any refinancing activity. Fourth, watch policy news on auctions and grid prioritization for renewables. Finally, keep an eye on stock-level flows and investor commentary after each quarter.

Bottom line

The Q2 showing on October 28-29, 2025, highlighted operational momentum. Profit and energy sales rose. Capacity is scaling fast. That combination lifted investor sentiment. Long-term value will depend on steady execution, disciplined capex, and affordable financing. Short wins are useful. Consistent delivery will be decisive.

Frequently Asked Questions (FAQs)

On 28 October 2025, Adani Green shares rose 11% after strong Q2 results. Higher power sales and better project output boosted investor confidence, driving the stock up.

For the quarter ending 30 September 2025, Adani Green reported a net profit of ₹644 crore, up about 25% from last year. Revenue was mostly flat, but margins improved.

Adani Green has growth in renewable energy and strong projects. However, revenue is flat, and market risks remain. Investors should watch future performance before deciding.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.