Orkla India IPO: Day 2 Subscription at 79%, GMP Trends and Investor Buzz

On October 29, 2025, Orkla India Limited opened its initial public offering, aiming to raise around ₹1,667 crore at a price band of ₹695-₹730 per share. By the end of Day 1, the IPO was subscribed to about 0.79 times, indicating moderate interest among investors so far. On Day 2, things picked up slightly with the issue reaching around 79% subscription by morning.

Orkla India, the parent company behind popular brands like MTR and Eastern, is looking to tap into India’s booming packaged-food market. The buzz around its IPO is driving sharp attention to its subscription pace, grey-market premium, and what this means for its listing. Let’s dig into the Day 2 subscription trend, GMP movements, and the investor sentiment surrounding this offering.

Company Background and Market Position

Orkla India is the maker of familiar brands such as MTR, Eastern, and Rasoi Magic. The firm focuses on packaged foods. It sells spices, ready-to-eat meals, mixes, and breakfast products. Its network covers modern retail and small shops across India. The company runs an asset-light model and has low debt. This gives it room to invest in brands and distribution.

IPO Details: Facts that Matter

The IPO opened on October 29, 2025, and closed on October 31, 2025. The price band was set at ₹695-₹730 per share. The issue is an Offer-for-Sale (OFS) of about ₹1,667 crore, with no fresh equity being raised by the company. ICICI Securities is the book-running lead manager, and KFin Technologies is the registrar. The tentative listing date shown in filings and market reports is November 6, 2025.

Day-2 Subscription: How Demand Evolved?

Demand picked up on Day 2. The IPO was about 79% subscribed on Day 1 and gathered momentum the next day. By mid-day 2, the issue crossed full subscription, led by strong interest from retail investors and NIIs. Retail lists were quickly filled, employee quota showed heavy interest, while QIB uptake remained low in early bidding windows. These flows shaped the allotment odds and market chatter through October 30, 2025.

Grey Market Premium (GMP): Signals and Trend

The grey market has reflected a positive but cooling mood. GMP peaked in the run-up to the issue and then eased. On October 30, 2025, several trackers reported GMP around ₹68-₹84, implying an expected listing near ₹798-₹814 if the premium held. That suggests modest expected listing gains in the low-to-mid teens percent range versus the upper band. The softening of GMP from earlier highs suggests some traders are taking profits while others stay optimistic.

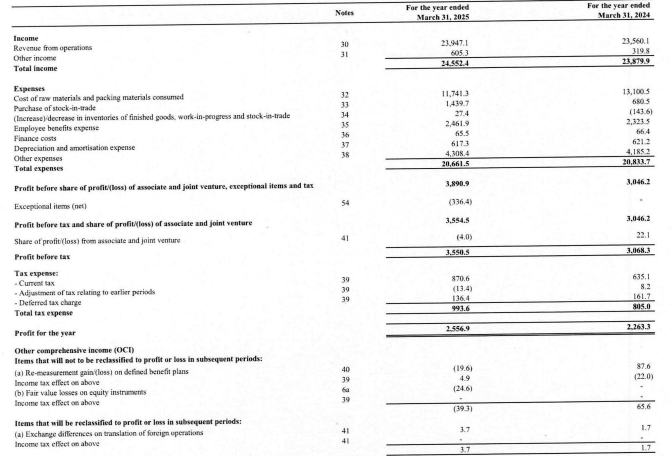

Financial Snapshot: Strengths and Cautions

Public filings show steady revenue growth for the group in recent years. Margins have felt pressure at times from input costs. The company’s large brand portfolio and distribution reach are clear strengths. At the same time, valuation on IPO pricing will matter. The OFS structure means proceeds go to sellers, not to expand company capital, a detail investors should note when judging growth funding.

Market and Investor Sentiment around the IPO

Social chatter and broker notes mixed optimism with caution. Retail investors liked brand familiarity and the perceived listing upside. Institutional interest, especially from QIBs, was restrained in early windows. Analysts pointed to a fair but not cheap price band given peers in the FMCG space. Overall market tone on October 30, 2025, was mildly positive, with participants focusing on listing gains and long-term brand play.

Expert Views and Listing Expectations

Broker reports suggested a likely listing premium in the single-digit to low-double-digit percent range if the GMP persisted. Some analysts flagged that peer valuations and margin trajectories should be the main long-term guides. Short-term traders may chase listing gains. Long-term investors must weigh brand strength against valuation and competitive pressures. One analyst note even referenced an AI research analysis tool to run scenario checks on listing outcomes.

Key Risks to Keep in Mind

High GMP does not guarantee sustained gains after listing. Competition in packaged foods is intense. Input-cost swings can compress margins. The OFS nature means no fresh capital for growth, which changes the investment case compared with a fresh-issue IPO. Finally, subdued QIB demand could make post-listing liquidity and price moves more volatile.

Final Words and What to Watch Next

Orkla India’s IPO attracted strong retail and NII interest by Day 2, while GMP pointed to modest listing gains as of October 30, 2025. Key watchables before allotment are final subscription ratios across categories, any late shifts in GMP, and analyst notes on valuation versus peers. For investors, the choice comes down to whether the brand strength and distribution justify the IPO price band for a medium- to long-term holding, or whether the current flow is mainly short-term listing speculation.

Frequently Asked Questions (FAQs)

As of October 30, 2025, the Orkla India IPO was subscribed around 1.2 times overall, showing strong demand from retail and non-institutional investors across market segments.

On October 30, 2025, the Orkla India IPO grey market premium (GMP) stood around ₹75-₹80, suggesting a possible listing gain of about 10% over the issue price.

The Orkla India IPO is expected to list on November 6, 2025, on both the BSE and NSE, according to reports from major financial news sources.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.