Nasdaq Today: Futures Rise as Markets Await Nvidia Earnings and Key Jobs Data

As of November 17, 2025, Nasdaq futures are moving higher as traders wait for two big events that could shift the market’s direction. Nvidia is set to report earnings soon, and many investors see this update as a key test for the AI boom. The company has been a major driver of tech gains this year, so its results matter a lot. At the same time, fresh U.S. jobs data is coming out this week. These numbers shape expectations for interest rates, which strongly affect tech stocks.

Markets are tense but hopeful. Many traders want signs that growth is steady and inflation is cooling. Even small surprises in earnings or jobs data can move the Nasdaq fast. Today’s outlook shows how closely investors watch the tech sector and the economy at the same time.

Nasdaq Futures Update

Nasdaq futures climbed in early trading as markets brace for two pivotal events: Nvidia’s earnings release and critical U.S. jobs data. The mood is optimistic, with investors banking on strong tech performance to carry the rally. Futures outperformance suggests traders are leaning into risk, especially in the tech-heavy index. Global markets are also contributing sentiment in Asia, and Europe is cautious but constructive.

Interest in Nasdaq is particularly high because of heavy weighting in big-cap technology names. As earnings season unfolds and macro risks swirl, futures provide a barometer for where sentiment is settling. Rising futures reflect confidence that positive corporate news could offset broader economic uncertainties.

Spotlight: Nvidia Earnings

Why Nvidia Matters for Nasdaq?

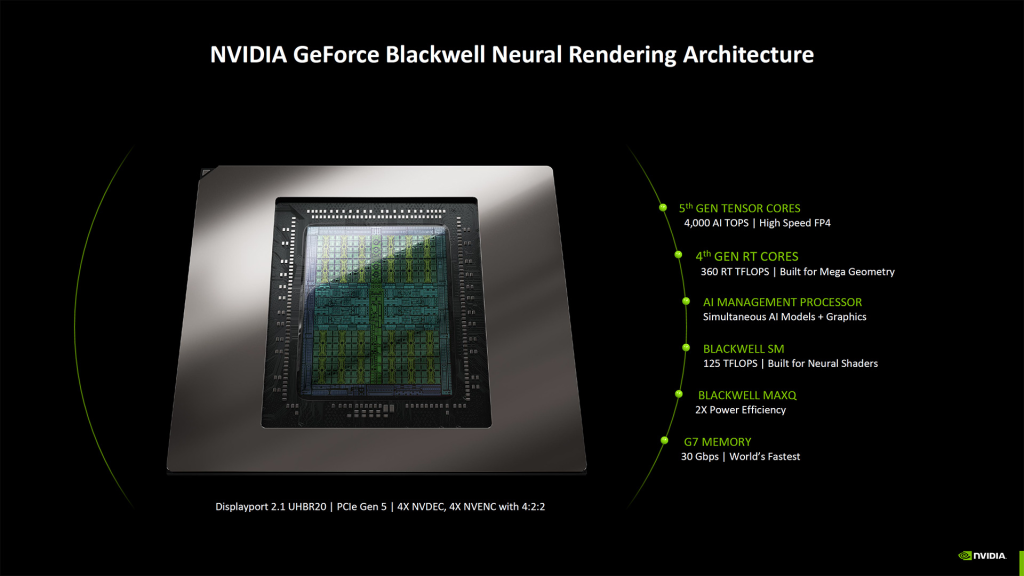

Nvidia remains the beating heart of the AI and chip narrative. Its upcoming earnings carry outsized influence on Nasdaq behavior because of its large index weighting and leadership in data-center GPUs. Strong results could lift not only NVDA but also other growth and semiconductor names.

What Wall Street Expects?

Analysts widely expect Nvidia to report its Q3 FY2026 results on November 19, 2025, after market close. Consensus forecasts estimate revenue around $54 billion, ±2%, with adjusted EPS near $1.24-$1.25.

Much of this optimism hinges on continued strength in its data-center business. The ramp of Nvidia’s Blackwell architecture is expected to power sales, as cloud providers and hyperscalers keep increasing AI infrastructure spend.

Potential Market Impact

If Nvidia beats estimates and guides strongly, it could validate the bullish AI-capex narrative. That would likely boost not just Nvidia but also other chipmakers like AMD and Intel. On the other hand, any disappointment, for example, due to slower enterprise orders or supply constraints, could trigger a pullback across the tech and semiconductor space. Given how much of the AI build-out depends on Nvidia’s chips, the guidance could set the tone for the next leg of growth or cooling.

U.S. Jobs Data in Focus

Key Reports to Watch

Normally, markets would closely monitor nonfarm payrolls, the unemployment rate, and wage growth. But this time, the situation is more complicated.

Why Jobs Data Matters for Nasdaq?

Job-market strength could push inflation higher, which may make the Fed more cautious about rate cuts. That, in turn, would weaken growth stocks. Conversely, a soft report would amplify rate cut hopes and support high-growth names, including Nasdaq’s tech heavyweights.

The Shutdown Blind Spot

Investors are now dealing with a major data vacuum. The Bureau of Labor Statistics suspended most operations during a 43-day government shutdown, according to its contingency plans.

Officials now warn that October’s jobs and CPI data may never be published, because field surveys weren’t carried out while the shutdown persisted. Economists say this could leave a “partial blind spot” in U.S. labor-market history.

Policymakers are now urging BLS to fast-track November data releases once the agency resumes work. The absence of clean, timely jobs data raises the risk of misreading inflation and talent-market tightness, a dangerous spot for markets dependent on data to gauge central bank policy.

Sector-by-Sector Breakdown

Tech Leaders to Watch

Big names like Apple, Microsoft, Amazon, and Alphabet remain central to Nasdaq’s direction. Their earnings and guidance will likely color investor sentiment, especially if they echo or diverge from Nvidia’s tone.

Semiconductor Sector

The chip space is especially sensitive. Nvidia’s earnings will set the benchmark. ETFs like SMH and SOXX are likely seeing positioning ahead of the report, as traders hedge or lean in depending on their views on demand for AI infrastructure.

Broader Market Influences

Interest rates and Treasury yields are key. With jobs data muddled, markets are watching yields closely for signs of shifting rate expectations. The dollar’s strength or weakness could also drive cross-market flows. Moreover, consumer-retail earnings (from big names like Walmart, Home Depot, Target) will add feedback on consumer health.

Investor Sentiment and Analyst Commentary

Sentiment is mixed but tilted toward risk. On one hand, many analysts remain bullish on Nvidia’s long-term AI dominance. On the other hand, there’s concern about overvaluation and macro risks. For example, Gene Munster, a prominent tech investor, argues that Wall Street is underestimating Nvidia’s future earnings power tied to Blackwell and Rubin platforms.

Others warn of potential guidance headwinds, especially if geopolitical or supply-chain constraints slow growth. Volatility indicators also point to guarded positioning: implied volatility around Nvidia options is elevated, suggesting traders are bracing for a big move.

Global Market Overview

In Asia, markets reacted with caution: Japan showed some weakness, and Chinese equities remain sensitive to demand signals for cloud and AI infrastructure. Europe is also cautious, as inflation data and central bank comments weigh on investor risk appetite. These global undercurrents could amplify any U.S. move once earnings or jobs data hit.

What Investors Should Watch Next?

- Nvidia’s earnings: Key items are data-center revenue, Blackwell ramp, and forward guidance.

- Treasury yields & the dollar: They will tell us how markets interpret macro risk and Fed direction.

- Jobs reports: When and how the BLS resumes missing data will matter. The quality and scope of any retroactive report will be closely scrutinized.

- Other earnings: Watch how other tech and consumer names speak to broader demand.

- Volatility: Option markets, especially around Nvidia, may deliver early clues about expectations and fears.

Using AI-based stock research tools may help decode real-time shifts in analyst sentiment, options flow, and earnings surprises.

Bottom Line

The Nasdaq is at a critical inflection point. With Nvidia’s earnings around the corner and labor-market data in limbo, the coming days could set the tone for the rest of the year. A strong Nvidia report may reinforce the AI growth story.

But the wider economic picture is foggy thanks to the shutdown-driven data blackout. That uncertainty could lead to sharp moves, making risk management more important than ever. As markets navigate this mix of opportunity and ambiguity, investors should stay alert to both company-specific news and macro developments.

Frequently Asked Questions (FAQs)

Nasdaq is up today because traders expect strong tech earnings and clearer economic signals. On November 17, 2025, investors showed more confidence as markets waited for Nvidia’s results and new jobs data.

Nvidia’s earnings on November 19, 2025, may move the Nasdaq because the company is very important in the AI and chip sector. Strong results can lift tech stocks, but weak numbers may cause pressure.

Jobs data affects tech stocks because it changes interest-rate expectations. Strong job growth may slow rate cuts, which can hurt tech. Weak job numbers may support tech by easing rate concerns.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.