Bitcoin Price Prediction: Traders Panic as Bitcoin Faces Potential Drop to $80,000

Bitcoin is back in the spotlight after a sharp jump in price earlier this month. But the mood has shifted fast. On November 18, 2025, market data shows that many traders are now worried about a possible pullback toward the $80,000 mark. This fear grew as Bitcoin price prediction showed signs of losing strength after reaching new highs. For many investors, the sudden change feels confusing and stressful.

The crypto market is known for big swings. Still, this drop in confidence feels different. Traders are watching key levels closely. Some believe the selling pressure could grow if support breaks again. Others think it may be a normal cooldown after heavy buying last week.

Either way, the next few days matter. Bitcoin’s price path could shape the rest of the month. This makes it important to understand what is driving panic, what the charts are saying, and how experts view the road ahead. A clear view can help traders stay calm and make smarter choices in a fast-moving market.

Current Market Overview

Bitcoin’s mood has shifted dramatically. After hitting highs above $126,000 in October, it fell below $90,000 by November 18, 2025, according to Reuters. This drop erased much of its earlier gains and rattled both retail and institutional traders. Trading volume has surged during sell‑offs, suggesting that risk‑averse investors are rethinking their positions. Broader market sentiment is turning cautious, with many participants worried that Bitcoin’s recent rally was overextended.

Key Factors Behind the Panic

Heavy Profit-Taking

Many investors took profits after the October peak. That profit-taking has added strong selling pressure. The rapid swing upward prompted traders to lock in gains, weakening short-term support.

U.S. Dollar Strength

The U.S. dollar has seen a bounce recently, which hurts risk assets like Bitcoin. On March 4, 2025, Bitcoin sagged toward $80,000 as the dollar strengthened. A stronger dollar makes crypto less attractive and adds headwinds to growth.

Regulatory Concerns

Uncertainty around regulation remains. The idea of a U.S. Strategic Bitcoin Reserve announced via an executive order in March 2025 has raised mixed reactions. While some see it as long-term validation, others worry about government control. These debates fuel fear among market participants.

Decline in Liquidity

Liquidity in the market is thinning. Large spot outflows have been observed, indicating that big players may be exiting. According to CoinEdition’s November 9, 2025, report, net outflows suggest distribution rather than dip‑buying. Without steady inflows, Bitcoin could struggle to hold key levels.

Technical Analysis: Is $80,000 a Realistic Target?

Breakdown of Key Support Levels

Bitcoin’s technical structure is under pressure. The $100,000 area, once a solid floor, is weakening. A daily close below $98,500 could expose a drop toward $92,000. If that breaks, further downside to around $80,000 becomes more likely.

Resistance Areas to Watch

On the upside, Bitcoin needs to reclaim zones around $107,000-$111,200 to shift momentum. Until it can sustain above that range, the risk of further correction remains.

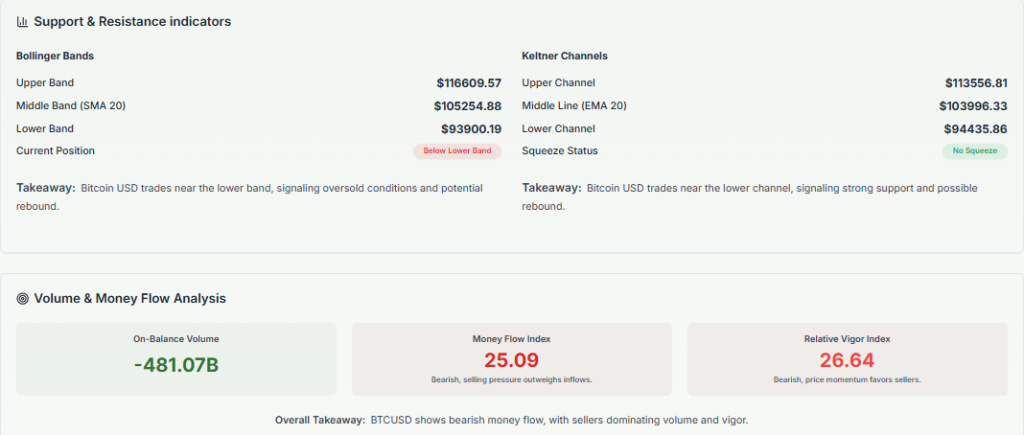

Indicators Signaling a Possible Drop

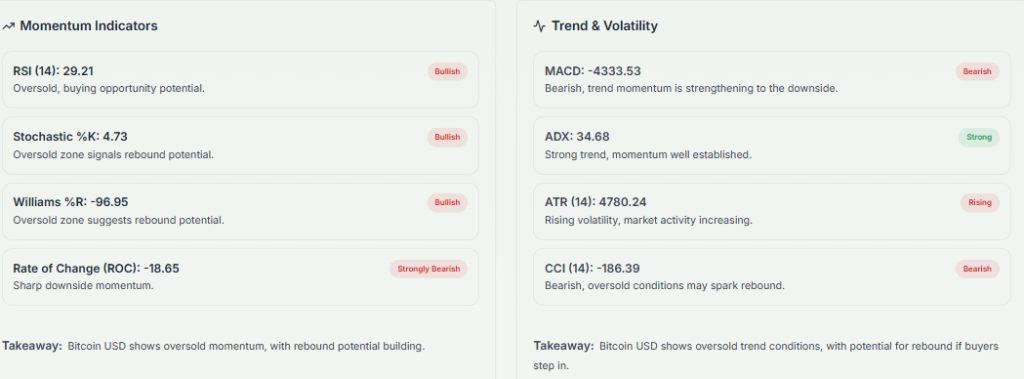

- RSI: Technical models show that Bitcoin may be moving from overbought toward neutral or even oversold zones.

- Moving Averages: Key averages are being tested, and a slide below them could trigger more selling.

- MACD: Though not confirmed yet, some analysts warn of a possible bearish crossover if the price continues to weaken.

On‑Chain Metrics

Exchange Inflows Rising

On‑chain data indicates more Bitcoin is flowing into exchanges. That may suggest holders are preparing to sell, rather than hold.

Whale Activity

Large holders (whales) are behaving more cautiously. Some accumulation has slowed, and profit-taking at current levels is possible, raising questions over sustained demand.

Miner Behavior

Miners, who often sell to cover costs, may be under pressure to offload holdings when prices drop. If this trend continues, it could add further selling pressure.

Expert Opinions and Market Forecasts

Some analysts still see long-term strength. On-chain data shows short-term holders are entering losses of about -11%, which is getting close to historical thresholds that preceded rebounds. This suggests a possible bottom could be forming soon.

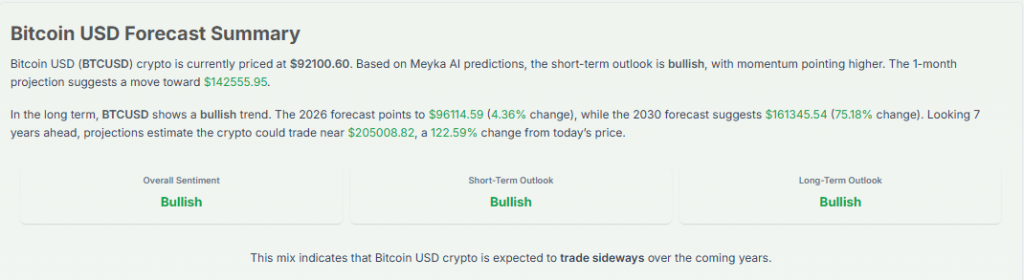

However, other voices are warning. For example, CoinEdition analysts believe that if support below $98,500 fails, Bitcoin could drift down to $92,000 or more. Meanwhile, a quantile regression model from earlier research even projected a possible cycle top of $275,000 by November 2025, although that assumes very strong market momentum.

Potential Scenarios on Bitcoin Price Prediction

Bearish Scenario: Drop to $80,000

If Bitcoin breaks below critical support and liquidity dries up, a retest of $80,000 is not out of the question. Macro headwinds like dollar strength and regulatory noise could accelerate the move.

Neutral Scenario: Sideways Trading

Bitcoin may also enter a consolidation phase. It could trade between $90,000-$105,000 while the market digests recent volatility and waits for clearer signals.

Bullish Scenario: Recovery to $150K+

If on‑chain metrics improve and Bitcoin regains strength above $107,000, we could see a renewed push upward. Some models suggest a rebound toward $150,000, especially if ETF inflows and demand from large holders continue rising.

Long-Term Outlook for Bitcoin

Despite the current jitters, many long-term investors remain bullish. Some on-chain models point to a very strong year-end, depending on demand. JPMorgan strategist Nikolaos Panigirtzoglou even argues that Bitcoin looks “relatively cheap” when compared to gold on a volatility‑adjusted basis, estimating potential upside over the next 6-12 months. Institutional demand, ETF growth, and wider adoption continue to underpin Bitcoin’s long-term thesis.

Bitcoin Price Prediction: How Traders Should React?

In this environment, risk management is more important than ever. Trading without a clear stop-loss could be dangerous. For traders who remain optimistic, dips might be a chance to buy in. But for others, it may be wiser to step back and wait for confirmation.

Staying calm helps. Emotional reactions to panic don’t serve long-term goals. Instead, watching volume, on-chain signals, and macro trends can guide safer entries or exits.

Bottom Line

Bitcoin is facing a tough moment. Weakening support, rising dollar strength, and regulatory uncertainty are fueling worry. A drop to $80,000 could happen if the sell-off intensifies. But there is also a path for recovery if key on-chain metrics and technical levels stabilize. How the next few days play out could very well define Bitcoin’s near-term path, whether it bounces back or slides deeper.

Frequently Asked Questions (FAQs)

If Bitcoin drops to $80,000, some traders may sell to avoid losses. Others may see it as a buying chance. This situation is being watched closely on November 18, 2025.

Buying Bitcoin during panic carries risk. Prices can fall further. Some investors buy small amounts for long-term goals.

Bitcoin’s price drop is due to profit-taking, a strong U.S. dollar, regulatory concerns, and low liquidity. These factors have influenced the market today.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.