Asian Shares: Weakness Spreads After US Tech Sell-Off

Asian markets felt fresh pressure on 18 November 2025, after a sharp sell-off hit major US tech stocks the day before. The drop in big names like Apple, Nvidia, and Amazon created a wave of fear across global markets. When Wall Street loses confidence, Asia often reacts fast. That is what happened this week.

Asian traders woke up to weak cues, lower futures, and growing worries about demand in the global tech world. Many investors have been nervous about high valuations for months. Rising US bond yields and new data showing slower consumer activity added more weight to the pressure. So, when the US market slipped, Asia followed.

This pullback shows how closely connected global tech markets are today. A single shift in US tech can move billions in Asia within hours. Let’s break down why the weakness spread so quickly, how major Asian markets reacted, and what investors should watch next.

What Triggered the US Tech Sell-Off?

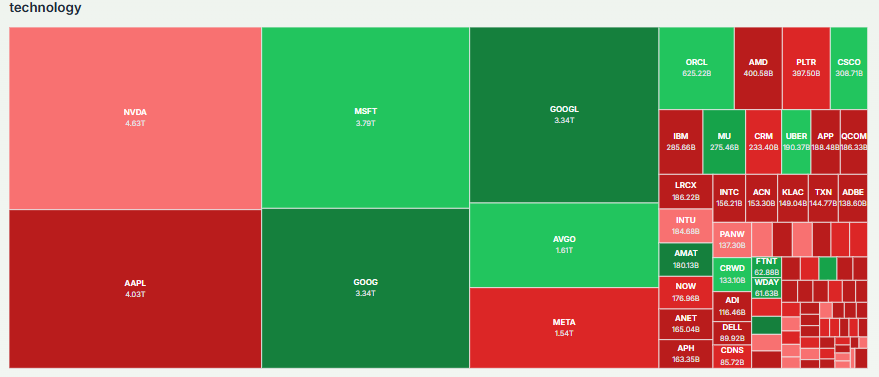

Tech giants fell sharply on U.S. exchanges on 17-18 November 2025. Investors booked profits in richly valued AI and chip names. Concern rose about stretched valuations for firms tied to artificial intelligence. Traders also grew cautious ahead of key earnings reports, including Nvidia’s much-watched update. Bond-market moves added pressure.

Shifts in Treasury yields changed discount rates for long-duration tech earnings. The result was fast de-risking across growth-heavy portfolios. Analysts flagged that sentiment had become fragile after a long rally.

Immediate Impact on Asian Markets

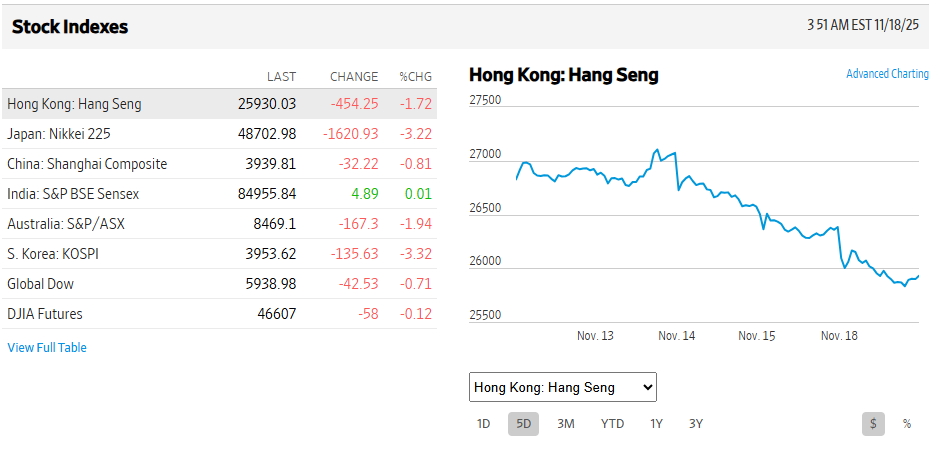

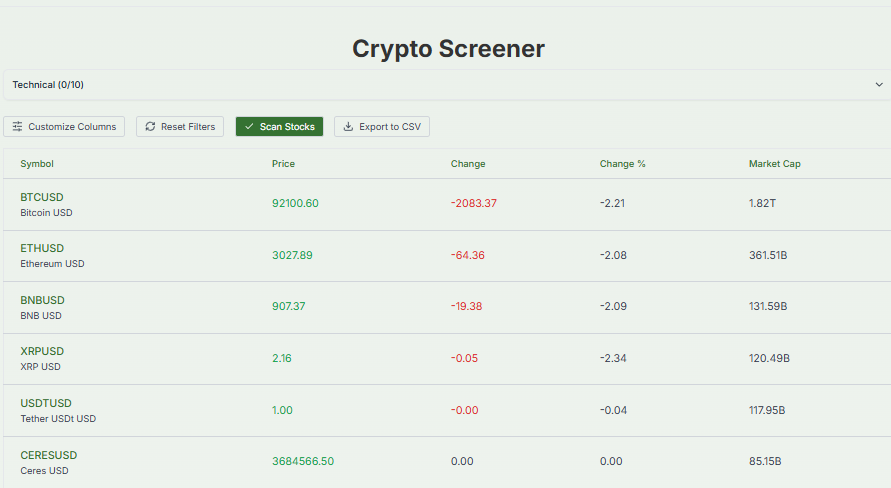

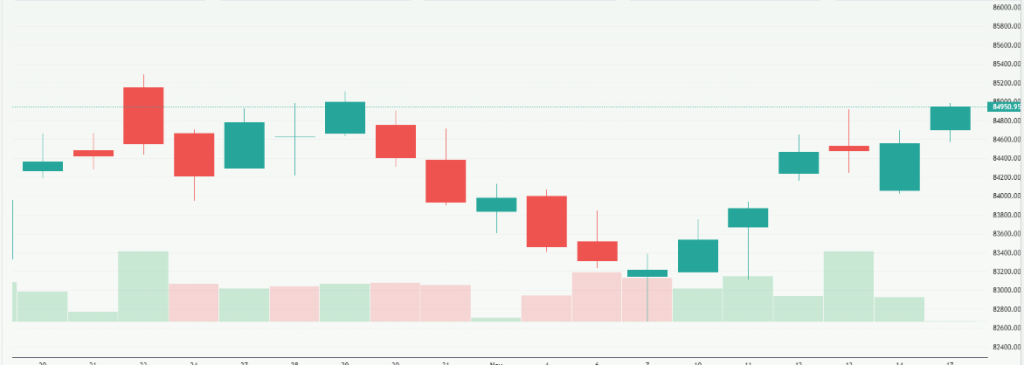

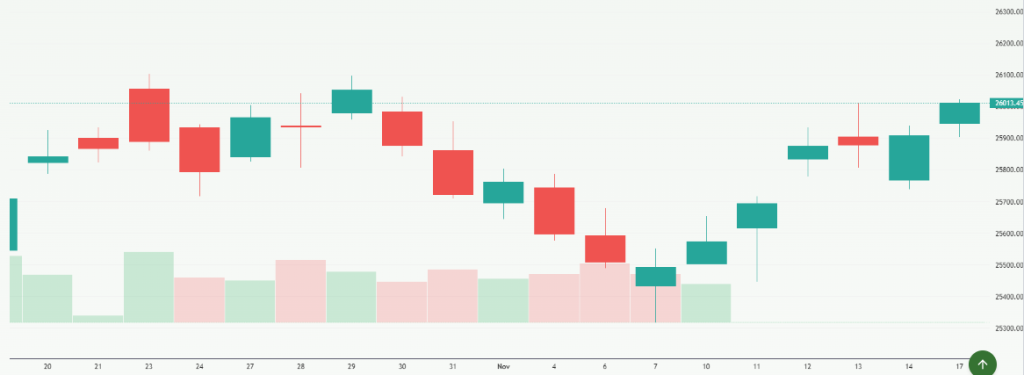

Asian bourses opened sharply lower on 18 November 2025. Futures signalled steep declines after the Wall Street slide. Tokyo and Seoul led losses. Both markets fell more than 3% intraday. Hong Kong and Australian indices also weakened. Risk appetite shrank quickly. Traders shifted toward safe assets like the yen and government bonds. Crypto markets also slumped, adding to the risk-off mood. Volatility spiked in equities and currencies. The move showed how fast U.S. tech shocks transmit to Asia.

Market Breakdown: Performance by Major Asian Economies

Japan

Tokyo’s Nikkei saw one of its largest drops in months. Tech-linked stocks and exporters fell. JGB yields moved as investors rebalanced risk. Currency swings amplified pain for exporters. Investors also watched the Bank of Japan for policy hints.

China & Hong Kong

Hong Kong’s Hang Seng fell as global tech fears hit local giants. Mainland indices were pressured by weak external demand and mixed domestic data. Slower industrial output and retail figures in recent weeks added caution. Big Chinese internet and e-commerce names lost ground on both global and local concerns.

South Korea

KOSPI dropped sharply. Major chip makers like Samsung and SK Hynix fell with global semiconductor names. Expectations of softer chip demand weighed on prices. The market’s heavy tech weighting made the index vulnerable.

Australia

The ASX fell as global risk aversion hit high-beta stocks. Commodity exporters fared slightly better but still saw selling. The equity market reacted to overseas shocks despite relatively firm commodity trends.

India

Sensex and Nifty recorded declines as foreign investors trimmed holdings. IT and software service firms, with large U.S. exposure, took the biggest hits. The rupee and flows into local equities reflected a more cautious stance.

Sector-wise Analysis: Who was hit the Hardest?

Technology and semiconductors led losses. AI-related names and chipmakers showed the steepest declines. Momentum and growth stocks suffered the most. E-commerce and online platforms also pulled back. Defensive sectors delivered relative stability. Energy stocks showed resilience because of commodity support.

Financials were mixed, depending on local rate dynamics. Low-volatility sectors outperformed during the risk-off phase. One analytical approach used an AI stock research analysis tool to scan earnings sensitivities and found that earnings multiples in tech were most vulnerable to yield shifts.

Key Drivers behind the Weakness in Asia

Higher real yields in global bond markets pressured growth valuations. Slower global demand raised doubts about forward earnings. The U.S. dollar’s strength put pressure on some Asian currencies. China’s recent economic readings added local drag. Positioning fatigue also mattered. Many funds had concentrated bets in AI and tech.

When sentiment reversed, those positions were cut quickly. Geopolitical headlines and uncertainty over central bank timing amplified selling. Together, these forces created a rapid and broad pullback.

Investor sentiment: What Analysts are Saying?

Analysts warned of short-term volatility. Many urged caution before adding risk. Several strategists said fundamentals for select large-cap tech names remain intact. Others highlighted that valuations must be reassessed if yields stay elevated. Some banks expect a re-pricing of AI hopes over weeks rather than days. Market commentators stressed watching liquidity and flows. The consensus view was that markets need fresh data, earnings, and U.S. economic prints to regain conviction.

What to Watch Going Forward?

Watch upcoming U.S. economic data. Check Treasury yield moves. Monitor Nvidia’s earnings and other tech results due this week. Track China’s monthly activity reports. Follow central bank comments from the Fed and the Bank of Japan. Observe net foreign flows into Asian equities. Monitor currency moves, especially the yen and the dollar. These items will shape whether this pullback stays short or deepens.

Bottom Line

The tech-led sell-off on 17-18 November 2025 forced a fast reset in Asian markets. Losses reflected both global valuation risks and local economic uncertainty. Short-term volatility is likely. Clarity from earnings and macro prints will drive the next leg. Investors should watch yields, earnings, and China data for signs of stabilization.

Frequently Asked Questions (FAQs)

Asian stocks fell on 18 November 2025 because US tech shares dropped the day before. Weak global sentiment spread fast, and investors became careful, causing broad selling across Asian markets.

Japan, South Korea, and Hong Kong were hit the hardest on 18 November 2025. These markets have many tech companies, so they reacted more when US tech stocks fell sharply.

Asian shares may recover if US tech earnings show strong results. Markets often follow US trends, so better earnings could improve confidence. But recovery also depends on local economic data.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.