Nifty Record High in Sight as Index Sprints Toward 26,277; Bank Nifty Also Hits New Peak

The Indian stock market is moving fast again. On 20 November 2025, the Nifty index came close to touching 26,277, marking one of its strongest rallies this year. This jump did not happen by chance. It came after steady demand from investors, upbeat global cues, and strong earnings from major companies. The Bank Nifty also hit a fresh peak on the same day, showing clear strength in the financial sector.

Many traders say this rally feels different. The moves are not only from big players but also from retail investors who are more active than ever. Stable inflation numbers and a positive GDP outlook are also giving the market extra support. Even the global market mood is helping, as investors expect interest rates to stay under control.

With all these factors coming together, the market is showing confidence. Yet, experts warn that sharp rallies often bring short pullbacks. For now, the focus is on whether Nifty can cross 26,277 and set a new record.

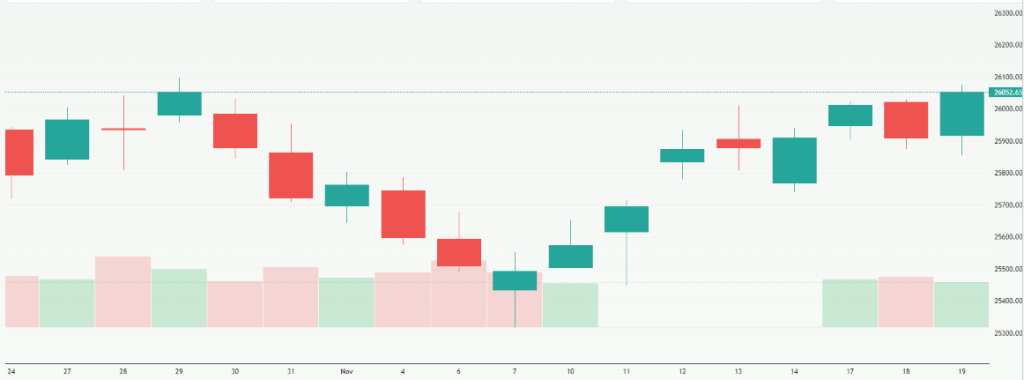

Market Overview: How Nifty Reached This Point?

The rally built up over several sessions in November. On 20 November 2025, headline indices moved sharply higher. Nifty closed the day around 26,192.15, within striking distance of its all-time high of 26,277.37. Market breadth was mixed, yet heavyweight stocks carried the advance. Reliance, HDFC Bank, and a few large financials led the gains. Global momentum also helped. Tech strength from the U.S. and steady crude prices kept sentiment intact. Domestic liquidity and steady retail interest added fuel to the move.

What’s Fueling Nifty Record High?

Corporate earnings have improved. Several large companies posted stronger profits and beat estimates. That lifted investor confidence across sectors. Foreign institutional flows have returned intermittently this month. Domestic institutions continued as steady buyers. Macro data has been supportive, with cooling CPI trends and a stable growth outlook.

Policy expectations also played a role. Analysts have priced in a benign RBI stance for now. Upgrades from global houses have added credibility to the rally. These forces combined to push Nifty closer to its 26,277 peak.

Bank Nifty: The Star Performer

Banking names outperformed the broader market on 20 November 2025. Bank Nifty touched a fresh lifetime high above 59,400 intraday and closed near that band. Large private banks and a few public sector lenders were key contributors. The index’s outperformance reflected improving credit demand and better asset quality in recent quarters. Traders said interest rate expectations and margin expansion prospects supported bank stocks. The banking gauge is now a major driver of overall market momentum.

Sector Highlights: Driving the Market

Financials were at the centre of gains. Oil and gas and defence stocks also added value. Auto names rallied on strong seasonal demand and better order books. IT showed selective strength as global tech sentiment warmed. However, mid and small caps underperformed frontline stocks. This gap kept the advance narrow despite headline gains. Investors focused on select high-quality names rather than broad participation.

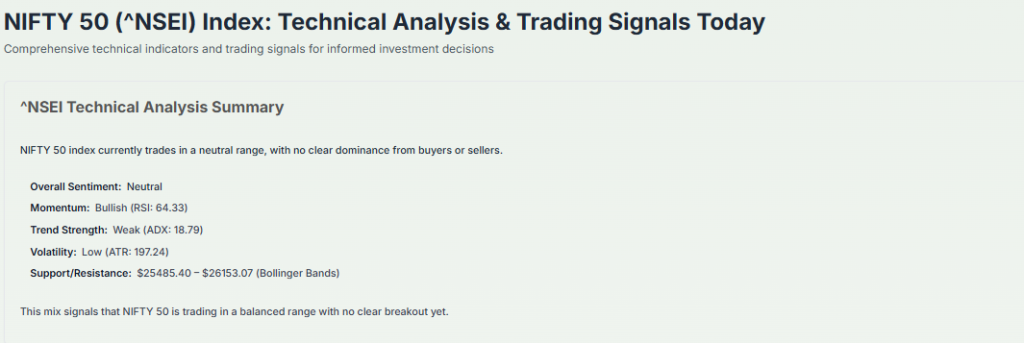

Technical Analysis: Key Levels to Watch

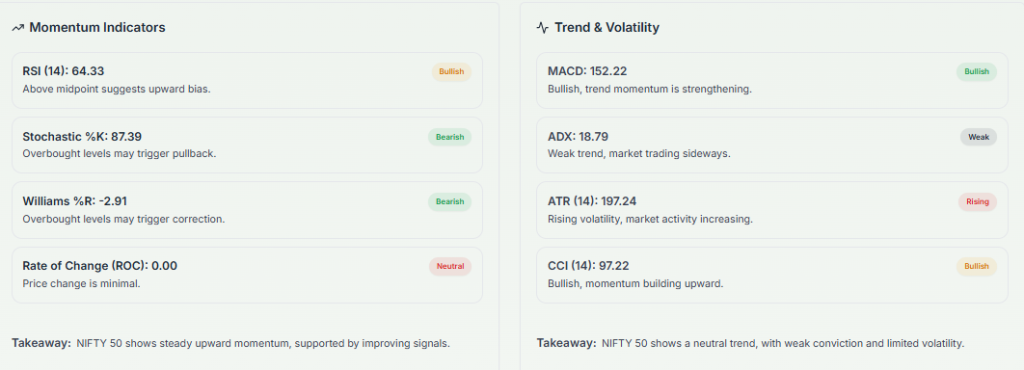

The immediate resistance is the all-time high at 26,277.37 from 27 September 2024. Near-term support sits in the 25,900-25,750 zone. Momentum indicators signal firm short-term strength, but they also show the market is running hot. Option chain activity suggests significant call writing around the 26,300-26,500 strikes. Volatility may spike if the index tests the record level and faces profit-taking. Traders should watch intraday breadth and volumes for confirmation of any breakout.

Expert Commentary & Market Sentiment

Market commentators are upbeat but cautious. Many say a clean move above 26,277 would invite fresh momentum. Some warn that the rally is concentrated. Others point to improving corporate earnings and global stability as durable supports. The general tone is positive for the near term. Still, strategists advise watching global cues, especially U.S. tech dynamics and crude moves.

Risks and Market Headwinds

Several risks remain. Global rate volatility can unsettle flows. Oil price shocks would pressure margins for some sectors. Geopolitical tensions could dampen sentiment suddenly. Valuations have risen in pockets. Narrow breadth increases the chance of sharp pullbacks. Investors who chase the highs may face short-term corrections. It helps to keep position sizes sensible and monitor stop levels.

Outlook: Can Nifty Sustain the Momentum?

A decisive breach of 26,277 would be bullish. That would shift the focus to fresh targets and sentiment momentum. If the index fails at that level, expect consolidation and possible short covering. Domestic flows are likely to remain important. Foreign buying would amplify any breakout. Analysts suggest focusing on companies with strong earnings visibility and healthy balance sheets. Use objective tools such as an AI stock research analysis tool alongside traditional checks for clearer signals.

Positioning Advice for Traders and Investors

Short-term traders can look for momentum trades with tight risk control. Swing traders should watch support bands and volume confirmations. Long-term investors should focus on fundamentals and avoid chasing intraday spikes. Rebalancing portfolios to take profits in richly valued names makes sense. Keep an eye on macro calendar events that could trigger volatility. Treat any new highs as opportunities for disciplined review, not blind buying.

Bottom Line

As of 20 November 2025, Nifty is close to a major milestone. Bank Nifty’s fresh peak underlines strength in finance. The rally has clear drivers, but it also carries risks. A clean break above 26,277 would change the technical picture. Until then, a mix of cautious optimism and risk control is the prudent approach. Stay alert to earnings updates and global cues for the next directional signal.

Frequently Asked Questions (FAQs)

Nifty came close to its record on 20 November 2025. It may test new highs if global markets stay stable and local earnings remain strong, but movement can still change anytime.

Bank Nifty climbed to new highs on 20 November 2025 because banks showed strong credit growth, better asset quality, and steady demand. Market mood also supported financial stocks.

Nifty’s rally on 20 November 2025 came from strong earnings, stable inflation, and positive global cues. Heavyweight stocks helped support the index as investor sentiment improved.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.