Sudeep Pharma Shares Surge: High-Priced Entry into Drug Raw Materials

The drug raw material market has grown fast in the last few years, driven by high global demand and tight supply rules. This trend became even more visible in 2025, as more pharma companies raced to secure safe and reliable ingredients. In the middle of this shift, Sudeep Pharma has become a name many investors are watching closely. Its shares surged sharply in recent trading sessions, and this rise has sparked a lot of questions. Why are investors paying such a high price? And what makes the company stand out in a crowded sector?

Sudeep Pharma is known for making key raw materials that drug makers depend on. These materials may look simple, but they play a very important role in the safety and quality of medicines.

As global supply chains face pressure, companies like Sudeep Pharma gain more importance. Many investors now see the company as a strong player with room to grow. But others wonder if the current rally is moving too fast. This article takes a clear look at both sides to help you understand the full picture.

Sudeep Pharma: Company Background

Sudeep Pharma began as a chemicals maker. The firm later focused on raw materials for drug makers. The company supplies active pharmaceutical ingredients (APIs) and specialty intermediates. It serves both local and global drug firms. Clients include major names in the pharma industry. Sudeep Pharma has built several production units in Gujarat. The firm highlights long-term contracts and repeat orders as core strengths. Recent public filings show decades of client relationships and steady capacity expansion.

What Triggered the Share Move?

The immediate trigger was the company’s IPO process. The price band was fixed at ₹563-₹593 per share. The IPO opened for subscription on 21 November 2025. Grey market activity and a rising grey market premium (GMP) added momentum. Reports on 20-21 November showed strong GMP signals, hinting that investors expect a strong listing. Market chatter and anchor allocations fed buying interest. These events pushed investor focus onto valuation and growth potential.

About the Drug Raw Materials Market

Global demand for APIs and excipients has been rising. Analysts expect steady growth through the late 2020s. The India API sector is seen as a growth engine for exports. Supply security and cost control matter to drug companies. The market has faced supply shocks in recent years. That raised the value of reliable suppliers. Companies that can assure quality and steady supply win premium pricing.

Sudeep Pharma’s Competitive Strengths

Sudeep Pharma emphasizes manufacturing scale. Plants follow good manufacturing practices. The firm claims long contracts with big pharma names. That gives revenue visibility. The company also plans capital expenditure to add lines. New machinery aims to raise output and reduce unit costs. Strong client linkages and facilities help secure higher-margin orders. These factors make the company attractive to institutional investors ahead of listing.

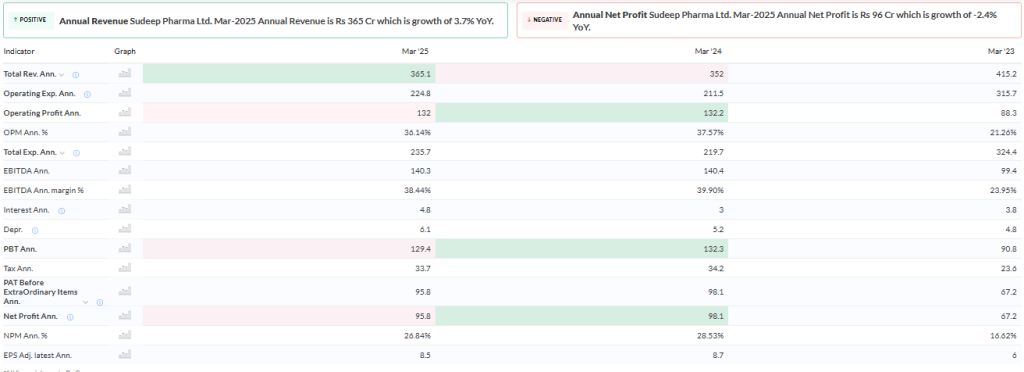

Financial Performance Overview

Recent public documents show revenue growth in prior years. Profit margins vary by product mix. The IPO includes a fresh issue to fund plant upgrades and capacity. The firm also offers an offer-for-sale (OFS) portion that will free promoter holdings. Balance sheet items show moderate leverage in the peer group. Investors should watch the capex plans and working capital needs. An AI stock research analysis tool can flag valuation gaps when price expectations outpace projected cash flows.

Why Raw Materials are a High-Priced Entry Point Now?

Three forces lift prices in this sector. First, stricter regulation raises the bar for compliant makers. Second, global supply disruptions force buyers to pay for security. Third, scale matters; large suppliers bid for long-term contracts. New entrants face high capital needs and regulatory tests. That creates barriers to entry. For established players, this translates to better pricing power. The result: raw-material makers can command high valuations when demand and quality credentials align.

Risks Investors Should Watch

The sector is not free of danger. Quality lapses at other firms have triggered severe regulatory action and reputational damage across India. Recent inspections and reports show the regulator is stricter after tragic incidents linked to substandard syrups. That raises compliance risk for all suppliers. Geopolitics and raw-material sourcing problems can disrupt production. Price swings for key chemicals can squeeze margins. Finally, IPO dynamics themselves can inflate listing-day moves that later correct.

Expert and Market Commentary

Analysts writing on the IPO note two themes. One is the favourable demand for reliable API suppliers. The other is caution over listing premiums. Some brokerage notes flagged strong grey-market demand and potential initial listing gains. Others stressed the need to compare Sudeep’s margins and growth plan with established API peers. Market commentary in the week of the IPO focused heavily on listing mechanics, GMP, and subscription trends rather than long-term fundamentals.

Long-term Growth Outlook

If plants come online as planned, revenue should rise. Export markets offer a large opportunity. Global drug makers seek alternative suppliers to diversify risk. Sudeep could gain market share with reliable deliveries. But scaling profitably requires tight quality control and efficient operations. The company’s planned capex and stronger customer ties will be key. Watch the allotment date and listing on 28 November 2025 for early price signals.

Wrap Up

Sudeep Pharma sits at an interesting crossroad. The IPO and grey-market interest show strong sentiment. The raw material market favors reliable suppliers. That supports higher valuations. Yet real risks remain. Regulatory scrutiny, input-cost swings, and execution on new plants can change the story fast. Investors who look beyond the listing day should check audited numbers, capex timing, and quality certifications. That will separate short-term hype from long-term value.

Frequently Asked Questions (FAQs)

Sudeep Pharma’s IPO on 21 November 2025 gained strong interest, but results depend on market trends and the company’s future performance. Investors should study risks and goals before deciding.

Sudeep Pharma makes key raw materials for medicines, such as APIs and chemicals. These materials help drug companies keep quality and supply stable in local and global markets.

Shares gained before the 28 November 2025 listing because of strong demand, a rising grey market premium, and positive news about the company’s growth. Market excitement increased buying interest.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.