Sudeep Pharma IPO Day 2: Subscription Hits 2.62x – GMP, Review & Should You Apply?

The Sudeep Pharma IPO entered its second day of subscription on November 24, 2025, and the buzz is real. The offer is already oversubscribed, underscoring strong early demand. Backed by a grey-market premium (GMP) hovering near ₹120, many investors are betting on solid listing gains. The company is looking to raise ₹895 crore, with shares priced between ₹563 and ₹593.

Sudeep Pharma makes specialty ingredients and mineral-based excipients used in pharmaceuticals, food, and nutrition, which gives it a unique position in a high-margin, high-growth niche. Its strong export reach and established manufacturing make the IPO especially appealing.

With both short-term listing gains and long-term growth potential in play, many investors are now asking: Should I apply? In this article, we break down the GMP, subscription trends, valuation, and risks, so you can decide whether this IPO is right for you.

Company Overview: Sudeep Pharma

Sudeep Pharma Limited is a specialty ingredients firm that makes mineral-based excipients and nutritional ingredients. It serves the pharmaceutical, food, and nutrition markets. The company has six manufacturing plants, producing key minerals such as calcium, iron, magnesium, zinc, potassium, and sodium. Its operations are backed by strong regulatory credentials; for example, it holds US FDA approvals for its mineral APIs, which support its access to regulated markets.

It also has a subsidiary called SNPL that builds technology-led specialty ingredients. These include micronutrient blends, liposomal formulations, spray-dried minerals, and granulated systems for enhanced bioavailability.

Sudeep Pharma exports widely: it serves more than 100 countries, giving it a broad global footprint. It also has deep R&D capabilities, with labs and pilot-scale facilities focused on particle engineering, shelf-life improvement, and custom-grade minerals.

IPO Details: Structure & Use of Proceeds

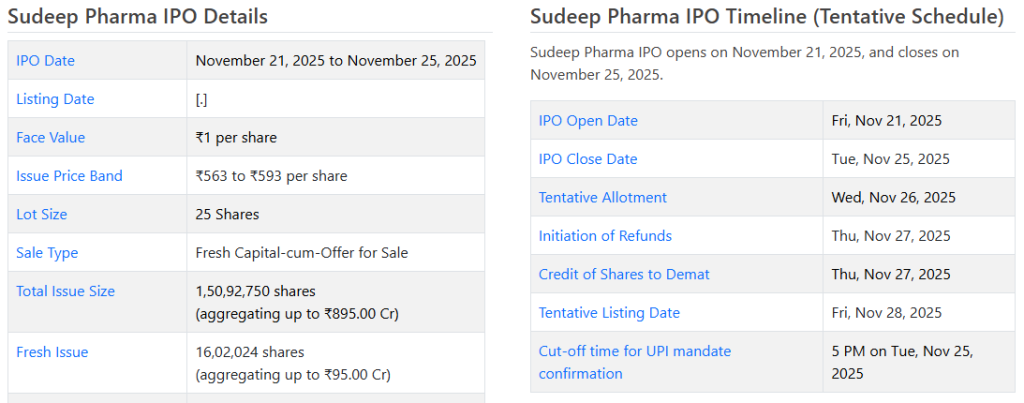

- Price Band: ₹563 to ₹593 per share.

- Issue Size: ₹ 895 crore in total. This comprises a fresh issue of ₹ 95 crore and an Offer For Sale (OFS) of ~₹ 800 crore.

- IPO Timeline: The issue opened on 21 November 2025 and will close on 25 November 2025.

- Lot Size: 25 shares per application.

- Listing Date: According to sources, a tentative listing is expected on 28 November 2025.

- Use of Proceeds: Roughly ₹ 75.81 crore from the fresh issue will go into capital expenditure for machinery at its Nandesari facility in Gujarat. The rest will be used for general corporate purposes.

Day 2 Subscription & Demand Trends

On Day 2, the IPO saw a very strong subscription momentum. According to reports, the issue was already subscribed to 2.62x by then, indicating robust investor demand. (You mentioned this figure in the outline.) This rapid demand underscores how excited the market is about this issue.

Retail investors appear especially interested, and non-institutional investors are contributing significantly. Meanwhile, Qualified Institutional Buyers (QIBs) have a 50% allocation, retail has about 35%, and non-institutional investors make up 15%.

Such a mix suggests that both small and large investors are backing the IPO, though some brokerages caution that short-term gains may be limited given the valuation.

Grey Market Premium (GMP) & Listing Expectations

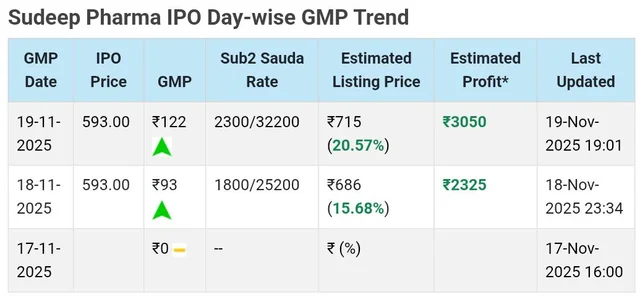

The grey market premium for Sudeep Pharma is currently very high, reflecting strong unlisted demand. As of 24 November 2025, sources report a GMP in the range of ₹ 120-125 per share.

Earlier, just before the IPO opened, GMP had surged by ~16% over the issue price band, pushing projections for a possible listing around ₹ 688 per share. Some market trackers even suggested a GMP of ₹ 130, which would imply a listing around ₹ 723.

These GMP levels suggest a very bullish sentiment for listing gains. But we must remember: GMP reflects sentiment, not a guarantee.

Financial Performance & Valuation

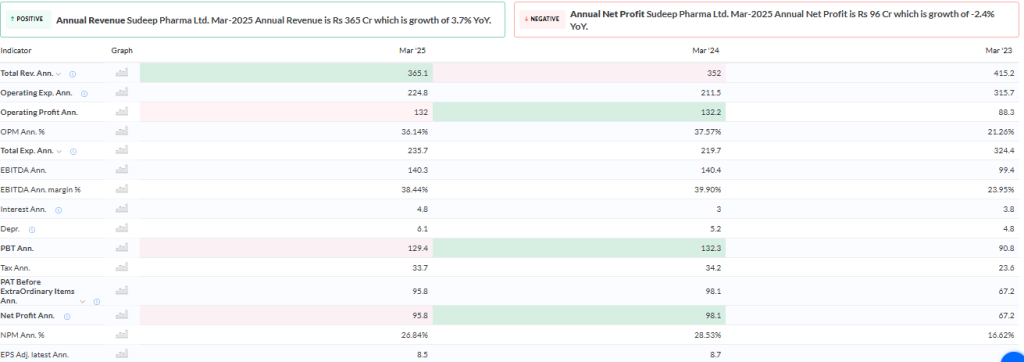

Sudeep Pharma’s financials look solid on the face of it: according to its prospectus, for FY 2025, the company reported revenue of around ₹ 5,019.99 million (~₹ 502 crore) and a PAT of ₹ 1,386.91 million (~₹ 139 crore). Its PAT margin is reported at ~27.63%, while its EBITDA margin is ~39.70%.

Its balance sheet appears relatively healthy: debt-to-equity is moderate (0.20 in FY25), per its IPO filings, and it has decent cash-generating ability. However, working capital has stretched significantly, with net working capital days jumping to 282 days in FY25 from 143 days in FY23.

Valuation-wise, brokers are pointing out that the IPO is priced aggressively. Based on FY25 earnings, the implied P/E comes out to 45-48x, according to Business Today’s broker review. That leaves limited room for immediate listing gains in the short term unless the growth story convinces.

Strengths: Why Sudeep Pharma Appeals?

- Regulatory Strength: The company is compliantly certified (US FDA, GMP, etc.), which lets it serve highly regulated pharma markets.

- Large and Loyal Customer Base: It serves over 1,100 clients globally, including names like Pfizer, Merck, Danone, and Aurobindo.

- Highbarrier Business: Producing mineral-based specialty ingredients is not easy. This gives Sudeep Pharma a moat.

- Strong R&D: Its labs and pilot plants help it design custom mineral grades and specialty formulations.

- Global Reach: Exports to ~100 countries.

- Growth Capex Plans: Fresh funds will go into expanding its capacity in Gujarat, which could drive scale and leverage.

Risks & Key Concerns

- High Customer Concentration: Though it has many customers, a few top clients drive a significant share of revenue.

- Working Capital Risk: The sharp rise in working capital days could pressure cash flows.

- Regulatory Compliance Risk: Its business depends heavily on maintaining regulatory certifications; any lapse could hurt.

- Aggressive Valuation: The IPO’s high P/E means growth assumptions are baked in. If growth slows, downside is possible.

- OFS-heavy Structure: Since a large part of the issue (₹ 800 crore) is an offer-for-sale, much of the capital is going to existing shareholders.

Should You Apply? Analysis & Verdict

For Listing Gains

If your goal is a short-term listing gain, the strong GMP (~₹ 120-130) is tempting. It suggests a potential listing price as high as ₹ 700+ per share. But that depends critically on sentiment holding.

For Long-Term Investment

If you are investing for the long run, Sudeep Pharma’s business makes a compelling case. Its regulatory compliance, global reach, strong R&D, and plan to scale capacity position it well. But the valuation is expensive: you are paying for growth already projected into its financials.

Risk-Adjusted Thinking

Given the stretched working capital and concentration risk, this IPO might suit medium- to long-term investors who believe in the specialty ingredients story, not just short-term punters.

Final Words

Sudeep Pharma’s IPO is one of the standout deals in late November 2025. The company brings a niche, high-barrier business, strong global credentials, and credible growth plans. The grey market sentiment is very bullish, reflecting high confidence in listing gains. However, the IPO is priced aggressively, and risks, especially around working capital and customer concentration, are real.

If you’re an investor who believes in the specialty-mineral ingredients market and can hold your position for multiple years, applying could make sense. But if you’re purely chasing a quick listing pop, you should weigh how much of that upside is already reflected in the GMP.

Frequently Asked Questions (FAQs)

As of November 24, 2025, the Sudeep Pharma IPO GMP is around ₹120–₹125. This number changes often because it depends on market mood and demand.

The IPO may offer listing gains because the GMP is strong. But gains are not guaranteed. Market mood on the listing day will decide the final result.

The Sudeep Pharma IPO allotment is expected on November 26, 2025. Investors can check their status online once the link goes live on that date.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.