Mortgage Rates Today, Nov 24, 2025: Holding Steady After 6 Weeks in Range

Mortgage rates have now stayed in a tight range for six straight weeks. As of November 24, 2025, the housing market is watching this trend closely. Rates are not falling sharply, but they are not rising either. This calm period is unusual, especially after two years of big jumps and sudden drops. It tells us something important about today’s economy.

Inflation is cooling, but it is still above the Federal Reserve’s target. The job market is slowing down. Bond yields are steady. All of these factors keep mortgage rates from breaking out of their current pattern. For buyers, this stability brings a small sense of relief. They can plan better. They can compare lenders without worrying about big daily swings.

For sellers, steady rates help keep demand from weakening too fast. For homeowners thinking about refinancing, the pause gives them time to decide. This stable trend does not promise big savings yet, but it does offer clarity. And in today’s uncertain market, that clarity matters.

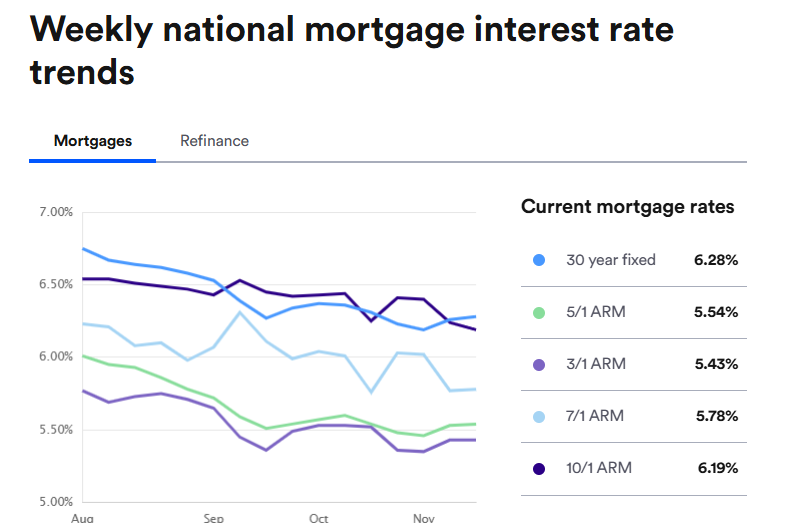

Current Mortgage Rates Overview (30-year, 15-year, ARMs)

On November 24, 2025, the national 30-year fixed mortgage rate sat near the mid-6% range. Freddie Mac’s weekly Primary Mortgage Market Survey shows the 30-year rate at about 6.26% for the week ending November 20. Bankrate’s daily lender survey reported a comparable national average of roughly 6.39% on November 24. Shorter loans remain lower.

The 15-year fixed averaged near 5.5% in recent weekly data. Adjustable-rate mortgage (ARM) pricing also held inside a narrow band. Lenders have not shifted pricing aggressively in the last month. These small moves keep borrowing costs predictable for now.

Why are Rates Holding Steady?

Several forces have locked rates into a tight range. Inflation has cooled since last year. However, it remains above the Fed’s 2% goal. The Federal Reserve has signaled a slower pace of policy change. That signal reduced volatility in bond markets. Bond yields are the main driver of mortgage pricing. Yields have been steady, which helped mortgage rates stay flat.

Economic growth is slowing. Slower growth reduces the chance of sudden rate spikes. Lenders are also watching housing demand. The market shows steady but muted activity. All these elements contribute to the six-week holding pattern.

Key Economic Data This Week and Its Impact

Recent economic releases shaped investor expectations. November consumer price index (CPI) readings and weekly job reports were major data points. Cooler inflation prints eased fears of rapid rate hikes. Still, any upside surprise in CPI could jolt bond yields and lift mortgage rates. Mortgage application trends have also mattered.

The Mortgage Bankers Association (MBA) reported a dip in applications in the week ending November 14. That decline signals softer demand. Fannie Mae’s refinance index showed lower dollar volume in mid-November. Those declines reduce pressure on lenders to change rates quickly. In short, data nudged markets but did not force a breakout from the range.

What Does Today’s Rate Stability Mean for Buyers?

Stability brings clarity for home shoppers. Small daily moves make budgeting easier. Lenders are holding spreads steady. That means rate shopping can focus on fees and service, not big swings. However, affordability remains tight for many buyers. Home prices have not fallen enough to offset higher rates.

First-time buyers should lock in preapproval and compare lender offers. If planning a purchase soon, consider locking a rate when lender quotes are favorable. Those who can wait might watch headlines for signs of a sustained dip in bond yields. Overall, steady rates remove a layer of unpredictability for house hunters on November 24, 2025.

What does this mean for Refinancing Homeowners?

Refinance economics depend on the original loan rate. Homeowners with loans above 7% still have clear savings opportunities if current rates are lower. The decision rests on break-even time. Closing costs can erase short-term gains. The refinance dollar volume fell in recent Fannie Mae and MBA reports. That drop shows many homeowners are sitting tight.

For those with high balances or adjustable rates that soon reset, refinancing can make sense even in a steady-rate market. Use a precise break-even calculator and compare true costs. The stability gives time for a careful analysis.

Housing Market Context: Inventory and Demand

Inventory remains limited in many regions. Low supply keeps home prices firm. Seasonal factors usually cool listing activity in late November. Yet demand from motivated buyers persists. Builders continue to add new homes, but not enough to ease shortages quickly. The combination of tight supply and steady demand supports home values. That environment reduces the likelihood of a rapid drop in mortgage rates driven solely by price weakness. Market observers will watch listings and pending sales for signs of change.

Expert Outlook: What Comes Next?

Analysts give a range of scenarios. If inflation keeps falling and job growth weakens, bond yields could decline. That would push mortgage rates lower in early 2026. If inflation bounces back, yields could spike and lift rates. The Fed’s meeting calendar, especially the December gathering, remains a focal point.

Many investors expect a gradual easing in the months ahead, but timing is uncertain. Lenders may react differently depending on secondary market liquidity. Market watchers should track CPI, Fed commentary, and Treasury yields. The outlook is balanced, not one-sided.

Practical Tips for Borrowers in a Steady Market

Check credit reports and correct errors before applying. Shop at multiple lenders to compare rates and fees. Get a loan estimate and compare the annual percentage rate (APR). For short-term ownership plans, consider ARMs cautiously. For long stays, fixed rates provide stability. Use a break-even analysis for refinancing decisions.

Lock periods vary; pick a lock term that suits the closing timeline. If uncertainty remains, ask lenders about float-down options. Finally, read loan disclosures carefully and ask direct questions about fees and timing. These steps keep decisions grounded when rates are steady.

Final Takeaway

On November 24, 2025, mortgage rates remained inside a narrow range. That pattern reflects steady bond yields, cooler but still elevated inflation, and cautious Fed guidance. The market’s calm gives buyers and homeowners more time to plan. Still, the next major data surprise could change the story quickly. Use lender comparisons and careful math before acting.

An AI tool can help run scenarios, but human review of documents remains essential. Stay alert to CPI releases and Fed announcements. Those items will likely determine the path of mortgage costs in the weeks ahead.

Frequently Asked Questions (FAQs)

Mortgage rates may ease in early 2026 if inflation keeps falling and the economy slows. However, nothing is certain. Rates will depend on new data and Federal Reserve actions.

On November 24, 2025, rates stayed in a tight range. Locking may help buyers who want stability. But waiting could help if bond yields drop later.

Rates stayed steady because inflation cooled slowly, bond yields held flat, and the Federal Reserve signaled no sudden moves. These factors kept lenders from making large daily changes.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.