US Stock Futures: Slip Slightly after Tech’s Strongest Rally since May

US stock futures showed a small slip on 25 November 2025, only a day after tech stocks posted their strongest rally since May. The move surprised many traders. Tech had jumped sharply in the last session as investors rushed back into big names and AI-linked companies. That big surge lifted market mood, but today’s slight pullback shows a more careful tone.

Futures are often the first hint of how the market may open. So even a minor drop can signal a shift in emotion. Investors seem to be catching their breath after the big tech rebound. Some are locking in profits. Others are waiting to see new economic data that could move markets again.

There is also caution around bond yields, global cues, and the next steps from the Federal Reserve. These factors usually shape short-term market direction. So the small slip in US stock futures is not a warning sign. It is more like a pause after a strong sprint.

Quick Summary of US Stock Market Moves

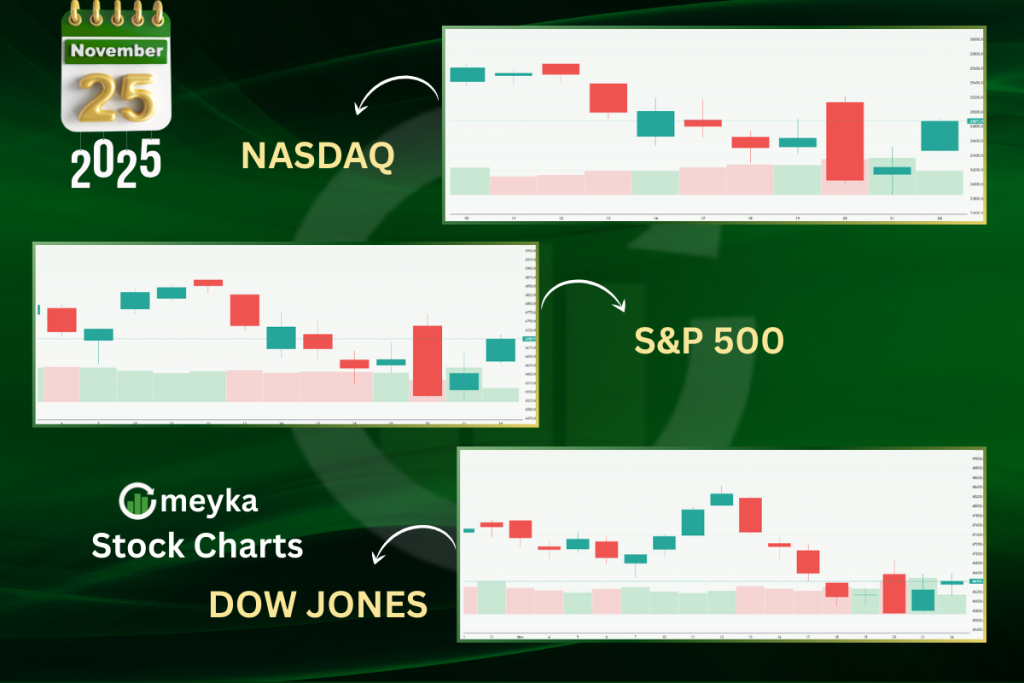

U.S. stock futures slipped modestly on 25 November 2025 after a powerful tech rebound in the prior session. Dow futures fell about 0.16%, S&P 500 futures eased roughly 0.19%, and Nasdaq futures were off near 0.33% in early trading.

The pullback came after the Nasdaq posted its biggest one-day jump since May on 24 November 2025, driven by gains in large-cap tech names. Traders moved to the sidelines ahead of key U.S. data and a packed earnings calendar. The softer futures show caution rather than panic.

What Triggered the US Tech Rally?

The rally on 24 November 2025 centered on renewed enthusiasm for AI and cloud spending. Alphabet led the surge after strong interest in new AI products. Other large-cap tech stocks followed as investors priced in faster revenue upgrades and bright guidance from software and chip companies.

Lower short-term bond yields also helped growth stocks regain favor. Optimism about a near-term Federal Reserve rate cut added fuel. The mix of earnings beats, bullish guidance, and AI excitement created a concentrated lift in mega-cap names.

Why are Futures Pulling Back Today?

Profit taking explained much of the early weakness. Many traders booked gains after the sharp move higher. Market participants also awaited fresh macro prints, including producer prices, retail sales, and confidence data. Those reports could reshape expectations for Fed policy and growth.

In addition, some headline news in the tech supply chain created short-term volatility and led certain big names to trade lower in premarket hours. The combination of profit-taking, data risk, and selective stock-specific headlines made futures edge down on 25 November 2025.

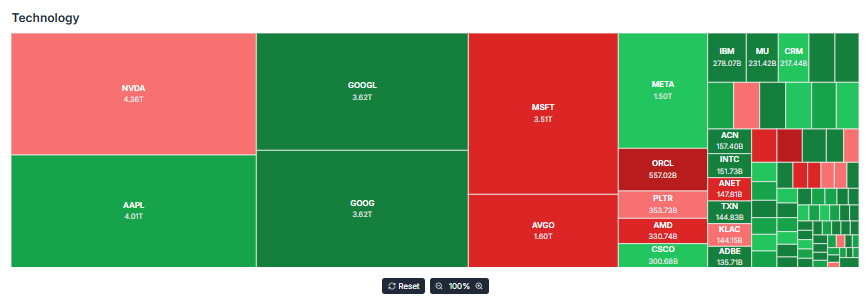

Sector Breakdown: Who’s Moving and Why?

Technology cooled but remained the focal point. AI-linked names saw mixed flows: some rose further while others pulled back after sharp gains. Semiconductors and cloud software experienced rotation as traders differentiated between winners and those with stretched valuations.

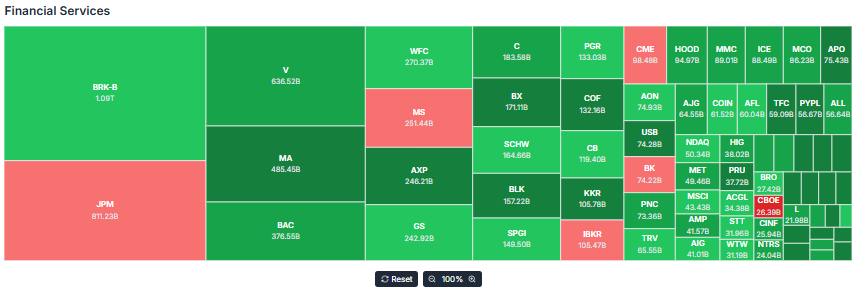

Financials showed little reaction and traded near flat, while consumer discretionary names moved on company-specific holiday-season forecasts. Energy lagged amid steady oil prices. The intraday shifts reflected a classic post-rally reshuffle where traders harvest short-term profits and redeploy capital more selectively.

Economic Factors Influencing Sentiment

Bond market moves shaped equity positioning. The 10-year Treasury yield fell from recent highs, easing pressure on growth stocks and adding support to the earlier tech bounce. Latest daily yields showed readings around 4.03%-4.04% on 24-25 November 2025, down from mid-November peaks. Markets also reacted to signals from Fed officials that increased the odds of a December cut.

A lower-for-longer yield outlook tends to benefit longer-duration assets such as high-growth tech names. Dollar strength remained a watch point because it influences multinational revenues and corporate guidance.

Investor Sentiment: Cautious Optimism

After such a concentrated rally, sentiment turned cautious. Short-term optimism exists because AI prospects and potential rate relief are constructive. At the same time, traders are reluctant to chase every high. Volatility expectations ticked up ahead of major economic releases and more earnings. Institutional desks showed selective buying but also trimming in names that had run up the most.

Retail flows continued to favor ETFs that track large tech baskets, but bid sizes were smaller than during the surge. One report noted traders using algorithmic scans and even an AI stock research analysis tool to filter earnings surprises and gauge momentum.

What to Watch Next in US Stocks?

Focus will be on the next round of data releases and earnings. Producer Price Index, retail sales, and consumer confidence figures will reach the tape soon. Each print can alter the path for Fed policy and thus risk appetite. Big tech earnings and guidance will be central to sustaining the rally.

Watch leadership breadth closely: if gains broaden beyond mega-caps into small- and mid-caps, the move has a higher chance of lasting. Also monitor the 10-year yield and Fed commentary for changes in rate-cut odds. Any fresh supply-chain or regulatory headlines for major tech firms could also trigger intraday swings.

Bottom Line

The mild slip in futures on 25 November 2025 is a natural pause after a steep tech surge on 24 November 2025. Markets are balancing optimism about AI and easing yields with caution about near-term macro data and stretched valuations. Short-term traders may reprice positions quickly as new information arrives. Long-term investors should wait for clearer breadth and sustained earnings improvement before declaring a durable regime change. Watching economic data and Fed signals will be the key to next week’s market direction.

Frequently Asked Questions (FAQs)

US stock futures slipped on 25 November 2025 because many traders took profits after the big tech jump. Some also waited for new economic data that could change market direction.

The tech rally on 24 November 2025 came from strong AI demand, better company results, and lower bond yields. These factors helped big tech stocks rise faster than other sectors.

Upcoming data on inflation, spending, and confidence could move futures because traders watch these numbers closely. They use the reports to guess the next Federal Reserve decision.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.