Gold Price today, Nov 26: Climbs on Dollar Decline and US Rate Cut Expectations

Gold price moved higher on November 26, 2025, as global markets reacted to fresh signs of a weaker US dollar and rising expectations of a Federal Reserve rate cut. The dollar index slipped in early trading, and this small drop was enough to push investors toward safe-haven assets. Gold often moves in the opposite direction of the dollar, so even a slight decline can lift demand.

Many traders also believe that the Fed may start easing interest rates soon. Recent US data shows slower job growth and cooling inflation. These signals increase the chance of a rate cut in the coming months. Lower rates usually make gold more attractive because the opportunity cost of holding it becomes smaller.

At the same time, global markets are still dealing with economic uncertainty. Investors remain cautious due to geopolitical tensions and concerns about slowing growth in major economies. This keeps gold in focus as a protective asset.

Overall, today’s climb in gold prices reflects a mix of currency weakness, policy expectations, and cautious market sentiment. Investors are now watching whether the dollar will drop further and how the Fed will respond at its next meeting.

Latest Gold Price Update

Spot gold rose on November 26, 2025, trading higher after a soft session for the U.S. dollar. Prices climbed toward $4,167 per ounce in some price feeds. That marked a clear uptick from the prior day’s levels. Volume pushed gently higher as traders adjusted positions ahead of major data releases. The marked rise reflects both currency moves and shifting interest-rate expectations.

U.S. futures also showed gains. COMEX contracts moved in tandem with spot bids. Asian and European trading hours reinforced the positive tone. Analysts noted that technical momentum supported short-term buying.

Dollar Weakness: Key Reason Behind Gold’s Climb

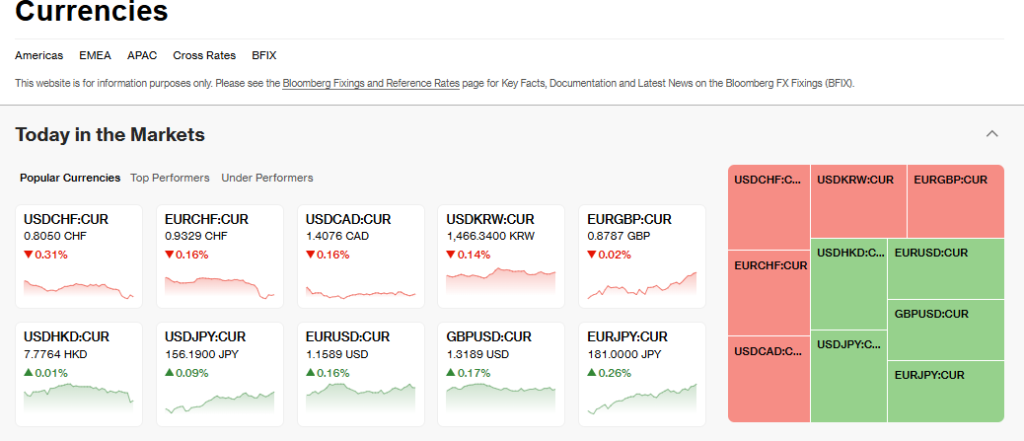

The U.S. dollar slipped on November 26. The dollar index fell below the 100 level in intraday trade. That fall made dollar-priced gold cheaper for holders of other currencies. The change increased physical and ETF demand. Markets reacted to weak U.S. data and to commentary that suggested earlier easing. Currency flows into risk assets also reduced safe-haven pressure on the dollar.

Other major currencies gained ground. The euro and sterling rose as traders priced higher odds of Fed easing. Emerging markets saw local gains, though some currencies were held back by local flows. The net effect favored gold as a hedge against dollar volatility.

US Federal Reserve Rate Cut Expectations

Markets now price a strong chance of a Fed rate cut at the December FOMC meeting. CME’s FedWatch tool shows a much higher probability of a 25-basis-point cut in early December. Traders increased bets after a string of softer U.S. employment and activity data. A cut would reduce real yields. That outcome usually helps bullion.

Lower policy rates reduce the opportunity cost of holding non-yielding assets. Thus, investors tend to prefer gold when real yields fall. Recent Fed commentary and futures pricing moved markets toward this narrative. The market now watches inflation prints and payroll numbers for confirmation.

Geopolitical and Economic Factors Supporting Gold

Geopolitical uncertainty still hangs over markets. Periodic diplomatic moves and trade questions keep risk managers alert. That pressure supports safe-haven demand for physical metal. Central banks continue to buy gold for diversification. Those purchases add steady structural demand beneath the market.

Slower global growth worries also press investors toward protection. Weak manufacturing or soft housing data in major economies can widen interest in bullion. At the same time, strong retail inflows into gold ETFs feed secondary buying and sustain price momentum.

Gold Price Outlook for December 2025

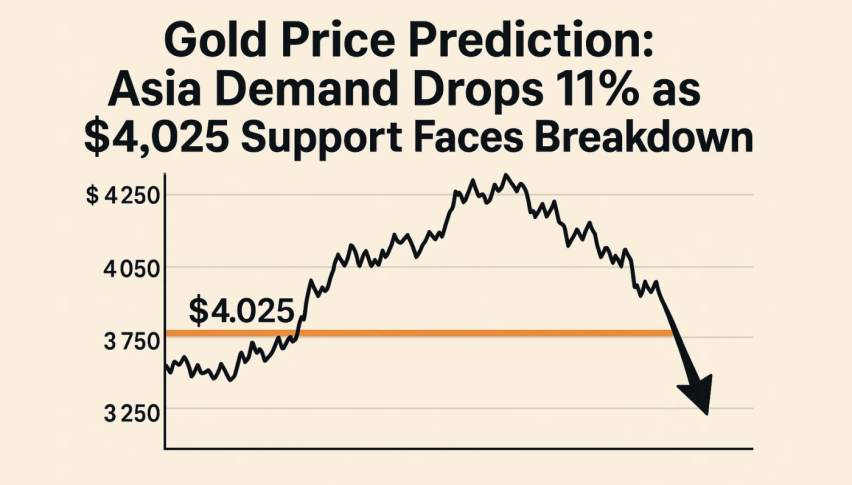

Near-term direction will depend on three items. First, U.S. economic data. Key releases include durable goods, jobless claims, and the Fed’s Beige Book ahead of the December meeting on December 9-10, 2025. Second, any fresh Fed commentary or personnel news. Market odds shift fast when central bankers speak. Third, the dollar’s path. Continued weakness will favor a higher gold price.

If the Fed signals a clear pivot, gold could probe new highs. Conversely, stronger-than-expected data could push real yields up and check gains. Short-term traders should watch $4,000 as a psychological pivot. On the downside, initial support sits near the prior session’s low around $4,100, followed by longer-term moving averages. Technical momentum and liquidity will decide if those levels hold.

Gold Price Trend in Asian Markets

Local gold rates followed international prices on November 26. The Indian rupee showed only limited gains despite global dovish cues. Import demand and dealer hedging restrained local upside. Retail premiums in India remained present, and wedding season buying kept physical demand resilient. Pakistan’s market mirrored global moves, but local currency swings amplified price shifts for domestic buyers.

Cross-border flows and import cover often mute the transmission of global moves into local markets. Still, sustained dollar weakness typically lowers import costs and narrows local premiums over time. Traders in the region monitor currency flows as closely as bullion moves.

Final Takeaways and What to Watch Next?

Gold rose on November 26, 2025, as the dollar weakened and Fed cut bets grew. The market now eyes the December 9-10 FOMC meeting and upcoming U.S. data. A confirmed dovish shift would likely push gold higher. Conversely, any surprise strength in inflation or jobs could trigger a quick pullback. Use of an AI tool can help analyze intraday order flows, but simpler signals, dollar moves, and Fed pricing remain the main drivers.

Frequently Asked Questions (FAQs)

Gold is rising on Nov 26, 2025, because the U.S. dollar weakened. Traders also expect a Fed rate cut soon. These factors make gold more attractive for many investors.

A rate cut in December 2025 may support gold prices. Lower rates reduce the cost of holding gold. This often encourages more buying and can push prices slightly higher.

Gold often moves up when the dollar index falls. A weaker dollar makes gold cheaper for global buyers. This can increase demand and lift prices in the short term.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.