IPO Listing Today: Excelsoft Technologies Share Price Expected to See Limited Gains

The IPO market in India has stayed active in 2025, even as investors turn more cautious about tech listings. On 26 November 2025, the Excelsoft Technologies share price made headlines as it prepared for its stock market debut. The company is known for its digital learning tools and software solutions that support schools, companies, and global training platforms. Many investors watched this listing closely because ed-tech firms have shown mixed performance in recent months. Some delivered strong gains, while others struggled after listing.

Excelsoft Technologies entered the market with steady financials and a strong client base. But analysts noted that the IPO was priced in a fair range, not very cheap or very expensive. This led to predictions of limited listing gains. The subscription numbers also showed balanced but not aggressive demand. Because of these factors, experts expect the share price to show a mild move on listing day rather than a big jump.

Still, the debut is important. It shows how investors now value stable tech firms over high-growth but risky models.

Excelsoft Technologies: Company Overview

Excelsoft Technologies is a global SaaS (software‑as‑a‑service) firm that builds digital learning, assessment, and training platforms. It serves schools, universities, corporate clients, and publishing houses worldwide.

The company offers online learning tools, e‑books, assessment systems, and learning‑management platforms. Its software supports education, professional training, and assessments for diverse clients globally.

Excelsoft caters to many institutions and learners across multiple countries. This global reach gives it a stable customer base.

IPO Details

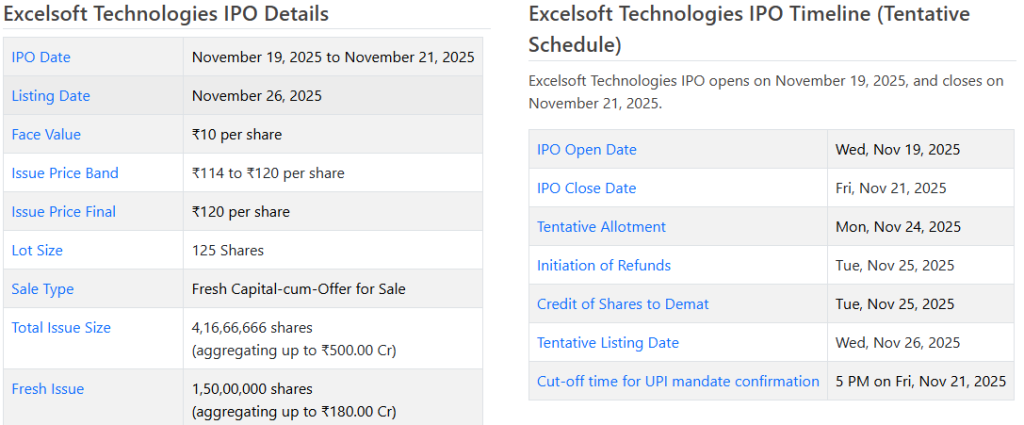

- The IPO of Excelsoft opened on 19 November 2025 and closed on 21 November 2025.

- The price band was ₹114 to ₹120 per share.

- The total size of the issue was ₹500 crore, combining a fresh issuance of equity (~₹180 crore) and an offer for sale (OFS) of existing shares (~₹320 crore).

- Minimum lot size for retail investors was 125 shares, about ₹15,000 at the upper band price.

- Shares were to be listed on the major Indian stock exchanges BSE and NSE on 26 November 2025.

The fresh issuance funds will be used to expand infrastructure at the company’s Mysore facility, upgrade IT infrastructure (software, hardware, communications), and support corporate growth needs.

IPO Subscription & Market Sentiment Pre‑Listing

The IPO received strong investor interest. Subscription numbers showed: total subscription at ~43.19×; Qualified Institutional Buyers (QIBs) ~47.55×; Retail Individual Investors (RIIs) ~15.62×; Non-Institutional Investors (NIIs) much higher (101.69×).

Before listing, the so-called Grey Market Premium (GMP), a non-official indicator showing how much shares trade in unlisted markets, indicated a modest upside. This premium ranged around ₹7-₹8 per share above the issue price, suggesting an estimated listing price near ₹127-₹128.

This cautious premium suggested that investors expected a modest listing gain rather than a large pop. Many analysts predicted a “muted” debut.

What do Excelsoft Technologies Financials Say?

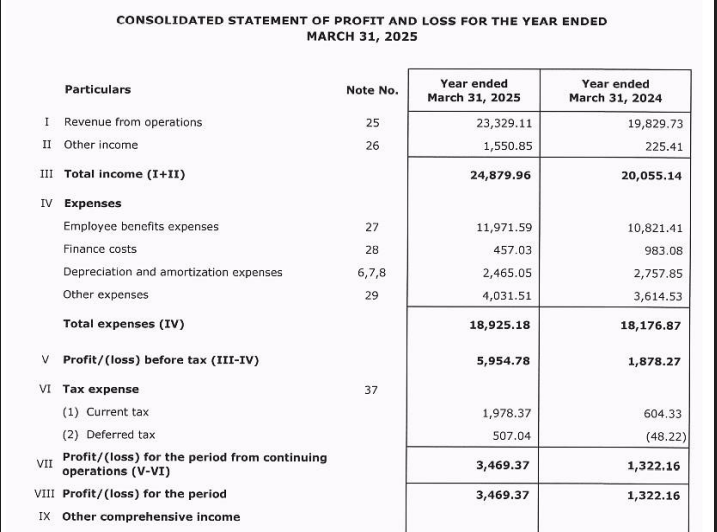

Excelsoft’s recent financial data show clear growth: revenue for FY25 rose significantly compared with prior years; profit after tax (PAT) saw strong growth. The company’s balance sheet looks relatively healthy: net worth has grown, and long-term borrowings are modest compared to assets and equity.

These facts suggest that Excelsoft is not a startup with uncertain cash flows. Instead, it is a firm with recurring revenues, established clients, and a global footprint. That steadiness often appeals to investors who prefer lower risk. The IPO appears priced to reflect this stability rather than aggressive growth. (Using an estimated valuation tool mentally, the price looks fair considering revenue growth and client base.)

Strengths That Work in Its Favor

Excelsoft sits in a niche global EdTech + SaaS + assessment + learning platforms. Demand for digital education and online learning has been rising globally. Its product suite is relevant for schools, universities, corporations, and training firms. This gives it long-term growth potential.

The company’s global reach of clients across multiple geographies reduces dependence on any single market. That geographic spread helps mitigate risk from regional slowdowns or local regulatory issues.

Also, the proceeds from the IPO will be used for infrastructure expansion and IT upgrades. That indicates a commitment to scale operations and improve capacity to serve more clients.

Finally, the financials: consistent revenue growth, improving profitability, and reasonable debt levels make Excelsoft a steady performer in a sector where many firms burn cash.

Risks and Limitations to Watch

However, there are important risks. One is client concentration. A significant portion of revenue comes from a few major clients. If one of them drops out or reduces business, that could hurt overall revenue.

Another risk is that the firm operates in a competitive global market. EdTech and SaaS are crowded spaces. Global players may challenge smaller firms like Excelsoft with larger resources or more aggressive pricing. That could squeeze margins or growth.

Also, while IPO funds aim to upgrade infrastructure, those improvements may take time to pay off. The benefit may only appear gradually, depending on how well new projects pick up clients.

Finally, valuations matter: if growth slows or market sentiment weakens, the share price could underperform expectations, especially for short-term investors seeking quick gains.

Listing Reality & Share Price After Listing

On 26 November 2025, Excelsoft shares were listed on BCE/NSE. Contrary to modest pre‑listing expectations, the shares opened at ₹135 per share, a 12.5% premium over the issue price of ₹120.

This listing gain exceeded the grey market premium prediction. The stronger-than-expected debut reflects investor confidence and possibly positive sentiment toward the EdTech/SaaS sector. Still, experts had warned earlier that gains might be limited. The actual listing outcome suggests some upside, but perhaps not a big surge beyond the opening day.

What Investors Should Monitor Next?

After listing, attention should shift to a few key factors:

- Whether Excelsoft can win new clients or expand existing ones that will drive future revenues.

- How it uses the IPO funds for infrastructure and IT upgrades. Execution will matter more than the plan.

- Market demand for EdTech and SaaS globally, if demand grows, Excelsoft could benefit.

- Competition and pricing pressures from global players can impact margins and growth.

- Financials in upcoming quarters: revenue growth, profit margins, cash flows, and new client acquisition.

Also, macroeconomic factors, such as global tech spending, education sector growth, and currency fluctuations, could shape performance.

Wrap Up

Excelsoft Technologies is a stable SaaS firm with a global EdTech focus. Its IPO and listing have shown that there is investor interest in quality companies with steady earnings. While pre-listing expectations suggested only limited gains, the actual listing at ₹135 shows the market may value stability in uncertain times.

For long-term investors, Excelsoft offers a chance to own a global‑scale EdTech company with recurring business and growth potential. But risks like client concentration and competitive pressure remain. Overall, Excelsoft’s IPO story shows a balanced mix of modest risk, decent reward, and potential for steady growth.

Frequently Asked Questions (FAQs)

Excelsoft Technologies shares are listed at ₹135 per share on 26 November 2025. This price is slightly higher than the issue price of ₹120, showing a modest debut gain.

Experts expected limited gains on listing. The shares opened around ₹135 on 26 November 2025, representing a roughly 12-13% rise from the issue price of ₹120.

Excelsoft Technologies shares started trading on 26 November 2025 on the BSE and NSE. Investors could buy and sell the shares on the market from this date onward.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.