ASX Shutdown Sparks Worries Over Potential Stock Market Crash

On 1 December 2025, the Australian Securities Exchange (ASX) faced a major system outage that stopped hundreds of company announcements from going live. The stock market crash issue began early in the morning, and many price-sensitive updates could not be released on time. Some stocks were even placed on a trading halt because investors did not have the information they needed. The problem spread fast across news channels, and worry started to rise.

People wanted clear answers. They wondered how such a large exchange could suddenly fail. The timing made things feel worse because global markets were already stressed by high interest rates, slow economic growth, and weak confidence. A simple technical fault now looked like a sign of deeper trouble.

This incident reminded everyone that even strong markets can face sudden shocks. A single disruption can shake trust and create fear of a possible stock market crash, even if the cause is only technical.

What Caused the ASX Outage and Backlog on Announcements?

On 1 December 2025, the Australian Securities Exchange (ASX) experienced an outage that stopped the publication of company announcements. The problem began just before 9:00 a.m. local time. ASX later said the platform could post some announcements after about 11:22 a.m., but a backlog remained.

Around 80 individual securities were placed in trading halts because of delayed price-sensitive information. ASX said trading and settlement systems were not affected, but the announcement platform itself failed. Regulators quickly sought details, and ASX opened an investigation into the fault.

Immediate Market Reaction and Investor Nerves

The market responded quickly to the ASX outage on 1 December 2025. The S&P/ASX 200 index fell about 0.3% during early trading as traders priced in extra risk. Shares of ASX Ltd dropped roughly 2% as investors grew nervous about recurring technical failures. Brokers paused some automated trading flows, and several funds postponed trades tied to corporate announcements.

Headlines spread fast on social media and financial news, increasing uncertainty. The pause in announcements left traders flying blind on key corporate moves. This lack of clarity caused short-term volatility in certain stocks and added pressure on the Australian dollar, which slipped slightly against the U.S. dollar. The numbers show how even a technical fault can ripple through markets, raising both fear and caution among investors.

Why this Outage Fuelled Crash Fears?

A failure at a major exchange feeds two fears. First, outages interrupt price discovery. Investors can’t see or trade on fresh data. Second, repeated technical faults erode trust. The ASX has had notable incidents before.

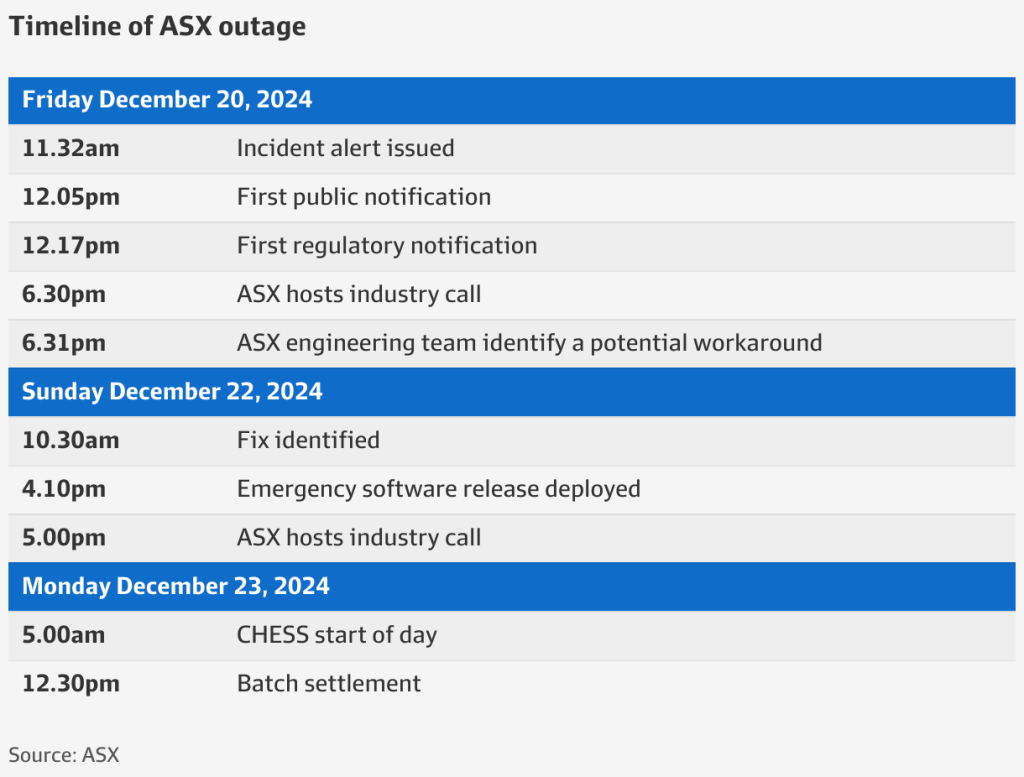

Regulators and markets remember the December 2024 settlement glitch and past trading stoppages. Those events made today’s outage seem less like an isolated hiccup. Markets already face global pressures. High interest rates, supply shocks, and geopolitical strain tighten margins for error. In that climate, a technical failure can magnify worries about systemic weakness.

The Global Ripple Effect and Linkages

Markets are linked. A problem on the ASX can affect Asia-Pacific trading desks. International funds that use ASX data may delay orders. Futures and currency desks watch for surprise moves. When an exchange goes quiet, correlated markets can spike in volatility.

The episode also came as other global platforms faced outages, such as the recent CME disruption. That pattern highlights a shared vulnerability: central nodes in global trading can amplify shocks when they fail. Commodity markets and currency pairs tied to Australia saw sought-after safe-haven flows as traders rebalanced exposure.

Regulatory Scrutiny and Past Findings

Regulators have already expressed concern. In early 2025, the Australian Securities and Investments Commission (ASIC) opened a wide probe into ASX governance and operational resilience after the December 2024 malfunction. The Reserve Bank of Australia also flagged deep worries about ASX’s risk management. Regulators demanded clearer remediation plans and faster fixes.

The new outage has intensified that scrutiny. Authorities are pressuring ASX for transparent root-cause findings and a timetable to restore full reliability. Investors now expect stronger oversight and faster public reporting on fixes.

Expert Views: Calm Voices and Cautionary Takes

Commentary from market strategists is split. Some experts call the outage a technical matter. They say it does not prove a failing economy. These voices point to the ASX claim that trading and settlement stayed intact. Other analysts warn that repeated incidents erode confidence. They say investors may demand higher risk premia. That could lift borrowing costs for some companies.

Independent reviewers have previously found gaps in project delivery and risk controls at ASX. That history makes sceptics less willing to accept isolated explanations. The balance of views keeps markets cautious but not panicked yet.

Stock Market Crash: Practical Steps for Investors Now

Do not react to headlines alone. Check official ASX notices and regulator statements first. Review portfolio exposures to stocks that were halted. Consider whether recent noise changes a company’s long-term outlook. Diversification can limit damage from sudden, idiosyncratic shocks. For active traders, confirm order execution and use brokers that provide timely confirmations.

For longer-term investors, focus on fundamentals. Use reliable tools for analysis, including an AI stock research analysis tool where appropriate, to cross-check signals and to screen for execution risk. Keep records of trades that were delayed or affected by halts. These may matter in tax or compliance reviews.

What does this mean for Market Structure and Trust?

The persistent message is simple. Market infrastructure must be robust. Exchanges are central pillars of financial systems. Repeated failures weaken the whole chain. Regulators will press for upgrades, clearer governance, and independent audits.

Firms that rely on ASX data may diversify data sources and risk-manage around platform outages. If reforms happen quickly, confidence can recover. If problems persist, markets may demand higher compensation for exchange risk. That will affect valuations over time.

Closing Note

The ASX announcement outage on 1 December 2025 stirred real concern as a stock market crash. The event amplified existing worries about systems and governance. However, a single outage does not equate to a market crash. The threat grows if technical problems repeat and regulators do not receive clear answers. Investors should stay informed, check primary sources, and avoid knee-jerk moves. Markets need transparency more than alarm. Strong fixes and frank reporting will be the true test of whether confidence returns.

Frequently Asked Questions (FAQs)

The ASX outage on 1 December 2025 happened because its announcement system failed. Trading stayed open, but companies could not share updates. This caused confusion and short delays.

The ASX shutdown does not directly mean a crash. It was a tech issue. But it worried investors because markets were already tense. People reacted with extra caution.

Investors should stay calm and follow official ASX updates. They should review their trades, avoid quick moves, and wait for normal services to return. Clear information helps prevent mistakes.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.