European Stocks Face Sharp November Volatility as AI Fears Intensify: Barclays

European stocks went through a rough ride in November 2025, and the numbers show it clearly. Major indexes like the STOXX 600 and the DAX moved up and down sharply throughout the month. This sudden change in market mood has caught the attention of many analysts. Barclays is one of them, and the bank warns that rising fear around artificial intelligence is playing a big role in this volatility.

Investors are now questioning whether the fast growth of AI can continue at the same pace. Some worry that companies may have pushed AI promises too far. Others fear that new rules under the EU’s expanding AI laws could slow major tech projects. These concerns have made traders more cautious, especially in sectors linked to automation, software, and semiconductors.

At the same time, weak economic signals across Europe added more pressure. Slower factory output, tighter financial conditions, and mixed earnings results all created a sense of uncertainty. With so many moving parts, November became a month of sharp swings and quick shifts in investor sentiment.

Market Picture and Intra-month Swings

European Stocks, November 2025 showed abrupt swings across Europe. The STOXX 600 fell about 2.1% by November 12, then rebounded 1.3% by November 20. Daily moves ranged up to ±1.8%, while the VSTOXX volatility index spiked from 18 to 27 during the month.

Markets first fell on worries about rich tech valuations, with the tech-heavy STOXX 600 Tech sector dropping 3.5% mid-month. They later recovered as hopes for 0.25% rate cuts from the U.S. Federal Reserve in December 2025 returned. Barclays highlighted that AI-related concerns and Fed uncertainty drove much of this intra-month volatility.

European Stocks: Barclays’ View on AI-driven Stress

Barclays pointed to investor unease about artificial intelligence as a central driver of November’s turbulence. The bank argued that part of the market had priced too much future success into AI-linked firms. That left shares vulnerable to sudden reappraisal. Barclays also noted that shifting Fed expectations added another layer of uncertainty. This combination raised short-term risk and produced rapid rotations between growth and defensive stocks.

Tech and Semiconductors: Fast Gains, Faster Doubts

Technology names led both the rises and the falls. Chipmakers and cloud vendors moved sharply after big earnings and analyst notes. Nvidia’s spectacular 2025 run helped push valuations higher. But late-November saw profit taking and caution return as some traders questioned the sustainability of AI-fueled gains. That sell-off spread into related suppliers. The result was a choppy market where winners one week became laggards the next.

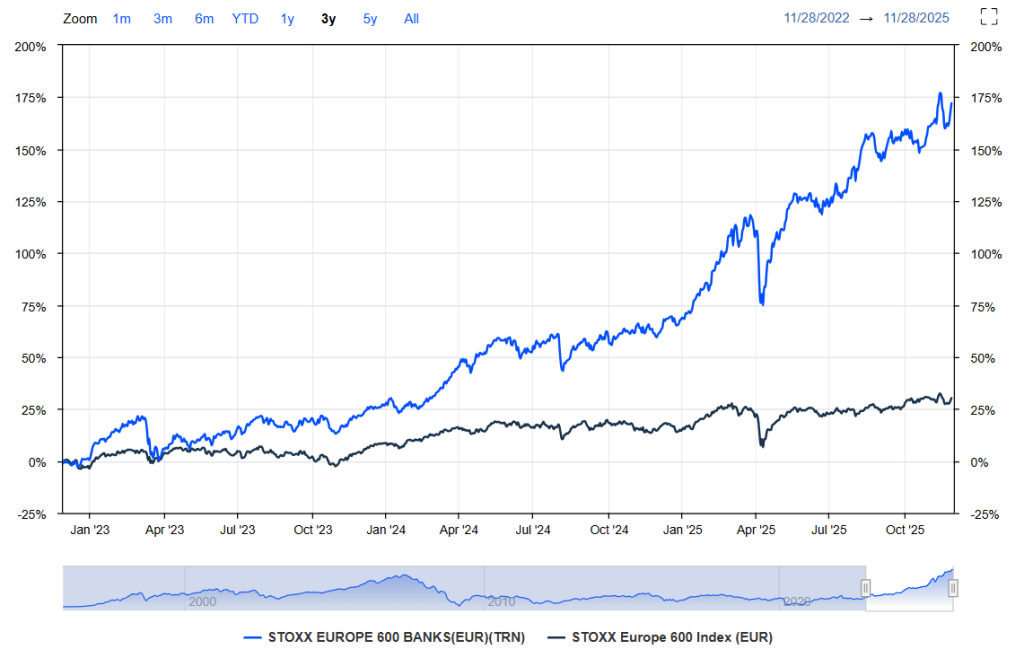

Banks and Periphery: Mixed Performance

European banks outperformed at times in November 2025. Peripheral sovereign bonds steadied in several sessions. Barclays observed that banks gained on a mix of stronger lending signals and the easing of some rate fears. Still, fiscal concerns in parts of the euro area limited upside. The banking patchwork across countries meant moves were uneven. Some lenders rallied while others lagged.

Industrial Automation Under Pressure

Industrial stocks felt the impact of AI-related debate, too. Firms selling automation, robotics, and industrial software saw their outlooks rechecked. Investors scaled back stretch valuations. That led to larger swings in shares tied to factory upgrades and logistics. Slower surveys of activity in parts of Europe added pressure on forecasts for equipment spending.

Consumer Sector and Advertising Cuts

Retailers and consumer-facing firms showed more caution. Several firms announced smaller-than-expected ad budgets and tamer guidance. That reaction tied back to two things: uncertain consumer demand and the shifting view on AI-driven marketing returns. As a result, stocks tied to digital ad growth experienced higher volatility. Analysts revised assumptions about near-term revenue for some platforms.

European Stocks: Macro Backdrop

Macro signals added fuel to market swings. Eurozone activity indicators came in mixed during November. Some PMI and industrial prints disappointed. Inflation trends also remained a key focus. The ECB and other policymakers continued to warn about stretched valuations driven by AI hype. That message echoed through the trading desks and helped explain some of the risk-off episodes. Global factors also mattered. US tech earnings, China growth signals, and geopolitical headlines created cross-currents that pushed prices around.

Policy and Regulatory Risk: The EU AI Act Timeline

Regulatory developments in Europe raised practical concerns for firms deploying large models. The EU AI Act has staged deadlines that affect general-purpose AI and high-risk systems. Some obligations for GPAI models became applicable in 2025, and further compliance steps will follow in 2026-2027. Market participants flagged that tighter rules could raise costs and slow rollouts. That uncertainty fed into valuations for AI-exposed companies across Europe.

Investor Behaviour: Flight to Safety and Portfolio Shifts

Investors rotated to defensive corners at several points in European stocks. Flows moved into government bonds, gold, and utility names during downswings. Managers also trimmed highly concentrated tech bets. Risk budgets tightened.

Some institutional players used data from an AI stock research analysis tool to reweight positions and stress-test scenarios. That cautious posture helped reduce drawdowns for some portfolios, but it kept volatility elevated as liquidity thinned in larger swings.

What could Calm Markets Next?

Clarity on a few topics could steady prices. Clearer AI regulatory guidance from Brussels would help. Conclusive signs that inflation is cooling could shift central bank plans and ease rate worries. Stronger earnings from Europe’s growth names would also soothe nerves. Conversely, another poor tech earnings cycle or a sudden geopolitical shock could renew sharp moves. Market participants will watch these triggers closely in December and into early 2026.

Final Takeaways for Investors

November 2025 proved that sentiment can swing quickly when hype meets policy risk. The month combined stretched valuations, shifting rate forecasts, and fresh regulatory steps. That mix produced sharp intra-month volatility across sectors. Investors should expect continued choppy trading until the policy picture and corporate earnings provide firmer signals. Staying diversified and monitoring regulatory updates appears prudent as markets digest the true costs and benefits of AI adoption.

Frequently Asked Questions (FAQs)

As of 1 December 2025, the FTSE 100 mainly moves because of company earnings, global market trends, energy prices, and investor confidence. Economic reports and interest rate news also change daily performance.

Oil and mining companies hold a large weight in the FTSE 100. Their prices change with global demand, so when energy or metal prices move, the index often rises or falls.

When commodity prices increase, UK energy and mining stocks often perform well. Companies linked to oil, gas, and metals usually gain because their products become more valuable in the market.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.