Top Stocks Today, Dec 1: Intel, Coupang, EasyJet, Fresnillo & Peel Hunt Lead Moves

The stock market opened on December 1, 2025, with a burst of activity. Several well-known names stood out as traders reacted to new data, earnings updates, and sector shifts. Intel climbed again as investors continued to reward its turnaround efforts and stronger chip demand. Coupang also gained attention as interest grew around e-commerce stocks heading into the holiday season. In Europe, easyJet saw fresh movement as travel bookings and analyst calls shaped the mood.

On the commodity side, Fresnillo moved higher as metals prices stayed firm and investors looked for safe-haven plays. Peel Hunt surprised many after posting sharp growth in revenue and profit, signaling a stronger outlook for the UK financial sector.

These moves show how quickly market sentiment can change at the start of a new month. Different sectors are reacting to different pressures, yet they all point to one trend: investors are searching for steady value and clear direction. Today’s activity offers an early look at how December may unfold and where money may be flowing next.

Top Stocks Today, Dec 1, 2025:

Intel: Signs of a Real Turnaround

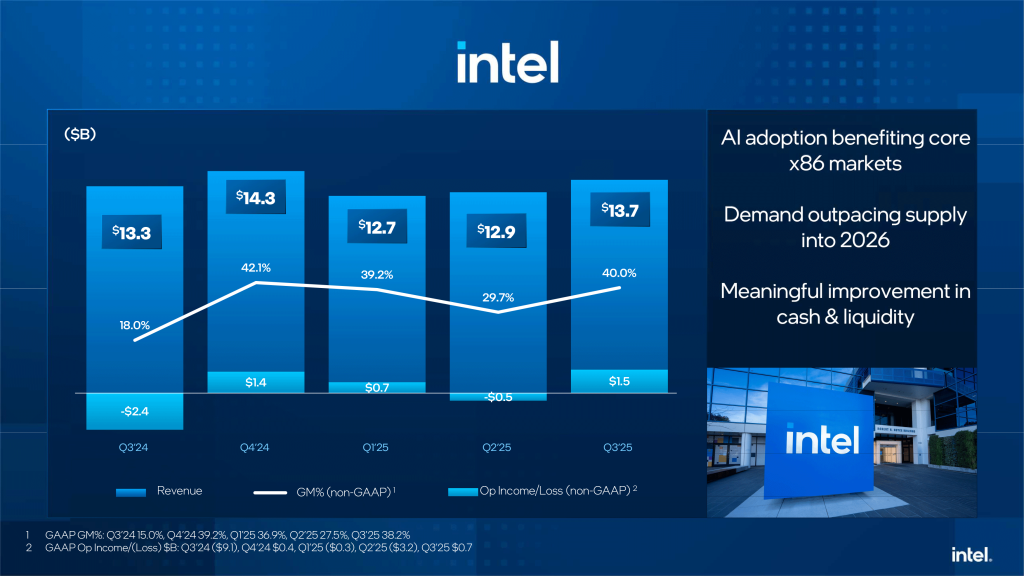

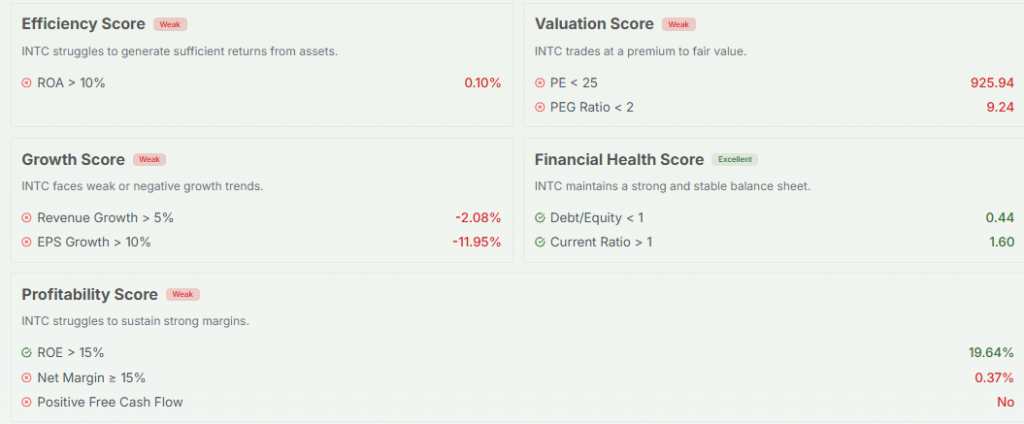

Intel delivered a strong third-quarter 2025 update that captured investor attention. The company reported revenue of around $13.7 billion and non-GAAP EPS of $0.23, reversing a string of disappointments.

Cost-cutting and strategic investments under new leadership seem to be paying off. Operating expenses dropped significantly while demand for AI and data-center chips rose. That helped Intel post a net income surge and boosted investor confidence in its recovery plan.

Still, challenges remain. The profitability looks fragile: some analysts warn of potential pullbacks as execution risk remains high, especially given heavy investment in manufacturing capacity and AI infrastructure.

Whether the rebound sticks will depend heavily on Intel executing its roadmap. The coming quarters will show whether this is a temporary boost or a lasting turnaround.

easyJet: Holiday-season Optimism vs. Underlying Caution

easyJet’s recent share activity reflects a mix of promise and caution. On one side, the airline industry’s recovery is supporting demand. easyJet remains competitive in Europe, particularly in leisure travel and holiday routes.

On the other side, macroeconomic headwinds and sector-specific risks loom large. Rising costs, fuel price fluctuations, and potential pressure on winter bookings make the outlook uncertain. Many analysts have scaled back growth expectations, and the stock now carries a more cautious rating.

The company seems to be balancing recovery with risk. Demand may stay strong if travel trends hold, but easyJet needs to manage costs and navigate economic headwinds carefully to turn that demand into stable profits.

Fresnillo: Mining Sector Volatility and Cautious Optimism

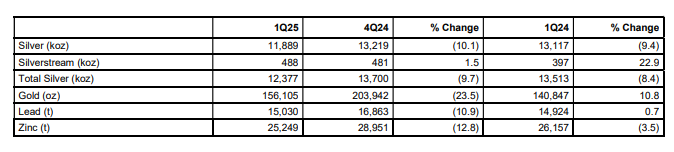

Fresnillo’s mining business remains tied to commodity price cycles and operational performance. In Q1 2025, silver output fell by about 8.4 % compared with the previous year, while gold output rose 10.8 %.

Production challenges, including lower ore grades and the closure of certain mines, have raised questions about near-term stability. Still, the company reaffirmed its full-year guidance, betting on a stronger second half to compensate.

Fresnillo remains appealing for investors seeking exposure to precious metals. If global inflation or economic uncertainty pushes gold and silver prices up, it could benefit. But the output volatility shows this remains a higher-risk, higher-reward kind of investment.

Peel Hunt: Standout Performance in UK Banking

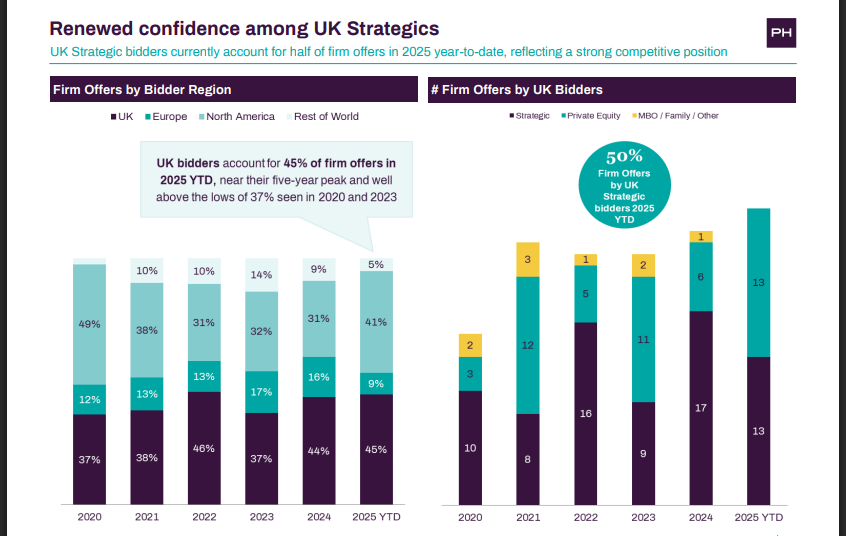

Peel Hunt delivered a surprisingly strong first half of fiscal 2026, showing that any lingering gloom in markets hasn’t hit all sectors equally. The firm posted a 38.3 % increase in revenue and an 858.3 % jump in profit before tax from £1.2 million last year to £11.5 million now.

All business divisions contributed: M&A advisory led growth, and equity capital markets plus execution services also saw strong gains. In particular, Peel Hunt advised on 10 major M&A transactions worth a total of £8.1 billion, a major vote of confidence in its advisory capabilities.

The results show that despite macroeconomic jitters, there remains demand for corporate finance and advisory work. For investors, Peel Hunt stands out as a financial-sector name with momentum, though success will depend on continued deal flow and a stable economic backdrop.

Broader Market Signals: A mix of Rotation, Selective Risk, and Caution

What ties these diverse stories from semiconductors to mining to airlines to banking is a larger shift in investor behaviour. There appears to be a rotation away from purely high-growth names toward companies offering a mix of recovery potential, tangible assets, or sector-specific strength.

In technology (Intel), investors are betting on a comeback tied to AI and manufacturing. In mining (Fresnillo), some expect safe-haven demand for metals to hold up. In banking/advisory (Peel Hunt), demand for M&A and capital markets is surprising in a tough macro climate. In airlines (easyJet), recovery depends on travel demand and macro trends.

This environment rewards selective risk-taking rather than blanket faith in any single sector. Returns may come from a mix of bold bets and steady value plays. But fragility remains: performance often depends on macroeconomic moves, commodity cycles, or regulatory shifts.

Top Stocks: What to Watch Next?

- For Intel: upcoming earnings, AI-driven demand, and execution on new manufacturing tech, and whether margins hold under increased competition.

- For easyJet: travel booking trends, fuel and cost pressures, and how Europe’s economic outlook affects discretionary travel.

- For Fresnillo: precious-metal prices and production updates, especially whether silver output recovers and gold prices stay firm.

- For Peel Hunt: continued M&A and equity deal flow in the UK, and how macroeconomic conditions affect corporate finance activity.

This mix shows today’s market is not about a single trend but many micro-stories. For investors, that means opportunities exist. But only for those willing to watch carefully.

Final Thoughts

The market moves on December 1, 2025, showed how different sectors can shift for very different reasons. Intel made real progress. easyJet moved on travel sentiment. Fresnillo reacted to metals and production updates. Peel Hunt rose on strong financial results.

Top stocks have their own risk profile, and none of the moves signal a single market trend. The lesson is simple: focus on company-specific drivers and stay alert to fast-changing conditions. In a market shaped by mixed signals, selective choices matter more than broad bets.

Frequently Asked Questions (FAQs)

Intel’s stock moved on December 1, 2025, after stronger demand for its chips and better financial results. Investors reacted to the company’s progress and expected improvement in future performance.

easyJet showed mixed signals on December 1, 2025. Travel demand is steady, but costs and competition remain high. Investors should review risks and recent results before deciding.

Fresnillo and other miners moved on December 1, 2025, due to changes in gold and silver prices. Market uncertainty increased interest in metals, affecting mining stocks.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.