ADP Jobs Data: Dow, S&P 500, Nasdaq Futures Show Mild Gains Ahead of Report

What is the buzz about ADP Jobs Data?

Investors on Wall Street are closely watching the upcoming ADP Jobs Data, a monthly report on private-sector employment. This data often acts as a preview to the official government jobs report, helping markets gauge labour market strength and possible direction for interest rates.

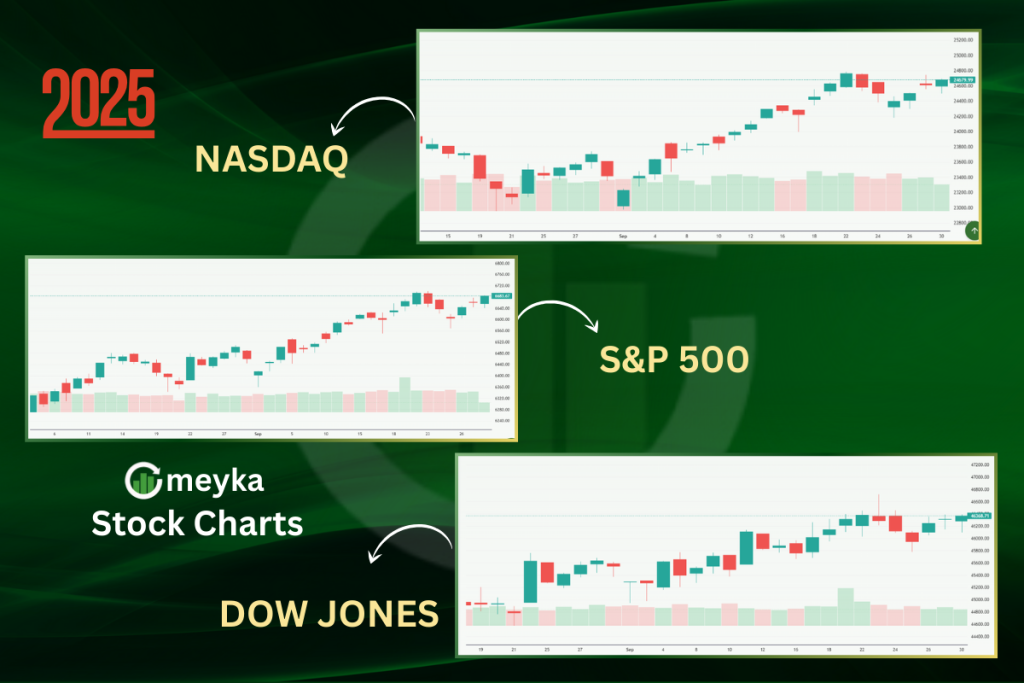

Because of all this attention, futures for the major U.S. stock indexes, Dow Jones Industrial Average (Dow), S&P 500, and Nasdaq Composite (Nasdaq), are showing modest gains as the report approaches.

Why ADP Jobs Data matters to markets

A quick preview of labour conditions

Since the official monthly jobs release from the government’s labour agency comes with some delay, markets often look to ADP’s data as an early signal. A strong ADP reading can boost confidence in hiring and economic growth; a weak one raises doubts.

Influences expectations for interest rates

If private hiring appears weak or cooling, investors might expect the Federal Reserve (the Fed) to lower interest rates to support the economy. Right now, rate-cut odds are elevated, and ADP’s numbers could cement those expectations.

Drives stock market mood and futures trading

Because it can sway expectations for both growth and monetary policy, ADP data often impacts stock futures and sentiment. That’s why we see the Dow, S&P 500, and Nasdaq futures inching up as the release nears.

What markets are currently expecting

Economists and traders expect a modest increase in private-sector jobs for November. Early forecasts point to around 10,000 new jobs, a slow pace, especially after a stronger month in October.

That cautious expectation has not stopped markets from showing optimism. Futures of the major indexes rose, supported by hopes that the Fed may cut rates soon.

Still, many traders remain wary: if the report disappoints, risk-off sentiment could quickly surface.

What could happen after the report?

If the ADP data surprises upside

If hiring numbers come in stronger than expected, stock markets may rally. Confidence in economic strength could support higher stock valuations. It might also reduce rate-cut expectations, which could boost sectors sensitive to interest rates and growth.

If the data disappoints or shows weakness

A weak ADP report could dampen investor mood. That may reinforce bets on a near-term rate cut from the Fed. Safe-haven assets and bonds might get a boost, while growth-oriented equities may underperform.

Mixed or neutral results

If the report is close to expectations, weak to modest hiring, markets may remain muted. Traders may turn to other macro data for cues, such as inflation numbers or official government employment reports.

How Adams, Powell, and the broader macro context play into this

- The ADP data is being watched closely because, in recent months, other private-sector job surveys showed signs of cooling, raising questions about the labour market’s strength.

- The Fed’s next moves on interest rates could hinge on what the job data shows. If employment falters, the central bank may lean more toward rate cuts.

- Market sentiment is also influenced by global factors: overseas investors, currency moves, bond yields, and broader economic growth, all of which interact with U.S. labour and rate expectations.

What investors should watch right now?

- Release timing: ADP’s report comes out soon, pay attention to the headline private-sector jobs change, and how it compares to expectations.

- Market reaction: Watch the futures of the Dow, S&P 500, and Nasdaq. A strong positive reaction may indicate optimism about growth and company earnings.

- Interest rate odds: Check tools like the CME Group FedWatch to see how rate-cut probabilities change after the data.

- Other signals: Look at wage growth, consumer spending, and upcoming inflation data. These may shift sentiment depending on how strong or weak jobs look.

Important Questions About ADP Jobs Data

Why is ADP Jobs Data so watched by traders?

Because it gives early insight into private-sector hiring before official jobs reports, which helps shape expectations for the economy and interest rates.

Could a weak ADP reading trigger a stock market drop?

Yes, especially if it raises doubts about hiring and economic growth or increases odds of rate cuts; that often pushes investors toward safer assets.

Does a strong ADP report always mean markets rise?

Not always, strength may boost confidence and equities, but if it raises fears of inflation or derails rate-cut bets, markets may react unpredictably.

Are other data points also important now?

Yes, inflation data, consumer spending, and manufacturing/service-sector surveys are all relevant to form a full picture of economic health.

What should long-term investors do ahead of the ADP release?

They should stay diversified, avoid panic trades based on one data point, and keep focus on fundamentals like company earnings and broader economic trends.

Final thoughts

The upcoming ADP Jobs Data release matters a lot for markets right now. It could influence whether the Fed leans toward rate cuts, which in turn affects interest-rate-sensitive sectors. The modest gains in Dow, S&P 500, and Nasdaq futures show cautious optimism, but everything depends on what the numbers reveal.

Traders and investors should watch closely, but also remember that one report is just part of a bigger economic picture.

FAQ’S

Analysts expect the S&P 500 to fluctuate based on economic growth, interest rates, and corporate earnings. Short-term predictions can vary, but long-term trends usually track overall U.S. economic expansion. Investors often use forecasts cautiously as markets can react to unexpected news.

Dow Jones futures are financial contracts that allow investors to speculate or hedge on the future value of the Dow Jones Industrial Average. They indicate market sentiment before the official stock market opens. Futures can move with global news, economic data, and investor expectations.

NASDAQ focuses on technology and growth stocks, while the S&P 500 represents a broader U.S. market with diverse sectors. Which is better depends on your investment goals, growth versus stability. Long-term investors often use both to balance risk and returns.

The S&P 500 gives a broader view of the market because it includes 500 large-cap companies across multiple sectors. The Dow has only 30 companies, so it reflects fewer industries. For general market trends, the S&P 500 is usually more representative.

Yes, Warren Buffett often recommends low-cost S&P 500 index funds for most investors. He believes they provide broad market exposure and long-term growth. Buffett suggests this over trying to pick individual stocks for consistent returns.

The 7% rule is a risk management strategy where traders limit losses or take profits when a stock moves 7% from the entry price. It helps protect capital and manage volatility. Traders adjust the percentage based on their risk tolerance and market conditions.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.”