Sify Infinit Spaces Eyes AI Growth Amid Caution on Market Bubble

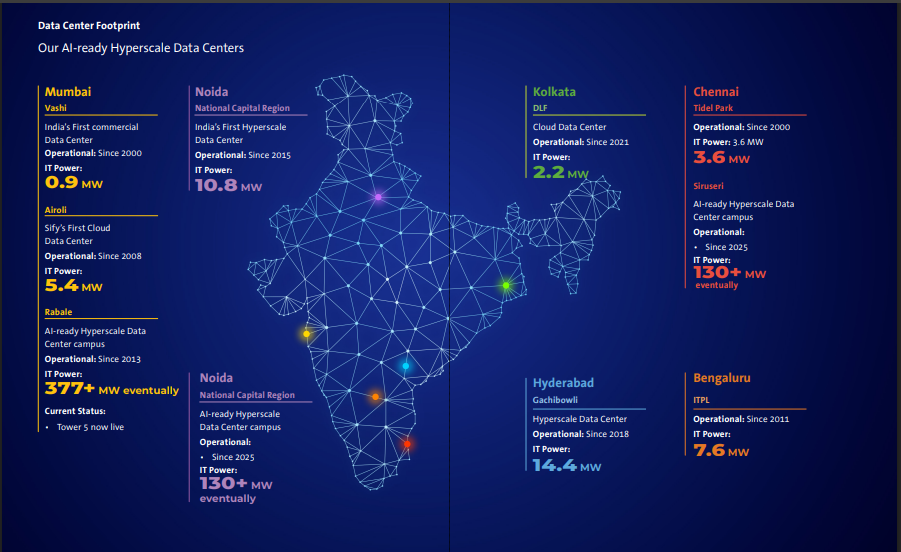

On December 3, 2025, India’s data-center landscape got a fresh spotlight. Sify Infinit Spaces now runs 14 data-centres across six major cities.

At a time when demand for artificial-intelligence (AI) infrastructure is surging, Sify has prepared ground wisely. Their newest facilities in Chennai and Noida earned NVIDIA DGX-Ready certification ready for dense GPU and liquid-cooling workloads.

This signals more than just growth. It shows intent. Sify isn’t merely chasing hype. They are building serious digital infrastructure to support AI while watching carefully for signs of a market bubble.

Let’s explore how Sify balances ambition with caution and why its path offers a realistic view of AI-driven growth in India.

Who Is Sify Infinit Spaces? A Quick Look at Its Position

From its early days as an internet service provider, Sify Infinit Spaces has moved into a new league. The company now runs multiple large data campuses across India. As of June 30, 2025, it operated 14 colocation sites and reported a built IT capacity near 188 MW.

Sify has also made specific technical bets. In May 2025, its Chennai and Noida facilities won NVIDIA DGX-Ready certification for liquid cooling. That makes those sites ready for very dense, GPU-heavy racks. The certification signals readiness for compute that trains modern models.

Yet leadership speaks with care. In an interview published on December 3, 2025, the CEO warned about herd behavior and oversupply. The message was simple. Growth is real. But caution is required to avoid a bubble.

Measured Builds, Not Speculative Campuses

Sify’s expansion strategy reads like a risk plan. New campuses are modular. The design lets capacity scale only when demand is firm. Power provisioning is tied to anchor customers and long-term contracts. This approach limits the chance of empty racks. It also protects margins if the market cools. The company shows a clear preference for pre-booked capacity over speculative construction.

At the same time, technical investments are forward looking. Liquid cooling and DGX-Ready architecture support densities above what traditional colocation built for. That matters because modern model training needs high power per rack and tight thermal management. Sify’s choice lets customers run GPU clusters without costly redesigns. The result is attractive to firms that value speed of deployment.

Customers Beyond Hyperscalers

Hyperscalers will always consume huge compute. But Sify’s pitch reaches local enterprises too. Banks, health platforms, e-commerce firms, and government projects all need compliant, low-latency compute. Data residency rules in India push some workloads to local colocation sites. Sify aims to capture those regulated and latency-sensitive segments. This diversification reduces the risk of depending solely on cloud giants.

Revenue Strategy that Cushions Cyclicality

Sify is pushing recurring services. Managed hosting, cloud orchestration, connectivity, and security are core draws. These services create steady cash flow. They also let the firm upsell AI-ready infrastructure without exposing revenue to one-time hardware sales. The DRHP filing and investor materials show focus on recurring contracts and energy arrangements that smooth costs. This tilts the business toward resilience if speculative demand falls.

Supply-chain and Energy Tightness are Real Constraints

The global push to build GPU farms is stressing supply chains. Memory, specialized chips, and GPUs remain tight. That can slow expansions and raise prices. At the same time, data centers need reliable, low-cost power. Sify points to long-term power purchase agreements and renewables contracts to control cost. These moves hedge against volatile energy prices. They also improve the appeal for customers that care about sustainability.

A Play for the Edge and the Core

Sify’s roadmap blends edge DCs with central campuses. Edge sites handle inference, real-time workloads, and low-latency services. Central campuses focus on training and heavy lifting. This hybrid model matches how enterprises will split workloads moving forward. It is more capital efficient than building massive monolithic sites everywhere.

How Valuation and Demand Risk Shape Decisions?

Market enthusiasm can distort investment plans. High private valuations for startups and surging demand signals tempt builders to overbuild. Sify’s leadership explicitly cites those risks. The CEO’s tone favors anchored deals over betting on continued hype. That approach is hardly flashy. But it limits the likelihood of stranded assets if demand retracts. Reuters coverage captured this nuance on December 3, 2025.

What Returns look like if demand Holds?

If demand for large models and enterprise automation stays steady, returns can be significant. High-density racks command premium pricing. Managed AI operations and GPU colocation carry higher margins than vanilla racks. Sify’s DGX-Ready certification speeds time-to-market for customers. That matters to firms that need to shift from prototype to production quickly. Public and private sector demand for model hosting and secure data processing could sustain multi-year growth.

Where the Plan could Go Wrong?

Several risks could hurt outcomes. First, a sharp drop in model demand would leave high-density capacity underused. Second, rapid moves by hyperscalers to build in-country campuses could reduce third-party demand. Third, regulatory shifts on data handling might boost compliance costs. Sify seems to plan for these scenarios by flexible builds and by focusing on services that lock in customers.

The Pragmatic Edge

Sify’s path is neither timid nor reckless. The company is equipping sites for cutting-edge compute. At the same time, expansion hinges on pre-booked demand. That mix brings optionality. It also lowers downside risk. Investors and customers watching India’s infrastructure evolution should note that engineering readiness alone does not equal success. Execution discipline and customer contracts matter just as much.

A Final View for Investors and Customers

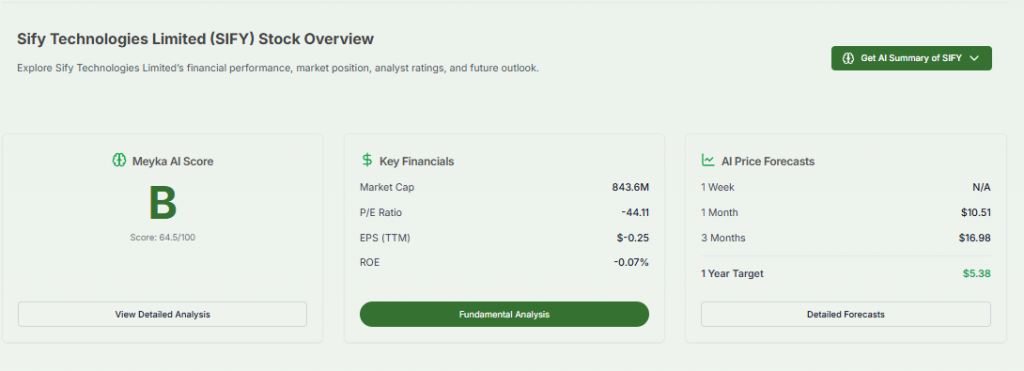

The market will test many assumptions in the coming years. Supply constraints, energy price swings, and client adoption rates will decide winners. Firms that pair technical readiness with contract discipline stand a better chance to survive turbulence. For Sify, the bet is on delivering GPU-grade capacity without overextending. Tools such as an AI stock research analysis tool may help market watchers separate hype from durable demand.

Frequently Asked Questions (FAQs)

Yes. As of May 2025, some Sify sites gained NVIDIA DGX-Ready status. These centers support high-power GPU systems, which makes them prepared for modern AI workloads.

Sify runs data centers across major cities, including Mumbai, Chennai, Noida, Hyderabad, Bengaluru, and Kolkata. These locations help serve national and regional digital needs with lower delay.

Sify is careful because AI demand can change fast. Leaders warn that building too much space could lead to unused racks if the market slows after 2025.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.