What Triggered the Fall? Indian Bank Share Price and Other PSU Bank Stocks Slide Up to 6%

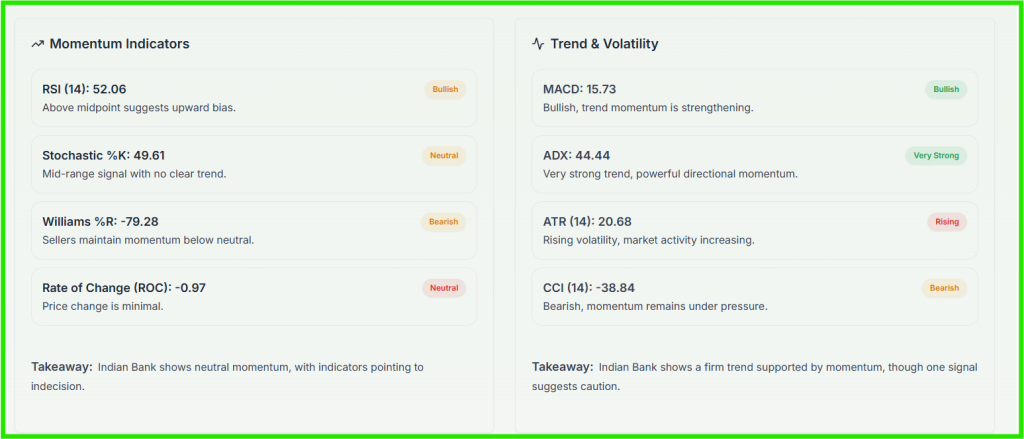

Indian Bank Share Price Slides Amid PSU Bank Sell-Off

The Indian Bank share price, along with other public sector banks (PSUs), witnessed a sharp decline of up to 6% in recent trading sessions. State-owned banks, including PNB, SBI, and Bank of Baroda, experienced heavy sell-offs, alarming retail and institutional investors alike.

Experts point out that the sudden dip reflects investor concerns over government policy decisions and foreign direct investment (FDI) limits in PSUs.

Why Did the Indian Bank Share Price Fall?

Government Rules Out FDI Limit Increase

The primary trigger for the fall is the government’s decision not to raise the FDI cap in public sector banks. Investors were hoping for enhanced foreign participation, which could have led to capital infusion and improved governance in PSU banks.

With the FDI limit remaining unchanged, market participants interpreted it as limited growth and capital flexibility for state-owned banks.

Market Sentiment and Technical Selling

Apart from policy concerns, the sell-off was amplified by technical factors, where stop-loss triggers accelerated downward movement in Indian Bank and PSU bank stocks. Retail and institutional investors responded swiftly, creating momentum-driven declines in the broader PSU banking segment.

Sector-Wide Implications

PSU Banking Sector Impact

The decline in Indian Bank share price is not isolated; the entire PSU banking sector has experienced a correlated slide, with several stocks dropping 4-6%.

Banks affected include Punjab National Bank, State Bank of India, Bank of Baroda, and Union Bank of India, reflecting investor caution.

Investor Confidence

The government’s stance on FDI has dampened investor optimism, raising questions about growth, capital adequacy, and long-term profitability in PSU banks. Analysts caution that sustained declines may affect market sentiment toward Indian banking equities in the near term.

Key Factors Behind the Decline

Limited Capital Infusion

With no FDI hike, PSU banks may struggle to raise fresh equity from foreign investors, which could limit future lending capacity and modernization plans.

Economic and Policy Considerations

Concerns over rising NPAs, interest rate pressures, and slower credit growth further influenced the decline in the Indian Bank share price.

Policy uncertainty adds to investor hesitation, impacting stock valuations and trading volumes.

Market Analyst Insights

Short-Term Outlook

Analysts predict volatile trading in PSU bank stocks until clarity emerges on policy support and capital infusion strategies. Technical corrections may continue, but long-term fundamentals of Indian Bank and other PSUs remain supported by government backing and large asset bases.

Long-Term Prospects

Despite short-term dips, PSU banks are expected to recover gradually, supported by economic growth, loan book expansion, and digital banking adoption.

Investors should monitor government reforms, capital adequacy, and FDI policy announcements for future guidance.

How Investors Can Respond

Diversification and Risk Management

Given the current volatility in the Indian Bank share price, investors may consider portfolio diversification and risk-adjusted exposure to PSU banking stocks. Long-term investors are advised to focus on fundamentals, capital adequacy, and government support, while short-term traders may leverage technical trends.

Monitoring Key Indicators

Track policy changes, RBI directives, and macroeconomic indicators like GDP growth, interest rates, and banking reforms for informed decisions.

Close monitoring of earnings announcements and asset quality reports is crucial to gauge stock performance.

Conclusion

The Indian Bank share price slide reflects a combination of government policy decisions, technical selling pressures, and investor sentiment in the PSU banking sector. State-owned banks, including PNB, SBI, Bank of Baroda, and Union Bank, experienced significant declines, highlighting sensitivity to FDI policies and capital adequacy concerns.

Analysts suggest that while short-term volatility may persist, long-term fundamentals of Indian Bank and other PSU banks remain robust, supported by government backing, digital transformation, and growing credit demand.

Investors are advised to stay informed on policy updates, sector reforms, and macroeconomic indicators to navigate fluctuations effectively and make strategic investment decisions.

FAQ’S

The fall was triggered by the government ruling out an increase in FDI limits, affecting investor sentiment and capital prospects.

Stocks of PNB, SBI, Bank of Baroda, Union Bank, and Indian Bank fell between 4-6% amid sector-wide sell-off.

Long-term investors may benefit as the fundamentals of PSU banks remain strong, with government backing and strategic growth plans.

Retail investors should diversify portfolios, monitor policy updates, and consider long-term value investing strategies.

The dip reflects policy concerns and technical selling rather than a fundamental weakness in the banking sector.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.