Chevron plans up to $19 billion spending push on US and Guyana oil output

Chevron has just announced that it plans to spend up to US $19 billion in 2026, a big bet on oil output in the United States and Guyana. This move comes after Chevron’s recent acquisition of major assets, including stakes that boost its reach in Guyana’s offshore oil fields.

The company says most of the money will go into upstream efforts drilling and production, especially shale oil in U.S. basins and deep-water oil in Guyana.

For Chevron, this is more than just spending. It is a clear signal that they aim to shape the next era of global energy supply. The risk is real. But the potential reward of stronger oil output and long-term value could reshape industry dynamics.

Breaking Down Chevron’s $19 Billion Investment Plan

On December 3, 2025, Chevron announced its 2026 capital‐expenditure (capex) budget: $18-$19 billion. That number sits at the low end of its long-term guiding range of $18-$21 billion per year through 2030.

Of that total, about $17 billion is dedicated to upstream activities, the core of oil and gas production.Roughly $9-10.5 billion will support U.S. operations, with a major part allocated to shale and tight oil assets.The rest about $7 billion is slated for global offshore and non-U.S. assets, especially offshore projects including deepwater fields.

Chevron says this plan targets “highest-return opportunities” while maintaining discipline and driving efficiency. Through this, the company aims to grow cash flow and earnings.

Why the U.S. Is it Central to Chevron’s Growth Strategy?

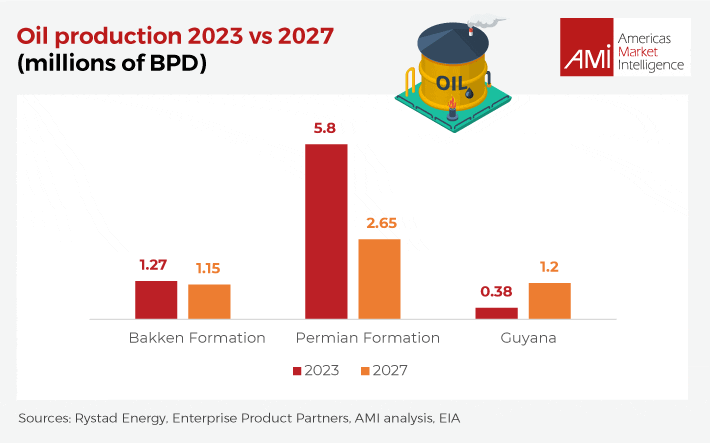

A big part of the new budget goes to U.S. shale and tight-oil assets. About $6 billion of the U.S. spend is earmarked for major shale plays such as the Permian, DJ Basin, and Bakken formations. Chevron expects this investment to push its U.S. production over 2 million barrels of oil equivalent per day (boe/d) in 2026.

Focusing on shale makes sense in the current market. These “short-cycle barrels” can be developed fast. When oil prices or demand shift, shale allows quicker response compared to long-cycle offshore projects.

In addition, prioritizing shale and tight oil in the U.S. helps Chevron balance risk. It lowers reliance on remote deepwater projects, and gives flexibility if global prices drop.

Guyana’s Rise: Why Deep-Water Offshore Matters?

Chevron is not just sticking to shale. A major portion of its offshore capex goes to projects in Guyana. This commitment follows Chevron’s acquisition of Hess Corporation, a deal that brought Chevron a significant stake in the deep-water oil fields offshore Guyana, especially in the Stabroek Block.

Guyana’s value lies in its low breakeven costs and fast development potential. The oil found there thanks to large, proven reserves promises high returns. The Hess acquisition dramatically increased Chevron’s exposure to those reserves.

Chevron is investing more in offshore projects to balance its U.S. shale growth. Shale gives quick output, while deep-water fields provide steady long-term supply. This mix helps keep production stable even if one area faces delays or problems.

Strategic Intent: More Than Just Spending

This investment plan isn’t a simple spending spree. It’s a clear strategy shift. By focusing on high-return assets in the U.S. and offshore, Chevron aims to boost cash flow and support future growth even with volatile oil prices.

During its November 2025 investor day, Chevron laid out goals: keep capex and dividend breakeven below a $50 Brent per barrel price through 2030. Also, the company plans to raise return on capital employed by more than 3% by 2030 if Brent stays at $70.

Chevron also expects to generate structural cost reductions, aiming for $3-$4 billion in savings by the end of 2026.

With this mix of disciplined capex, cost control, and strategic asset balance, Chevron aims for stable cash flow, robust output, and shareholder returns as the coming decade unfolds.

Market Reaction and What Analysts See

The news of the 2026 capex plan triggered market attention. Some analysts welcomed the move for its balance neither aggressive overspending nor overly conservative posture. They see the plan as realistic, anchored in high-return assets.

Other watchers warn of execution risk. Integrating major assets (from the Hess acquisition) and managing simultaneous growth in U.S. shale and deep-water offshore may stretch resources. Offshore projects especially in deep water often come with high capital intensity and long timelines.

Moreover, global oil prices remain uncertain. If oil dips significantly, offshore projects may become less profitable. That would test Chevron’s ability to deliver on its promises.

Still, many believe the strategy is smart. By combining quick-cycle U.S. shale with long-life deepwater assets, Chevron balances short-term cash flow and long-term reserve growth.

Risks Chevron Is Willingly Accepting

Chevron’s plan does come with risks. Offshore projects especially in deep-water regions like Guyana face potential delays, higher costs, and regulatory or environmental challenges.

Capex inflation and supply-chain constraints remain a concern. Rising costs for labor, materials, and logistics could throw off budgets. Deepwater operations are especially vulnerable to such swings.

Integration risk after the Hess acquisition also looms large. Combining large asset portfolios U.S. shale, Bakken shale plays, plus deepwater offshore poses organizational challenges.

Finally, global energy markets remain volatile. Demand shifts, policy changes, or new energy-source competition could affect returns.

What This Means for the Future of Global Oil Supply?

If everything goes as planned: U.S. shale output climbs, and Guyana delivers deep-water barrels. Chevron would be well positioned for stable production through the late 2020s.

This mix could help offset long-term decline in older fields. Chevron’s new portfolio diversified across shale, deepwater, and global offshore would offer resilience.

At a broader level, Chevron’s move shows how major oil companies are reshaping portfolios. Rather than relying only on old fields or one region, they now blend fast-cycle shale with deepwater projects to manage risk and reward.

Conclusion: A Balance of Discipline and Growth

Chevron’s 2026 plan $18-$19 billion in capex signals discipline. But it also shows ambition. By putting most funds into high-return U.S. shale and deepwater offshore in Guyana and other regions, the company aims to secure cash flow and long-term supply.

This strategy offers a blueprint: combine fast-cycle barrels with deepwater growth, manage costs, and stay flexible. If Chevron delivers, it could emerge stronger. But much depends on execution, global oil markets, and project costs. The coming years will show whether this is a smart bet or a risky gamble.

Frequently Asked Questions (FAQs)

Chevron announced on December 3, 2025, that it will invest $19 billion to grow U.S. shale and Guyana oil output. The company says these projects offer strong returns and long-term supply.

Chevron’s growing stake in Guyana may add more low-cost deepwater oil between 2026 and 2028. More supply can ease pressure on prices, but global demand still sets the final trend.

Yes. Chevron plans more drilling in key U.S. basins in 2026. The company expects higher output as new wells come online, though actual results depend on market conditions.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.