Asia Stocks Mixed as Fed Rate-cut hopes lift Japan’s Nikkei

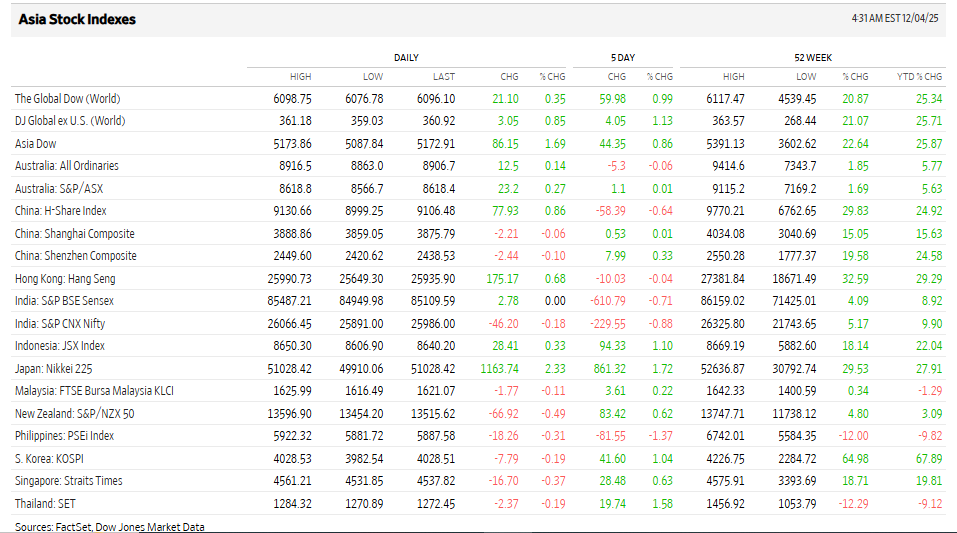

On December 4, 2025, Asian stocks showed a mixed mood even as investors across the region eyed possible interest-rate cuts by the Federal Reserve (Fed) , a factor that boosted hopes and spurred selective gains. In Tokyo, the Nikkei 225 index surged as traders grew optimistic about lower U.S. borrowing costs.

Still, the mood remained cautious elsewhere in Asia: markets responded unevenly, reflecting local economic concerns and global uncertainty. Some regions lagged while others rallied showing that Fed-driven optimism doesn’t push all markets forward together.

This patchwork reaction highlights a key truth: even in a globally connected financial world, local conditions and investor sentiment matter. Today’s snapshot shows that while rate-cut hopes can lift markets like Japan’s, other Asian markets remain on edge, watching both global signals and domestic headwinds.

What Triggered Today’s Asia Stocks Sentiment?

On December 4, 2025, traders reacted strongly to fresh U.S. data and Fed chatter. Weak U.S. jobs signs and softer inflation readings pushed expectations that the Federal Reserve may cut rates sooner than markets had thought. That lowered Treasury yields. Lower yields lifted risk assets and eased borrowing-cost worries for many investors. This shift set the tone for Asia stocks mixed session, where some markets rallied and others lagged.

Beyond U.S. signals, Tokyo bond moves and yen swings added a local twist. Rising Japanese government bond yields at times created nervousness. That made the situation more complex: a U.S.-led easing story, but with country-specific quirks shaping how money flowed across Asia.

Japan’s Nikkei Leads Gains

Japan emerged as a clear winner on the day. The Nikkei 225 jumped strongly as traders priced in easier U.S. policy and a weaker yen. Exporters looked cheaper in dollar terms. That drew foreign demand into large-cap exporters and technology names. The Nikkei reached levels close to recent highs and posted one of the region’s biggest gains on December 4, 2025.

Two forces boosted Japan. First, a weaker yen helps exporters’ profits when translated to dollars. Second, domestic flows have returned as local investors sense policy clarity. Banks and industrials also saw rotation, while AI and chip-related names drew attention after corporate moves and fund flows. Some traders used an AI stock research analysis tool to scan momentum and sector strength, which amplified the buying in fast-moving names.

China and Hong Kong Under Pressure

China’s mainland markets did not join the broad Japan rally. Shanghai and Shenzhen showed mild weakness on the day. Investors remained cautious about slower domestic growth and recurring property worries. Regulatory risks and mixed corporate news kept foreign buyers on the sidelines.

Hong Kong’s Hang Seng was more resilient but still lacked strong conviction. Some large-cap tech and property-linked names moved unevenly. That split performance reflected a market that will only rally on clear policy easing or a major upgrade in China’s growth outlook. Analysts said local catalysts are needed to sustain a firm uptrend.

South Korea: Chip Stocks Lead but Market Stays Range-Bound

Seoul’s market showed mixed trading. Semiconductor stocks, which usually drive the KOSPI, struggled after weakness in U.S. chip names. SK Hynix slid on profit-taking and linkages to global chip cycles. Samsung showed resilience in parts of the session, but the sector’s swings left the broader index range-bound.

Automakers helped offset some tech pain. Positive trade moves and tariff updates lifted car makers on December 4, 2025. Still, the overall picture felt fragile. Traders said gains will need steady global demand and clearer signals on rates.

Australia and Southeast Asia: Diverging Paths

Australia had a split session. Mining firms and energy stocks helped the ASX end slightly higher as commodity prices rose. That cushioned the market against domestic spending data that raised short-term rate talk. Strong household spending in October pushed some to warn about potential RBA action ahead, which kept the market watchful.

In Southeast Asia, the story varied by country. Singapore’s banks showed steady interest. Indonesia and Malaysia traded cautiously as investors waited for more U.S. data. Malaysia’s IPO and fundraising news drew local attention, helping specific sectors. Overall, ASEAN markets moved on local news and external flows rather than a uniform regional theme.

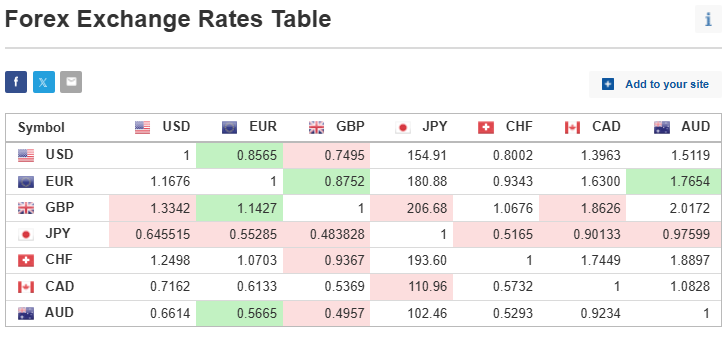

Currency Moves Shaped Equity Performance

Currency shifts were key. The yen fell versus the dollar, boosting exporters and lifting Japan’s stock market. China’s yuan stayed relatively stable but remained sensitive to policy signals. The Australian dollar rose on commodity strength and household spending news, which fed debate over RBA policy.

Korea’s won followed chip stock news and yield moves. In short, currency moves changed profit math for multinational firms and guided where foreign money went on December 4, 2025.

Asia Stocks: What Investors are Watching Next?

Traders are focused on a tight list of events. The next U.S. inflation prints and the Fed meeting top the list. Markets will watch whether soft job numbers turn into a formal Fed easing path. In Asia, Japan’s data on wages and inflation matter as they affect BoJ thinking. China’s PMI and consumer data will also draw scrutiny. Sector-wise, chip inventories and EV demand remain key triggers for tech and auto stocks.

Expert View: Why Asia Won’t Move in One Direction?

Experts note that Asia is not a single market. Each country has its own drivers. Export-led Japan gains when a weak yen helps profits. China needs policy support to lift domestic demand. Korea depends on chip cycles, while Australia rides commodity moves. That explains why Fed news can lift one market while leaving another flat or down. The message is simple: global signals matter, but local facts decide who wins and who does not.

Conclusion: A Clear Short-Term Winner

On December 4, 2025, Fed rate-cut hopes put wind in risk assets across Asia stocks. Japan’s Nikkei clearly benefited. Other markets stayed cautious or fell back. The coming days will test whether the Fed signal turns into cuts and whether local data support follow-through rallies. For now, investors must pick markets with clear policy paths or strong local catalysts.

Frequently Asked Questions (FAQs)

Japan’s Nikkei rose on December 4, 2025, because investors expect lower U.S. rates. A weaker yen also helped exporters. These factors pushed more money into Japanese stocks that day.

Fed rate-cut hopes lower borrowing costs and lift global market mood. When the Fed signals easier policy, Asian markets often react with mixed moves because each country has different risks and investors.

On December 4, 2025, China and Hong Kong felt pressure from weak growth worries. South Korea also saw stress in chip stocks. Other markets stayed cautious due to global and local uncertainty.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.