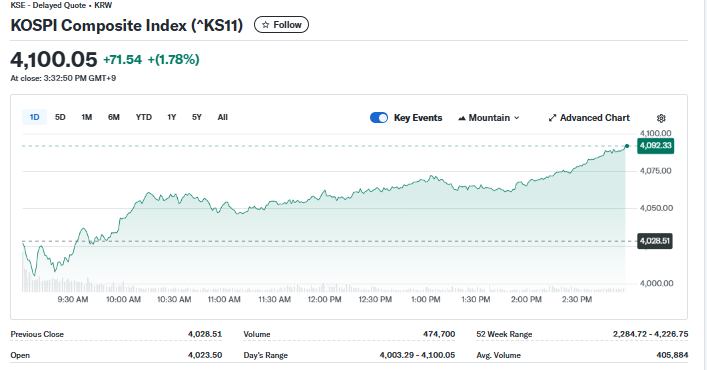

KOSPI Surges Past 4100 Amid Heavy Buying by Foreigners and Institutions

On December 4, 2025, the KOSPI closed at 4,028.51, a stunning milestone that underlines renewed confidence in South Korea’s equity market. Investors barely blinked when the index surged past 4,000, driven by a fresh wave of strong buying from foreign and institutional players. The mood in Seoul’s trading rooms shifted from caution to optimism.

In just a few weeks, KOSPI jumped from around 3,500 to over 4,000, a dramatic leap that signals more than a short-term rally. What’s behind this leap? It is not just momentum. Deep structural shifts in investor sentiment, global demand for Korean tech, and improving fundamentals are at play. This breakthrough may mark the start of a new chapter in Korean markets, one worth watching closely.

Buyers Return: What the Tape Shows

Foreign and institutional buyers led the move that pushed the KOSPI above the 4,100 level in late 2025. On December 4, 2025, the KOSPI recorded a close above 4,000, underscoring the renewed appetite for Korean stocks. Trading data for early December show large net purchases by institutions and foreigners while local retail investors stepped back. This mix flipped a market that had seen intermittent foreign selling just weeks earlier.

Who Took the Lead on the Bid?

Large pension funds and overseas asset managers were the biggest buyers on several heavy-volume days. Their activity was not random. Portfolio managers rotated into exporters and tech names. They cited better corporate governance, dividend moves, and clearer buyback plans. Foreign funds also chased cheap valuations relative to global peers. Korea Exchange flows, and local broker reports confirm these patterns.

Who’s Winning the Trade?

Semiconductors and large-cap tech names saw the strongest demand. Samsung Electronics and SK hynix repeatedly hit multiyear highs during the rally. These firms benefited from AI-related demand and renewed server spending. Smaller parts of the market also advanced. Battery-material suppliers and some industrial exporters recorded notable gains. However, the rally’s center of gravity remains tech and chip-related plays.

KOSPI Earnings and the Real Drivers

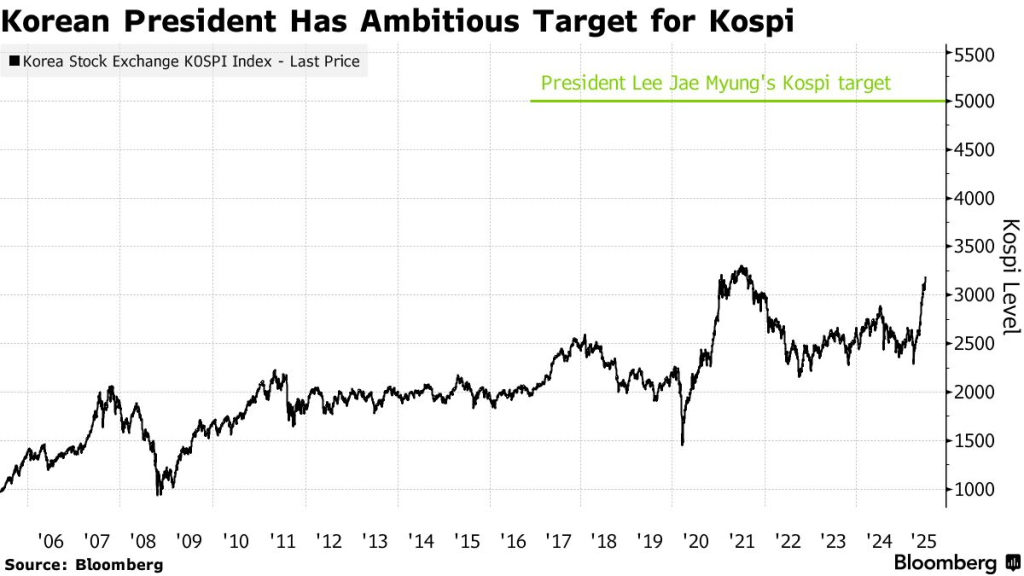

Earnings upgrades amplified the move. Analysts revised forward profit estimates for key exporters after a clearer global demand signal emerged in October and November 2025. Corporate reform talk from Seoul also lifted sentiment. Policymakers pushed programs to boost corporate value. Investors priced the chance of more buybacks and higher dividends into stock valuations. These expectations underpinned buying flows even when daily headlines were mixed.

Currency and Macro: A Two-Way Street

The won’s swings mattered. A softer won helped exporters’ dollar revenues. At the same time, currency weakness raised alarms for forex exposure among retail holders of overseas assets. Seoul’s financial watchdog flagged FX risks and promised closer oversight in early December 2025. Such macro moves mean foreign flows can reverse quickly if the dollar or U.S. rates surprise the market.

The Crowd That Did Not Join

Retail investors largely sold into the rally. Local households trimmed positions after a long run of volatility earlier in the year. That left the index’s upswing concentrated in institutional hands. A concentrated rally can push headline indices higher while leaving many small-cap names behind. This divergence is worth watching for signs of a broadening market advance.

Technical Breadth and Market Structure

The breadth improved compared with prior months. More sectors recorded positive returns on high-volume days. Yet, mega-cap leadership still matters. A few giants can carry indexes higher while overall risk remains uneven. Traders should watch volume patterns and sector rotation. Sudden shifts in foreign positioning have moved the market sharply before. Market participants now lean on AI-driven screens and an AI stock research analysis tool for flow signals and heat maps.

Key Risks That Could Snap the Rally

A handful of real risks could reverse gains. First, tech demand could cool if global AI spending slows. Second, geopolitical flare-ups in the region can spook cross-border flows. Third, a sudden U.S. The Federal Reserve shift would test carry trades and the won. Fourth, retail exposure to FX and overseas assets could feed volatility if the currency weakens sharply. Finally, earnings must keep up with lofty expectations. Analysts warn that momentum alone will not justify higher multiples indefinitely.

KOSPI: How Investors Might Position?

Conservative players may favor dividend growers and high-quality exporters that benefit from a weaker won. Risk-tolerant traders could lean into semiconductor suppliers and AI-related component makers on pullbacks. Long-term allocators should monitor corporate governance reforms and actual buyback announcements rather than rhetoric alone. Active risk controls remain essential due to rapid foreign flow shifts.

What to Watch Next: Concrete Dates and Triggers

Monitor the next quarterly earnings cycle in January-February 2026. Watch foreign net flow reports published weekly by local brokers. Track any policy announcements from the Financial Supervisory Service in early December 2025 that address FX disclosures. Finally, watch U.S. macro prints and Fed commentary; that data will likely drive short-term cross-border flows.

Bottom Line

The KOSPI’s move past 4,100 in late 2025 reflects more than short-term momentum. It shows a shift in who leads the market. Foreign and institutional money returned in force. Tech and export play reaped most gains. The advance is promising. It is not without fragility. Close attention to flows, earnings, and macro triggers will reveal whether this is a sustained market cycle or a powerful, but limited, rebound.

Frequently Asked Questions (FAQs)

Because big foreign and institutional investors bought lots of shares. Also, strong export and tech demand, plus better earnings hopes, lifted value in December 2025.

Semiconductors, tech giants, and exporters lead now. Big firms such as Samsung Electronics and SK Hynix, plus battery and industrial supply makers, power most gains.

A global drop in tech demand, weaker won currency, shifts in U.S. interest rates, regional tensions or weak company earnings could reverse gains quickly.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.