Asian Shares Trade Mixed While Investors Brace for Fed Announcement

On 8 December 2025, Asian shares started the week on a cautious note. Investors kept a close watch on the upcoming Federal Reserve (Fed) policy decision. Markets across Asia moved in different directions; some indexes rose, others slipped, reflecting uncertainty.

Many traders are waiting to see if the Fed will cut interest rates or hold steady. That uncertainty is shaping investor mood across Tokyo, Hong Kong, Seoul, and beyond. Markets are also reacting to global signals: bond yields, currency swings, and shifting oil prices. Together, these make for a nervous, wait-and-see start to trading.

This mix of hope and caution shows just how much is riding on the Fed’s next move and how fragile market sentiment feels right now.

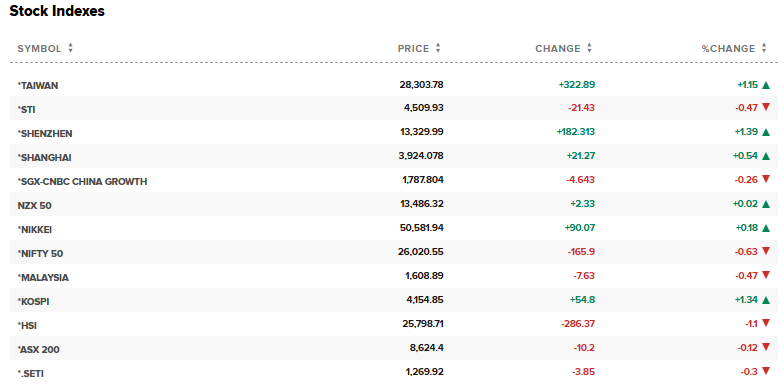

Regional Performance Snapshot: Divergence across Asia-Pacific Indices

Tokyo traded with little direction. The Nikkei held near recent levels as exporters digested currency moves and revised domestic data. Hong Kong’s Hang Seng was among the weaker indexes.

The index slid amid lingering concerns over the property sector and tech-stock profit taking. Shanghai and Shenzhen recorded modest gains. Chinese onshore markets took heart from policy signals and liquidity support even as domestic demand stayed soft. Seoul’s KOSPI showed selective strength.

Chip exporters found buyers after mixed U.S. tech moves. Sydney’s ASX 200 drifted lower as miners and banks adjusted to moves in commodity prices and bond yields. These regional swings reflected local news and cross-border flows ahead of the Fed decision on 9-10 December 2025.

What’s Driving the Mixed Sentiment? Five Forces Shaping Markets

First, the Federal Reserve meeting sits centre stage. Markets priced a high chance of a quarter-point cut. Traders parsed the dot plot and Chair language for clues on future easing. That tension produced tentative positioning across risk assets.

Second, the U.S. dollar and Treasury yields set the global tone. The dollar steadied after a sell-off. Long-dated yields remained sensitive to growth and inflation surprises. Asian bond and equity moves reacted in tandem.

Third, China’s growth puzzle kept investors cautious. Exports showed pockets of strength. Domestic consumption lagged. The property sector still weighed on risk appetite in Hong Kong and onshore markets. Policy hints from Beijing prevented a deeper sell-off but did not erase doubts.

Fourth, geopolitics added an extra layer of risk. Recent incidents involving naval and air interactions in East Asia raised diplomatic tensions. Such events constrained risk-taking in regional markets and amplified demand for safe assets.

Fifth, earnings and sector rotation shaped trading flows. Investors preferred companies with clear near-term cash flows. Exporters saw divergent outcomes versus firms reliant on local consumption. Options and volatility indicators showed muted conviction ahead of the Fed decision.

Asian Shares Sector by Sector: Where Funds Moved?

Technology stocks traded cautiously. Global AI momentum helped some names. Yet Asian chipmakers tracked U.S. tech swings closely. Semiconductor order cycles remain uneven. Financial stocks reacted to yield signals. In markets where rates might fall, banks’ net interest margins drew attention.

In others, higher-for-longer rate talk kept some banks supported. Commodities and energy names responded to oil swings and safe-haven flows. Gold advanced on rate-cut expectations even as traders weighed inflation risk. Retail and consumer stocks underperformed as China retail data disappointed.

Bond Yields, FX, and Derivatives: The Macro Signals

U.S. Treasury yields moved the needle for Asia. A softer long yield supported equities and pressured the dollar. Currency moves were decisive for exporters. The yen’s swings put pressure on Japanese equity valuations tied to overseas sales. The Chinese yuan held within its recent trading band but remained sensitive to capital flows. Traders used FX forwards and options to hedge short-term risk. Volatility in rate markets implied that any Fed surprise could trigger sharp moves across Asian bond curves and equities.

Analyst Views: How Institutions are Reading the Signals

Investment houses flagged a delicate balance. Some strategists saw room for gains if the Fed delivered a dovish cut and signalled a clear easing path. Others warned that an ambiguous message would spur profit-taking.

Credit analysts emphasised liquidity and refinancing risks for certain Chinese developers. Equity strategists highlighted the potential for rotation into cyclicals if risk sentiment improved. Traders noted that position sizes remained small ahead of the Fed, a sign that many participants preferred to wait for clarity.

Trading Tactics and Positioning

Hedging activity rose. Investors used short-dated options to protect portfolios against a sharp move in yields or FX. Long positions in defensive sectors increased in markets with weak domestic demand. Momentum plays favoured AI-linked names that had strong earnings proofs. Separately, some sophisticated desks referenced an AI stock research analysis tool to screen for chips and software firms with durable earnings growth. That approach helped narrow focus amid broad uncertainty.

Asian Shares: What to Watch Next?

The Fed decision on 9-10 December 2025 will be the primary trigger. Markets will read the dot plot, the committee’s statement, and the Chair’s remarks for guidance on future cuts. China data due in the coming days, including retail sales and industrial output, will test growth assumptions and influence onshore sentiment.

Japan’s revised GDP figures and wage news will remain important for USD/JPY and BoJ outlooks. Corporate earnings from major tech suppliers and regional banks will add fresh, stock-specific drivers.

Conclusion: Cautious Stance until Policy Clarity

Markets across Asia reflected caution rather than capitulation. Moves were selective and often short-lived. The Fed meeting is the inflection point. If guidance is clear and dovish, risk appetite could return quickly. If instead the Fed signals more caution, volatility is likely to rise. Traders and investors should expect sharp, fast reactions in rates, FX, and equities around the policy announcement on 9-10 December 2025.

Frequently Asked Questions (FAQs)

Asian shares are mixed because investors are waiting for the Fed’s decision on 10 December 2025. Markets react to interest rate clues, currency moves, and new economic data.

The Fed decision on 10 December 2025 may change borrowing costs and move the U.S. dollar. These shifts can affect Asian stocks, exports, and investor confidence across the region.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.