Eli Lilly’s Mounjaro Secures Spot on China’s State Insurance List for Diabetes Care

The number of people living with diabetes in China is rising fast. On December 7, 2025, authorities announced that Eli Lilly’s Mounjaro, a weekly injectable diabetes drug, will be added to China’s state health insurance starting January 1, 2026.

That move could bring Mounjaro into reach for millions of patients with type 2 diabetes. Mounjaro is not just another diabetes medicine; it treats blood sugar with fewer shots, and early data suggest it may help with weight control too. For a country of 1.4 billion people, including this drug in insurance coverage could change how diabetes is managed.

This step marks a turning point. Access to Mounjaro will likely rise, making modern treatment easier for many. And for the healthcare system, it could mean fewer complications down the road.

Why China’s Diabetes Burden Makes This Move Critical

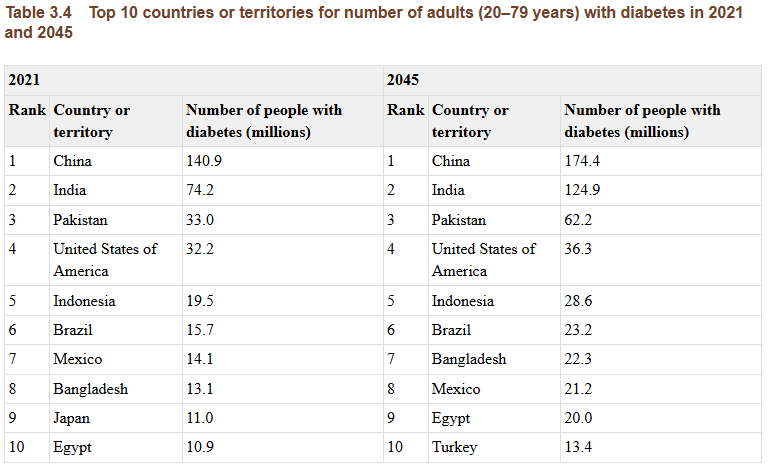

China has the world’s largest number of adults with diabetes. About 148 million adults in China live with the disease, according to the International Diabetes Federation. This high burden strains hospitals and families. Lowering long-term complications is a national priority.

Adding effective drugs to state insurance can widen access fast. The National Reimbursement Drug List (NRDL) is the main route for that. Inclusion there changes who can afford modern therapies and where doctors will prescribe them.

Mounjaro’s Clinical Edge over Traditional Treatments

Mounjaro (tirzepatide) is a dual GIP and GLP-1 receptor agonist. It targets two hormone pathways that control blood sugar and appetite. This dual action produced larger A1C and weight reductions than several GLP-1 drugs in head-to-head trials.

The SURPASS program showed strong glucose control and meaningful weight loss. Studies also reported durable benefit over long follow-up. Those clinical gains helped regulators and payers view Mounjaro as more than a standard glucose-lowering drug.

The Chinese State Insurance Lists What Changed

China’s National Healthcare Security Administration posted the update in early December 2025. The listing takes effect on January 1, 2026. This step means patients with eligible type 2 diabetes can get Mounjaro partly paid by state insurance. Price will be lower than private market levels because of government negotiation. That tradeoff often expands patient access while compressing unit revenue. Analysts expect higher volumes and slimmer margins per dose.

Market Strategy and Competition in China

China’s GLP-1 market is now crowded. Novo Nordisk’s semaglutide (Ozempic) led early sales. Local rivals and newer entrants have also scaled fast. With NRDL status, Mounjaro becomes a stronger challenger.

Pricing will matter most. If government negotiations cut the price sharply, broader uptake will follow. That will pressure local drugmakers that sell competing peptides and biologics. Investors and analysts already flagged potential share shifts in the diabetes portfolio across companies after the listing announcement.

Economic and Healthcare Impact for China

Bringing Mounjaro onto the reimbursement list could reduce future complications. Better glucose control and weight loss cut the risk of kidney disease, heart events, and hospital stays. For working-age adults, that can mean fewer sick days and higher productivity.

Rural patients may benefit if provincial health programs extend the coverage. Still, real gains depend on diagnosis rates and follow-up care. China has a large share of undiagnosed diabetes, so screening and education must improve to capture the full benefit.

Key Challenges Ahead

Demand will likely spike. Manufacturing and distribution must scale quickly. Global supply chains already felt pressure from fast demand for GLP-1 medicines. If supply lags, patients may face shortages or rationing. Off-label demand for weight loss is another worry.

Even if reimbursement is for diabetes, some patients and clinicians may seek Mounjaro for obesity. Regulators will need monitoring and clear prescribing rules. Finally, lower negotiated prices could reduce incentives for rapid local investment in production.

Public Perception and Prescribing Trends

Doctors tend to prescribe reimbursed drugs more often. Once Mounjaro is listed, urban tertiary hospitals and major endocrinology clinics will adopt it quickly. Primary care uptake takes longer. Patient awareness grew through media and online health platforms. Partnerships between Eli Lilly and Chinese online pharmacies helped provide early access in 2025.

Still, many patients will wait for doctor guidance and insurer confirmation before starting therapy. Clear guidelines about patient selection and monitoring will shape real-world use.

Analyst Outlook and Market Projections

Market analysts predict strong volume growth in China after NRDL entry. The exact revenue impact depends on the negotiated price and uptake speed. Some notes predicted Mounjaro could take share from both foreign rivals and domestic entrants. Investor commentary already reflected the expectation that insurers’ bargaining will push prices down while lifting units sold.

For portfolio watchers, the NRDL inclusion is a bullish distribution milestone but a mixed signal for near-term margin expansion. An AI research analysis tool flagged the listing as a key sales catalyst for Eli Lilly’s Asia division.

Eli Lilly’s Mounjaro: What to Watch Next?

Watch official reimbursement rules from provincial health authorities and the final negotiated price. Track supply updates from Eli Lilly and any prioritization guidance for clinics. Monitor prescription patterns and any regulatory steps targeting off-label weight-loss use.

Also watch competitors’ price moves and local drug launches, which could reshape choices for physicians and patients. Real change will show up over six to twelve months after January 1, 2026.

Conclusion: A Pragmatic Shift toward Access

Inclusion of Eli Lilly’s Mounjaro on China’s state insurance list is a major access milestone. It pairs strong clinical data with broad public coverage. That can lower barriers for many people with type 2 diabetes. The move also tightens competition and forces pricing adjustments.

Long-term public health gains will depend on supply, clinical guidance, and better disease detection. If those pieces align, China could see more patients get modern, effective diabetes care and fewer avoidable complications over the next few years.

Frequently Asked Questions (FAQs)

Yes. On December 8, 2025, China added Eli Lilly’s Mounjaro to its state insurance list. Starting January 1, 2026, type 2 diabetes patients may use insurance to get Mounjaro.

Reimbursement begins January 1, 2026. Patients with approved state insurance plans can use Mounjaro with lower direct costs once pharmacies start stocking it under the national scheme.

Yes. The insurance listing lowers out-of-pocket costs for many users. Actual price depends on negotiation. Patients may pay much less after January 2026, but the amount varies by region.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.