Magnum Tests Investor Demand With $9.1 Billion Amsterdam IPO

On 8 December 2025, The Magnum Ice Cream Company made its debut on the Euronext Amsterdam stock exchange. The shares opened at €12.81, giving the company a valuation of about $9.1 billion.

Magnum is now the world’s largest standalone ice-cream company. It owns classic ice-cream names like Ben & Jerry’s, Walls, and Cornetto.

This listing is more than a corporate rebrand. It is a bold test: can investors still back indulgent foods at a time when health trends from diet fads to weight-loss drugs are changing how people eat? As Magnum steps out on its own, markets around the world will be watching closely.

The Company Behind the Buzz: Magnum

Magnum is the largest standalone ice-cream business. The company owns marquee brands such as Magnum, Ben & Jerry’s, Walls, and Cornetto. Its products sell in supermarkets, convenience stores, and foodservice outlets worldwide. The business mixes fast-moving consumer goods scale with premium branding. That mix helps drive consistent revenues.

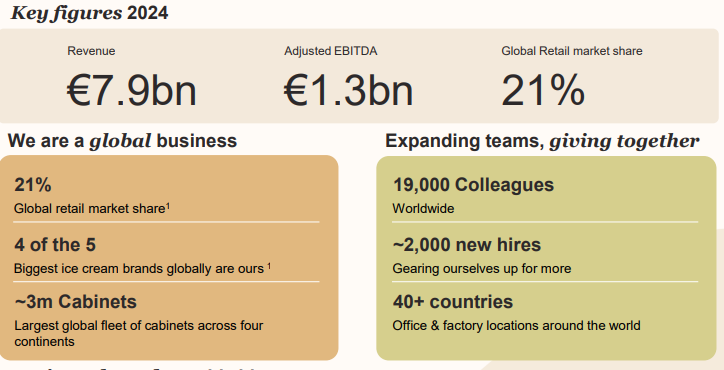

The firm reported substantial revenue in 2024 and projects steady cash generation as a standalone company. The demerger from Unilever lets the company focus on product innovation and supply-chain efficiency.

Magnum runs regional hubs across Europe, North America, and Asia. Production uses both company-owned plants and third-party co-packers. The firm benefits from global cold-chain know-how and large retail listings. That footprint gives it pricing power in many markets. New product formats and local flavours remain central to future growth.

Why Amsterdam? Strategic Forces Behind the Listing Venue Choice

The listing took place primarily on Euronext Amsterdam on 8 December 2025. Amsterdam was chosen as the primary venue after a long planning process tied to Unilever’s decision to spin off the ice-cream unit. The city offered regulatory clarity and a natural home for a European consumer group with deep Dutch roots. Listing on three exchanges, Amsterdam, London, and New York, broadened investor access while making Amsterdam the headline venue.

Post-Brexit shifts in capital flows also made Amsterdam more attractive for some issuers. Euronext has actively courted global consumer names that want deep European liquidity and visibility. For Magnum, Amsterdam delivered both symbolic and practical benefits.

$9.1 Billion Valuation: Magnum IPO Price

The firm’s market capitalisation at debut translated to roughly €7.8-7.84 billion (about $9.1 billion) based on opening prices on 8 December 2025. That market value was anchored to a reference price set ahead of trading and reflected investor feedback from roadshows and the company prospectus.

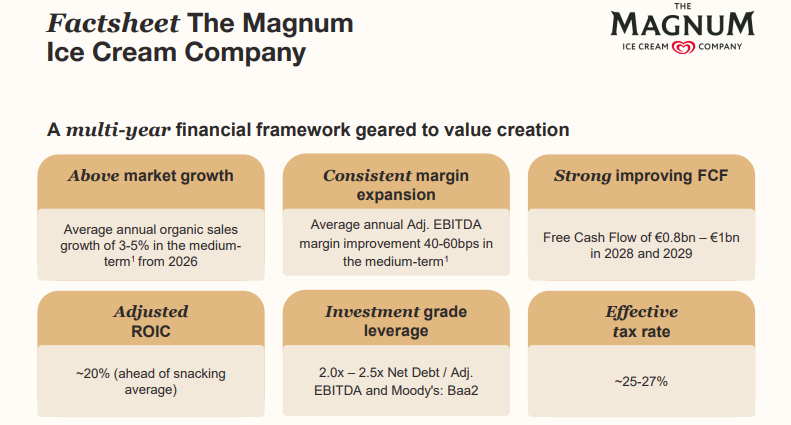

Analysts benchmarked the valuation using revenue multiples, adjusted EBITDA forecasts, and sector comparables such as Froneri. The multiple appeared ambitious versus historical growth. Yet management argued that a focused structure improves margin potential over time.

Prospectus figures showed expected free cash flow targets and debt plans. These projections underpinned investor models. Independent research houses ran sensitivity checks. Some used machine models and even an AI stock research analysis tool to stress test cash-flow outcomes against price scenarios. The range of possible valuations reflected differing views on margin expansion and brand pricing power.

Demand Signals: What Early Investor Interest Reveals?

Initial trading and the book-building phase sent mixed signals. Institutional interest included long-only investors and some large fixed-income players who had already bought Magnum’s debut bonds earlier in the process. The bond sale was heavily subscribed in November, which demonstrated credit market appetite for the newly independent firm. That demand hinted at confidence in the balance sheet even before public trading began.

On the equity side, demand varied by region. European funds showed the strongest early interest, while some U.S. investors remained cautious. Concerns included short-term consumer trends and governance complexity at Ben & Jerry’s. Roadshow feedback suggested investors liked the brand mix but wanted clearer signs that margins would improve without Unilever’s shared services.

Macro conditions also shaped demand. Markets in late 2025 were sensitive to rate signals and consumer spending data. That environment favours proven cash generators over high-growth narratives. Magnum’s arguable strength was its defensive profile paired with a premium brand portfolio, a combination that attracted certain yield-seeking and diversified funds.

IPO Structure: The Mechanics, Share Distribution, and Lock-Ins

The demerger structure delivered a direct admission of Magnum shares to Euronext Amsterdam, with a simultaneous admission in London and New York. The reference price was set at €12.80 per share, and the market opened at €12.20 to €12.81 in reported feeds on 8 December 2025. Unilever retained a near-20% stake initially, with plans for a full exit over several years. The company disclosed lock-in provisions for founders and key shareholders to provide post-listing stability.

The mix of primary and secondary shares focused on delivering free float while enabling Unilever’s orderly separation. Cornerstone investor allocations and institutional lock-ups helped ensure a measured initial float. These mechanics aimed to prevent extreme volatility at debut and to give the new management a runway to execute strategic plans.

Competitive Landscape: Who Magnum Is Up Against

Competitors include global frozen-dessert players such as Froneri and strong private labels. Froneri remains a large listed comparator with different scale and margin dynamics. Retail private labels also compress prices in many markets.

Additionally, local craft players in key geographies compete on novelty and premiumization. Regulatory or ingredient-cost shifts can quicken competitive pressures. Analysts noted that maintaining brand premium will be essential to preserving market share and margin.

What Success Looks Like: Scenario Analysis for Post-IPO Trading

A clear bull case would show strong execution on cost savings and steady margin gains from streamlined operations. That scenario could prompt a positive re-rating in the months after listing. A base case would see the stock trade in line with peers, with gradual improvement as synergies materialise.

The bear case would involve weaker consumer spending or an inability to cut overlapping costs, which could pressure the share price soon after listing. Investors should watch quarterly results, market share trends, and management’s progress on targeted cost initiatives.

Strategic Use of Magnum IPO Proceeds

Proceeds and balance-sheet moves were earmarked for debt reduction, working capital, and targeted investment in premium segments. The company has signalled a desire to invest in higher-margin innovations and to modernise manufacturing.

Debt refinancing via the bond market had already been used to set a cleaner capital structure ahead of the debut. Clear allocation and disciplined capital returns will be crucial to justify a higher future multiple.

Risks Investors Must Watch Before Buying the IPO

Key risks include soft consumer demand, ingredient cost inflation, and governance-related controversies at brand units. Currency exposure also matters, given global sales. Another risk is the market’s reaction if guidance misses expectations soon after listing. The absence of a dividend in the near term could reduce appeal to income-focused buyers. Monitoring these factors is essential before committing capital.

Final Outlook: The Listing’s Broader Meaning

Magnum’s listing on 8 December 2025 marks a notable shift in the consumer landscape. It creates a pure-play ice-cream company with global scale. The move tests whether iconic brands can grow faster as focused entities than within a conglomerate. Short-term trading will depend on execution and macro context.

Long term, success depends on brand strength, margin recovery, and disciplined capital use. The debut also shows that Europe retains the capacity to host large consumer listings when strategy and timing align.

Frequently Asked Questions (FAQs)

Magnum is listed in Amsterdam on 8 December 2025 because the market offers strong trading activity, stable rules, and better support for large consumer brands after Brexit changes.

Magnum stock may appeal to some investors, but the decision depends on price, costs, and future demand. Many investors still wait for steady results after the 2025 listing.

Magnum owns well-known ice-cream brands, including Magnum, Ben & Jerry’s, Walls’, and Cornetto. These brands became part of the new company after the 2025 demerger.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.