Pensana Secures $100 Million Investment to Boost Global Rare Earth Supply Chain

On 9 December 2025, Pensana Plc announced a major milestone: it has secured US$100 million in strategic equity funding to push its rare-earth ambition forward.

Rare earth elements like neodymium and praseodymium (NdPr) are in growing demand. They power electric vehicles, wind turbines, and high-tech electronics. At the same time, global supply chains remain heavily reliant on a few dominant nations leaving many industries vulnerable.

With this fresh investment, Pensana aims to build a reliable, independent source of rare-earth magnets. The funding could shift the balance in the global rare-earth market. For nations and industries seeking alternatives to traditional supply channels, this move may bring new hope of stability, transparency, and long-term supply.

Who is Pensana? A Rising Player in Critical Minerals

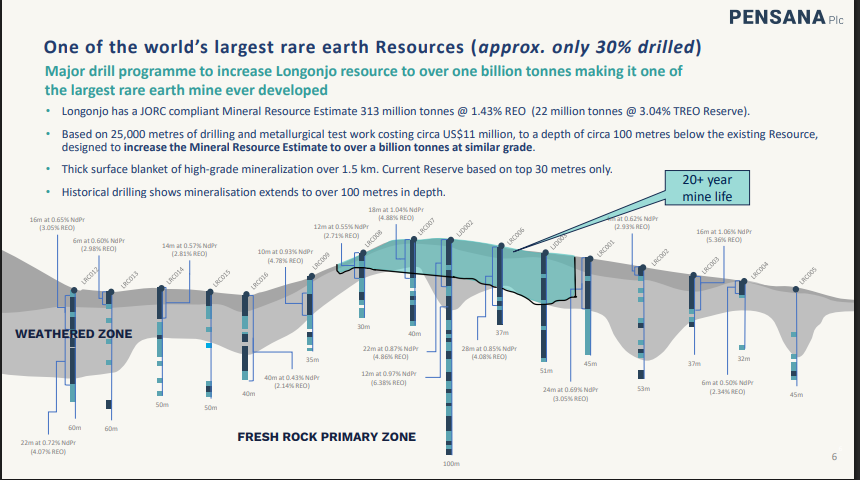

Pensana Plc is a London-listed rare earths company. It develops the Longonjo mine in Angola. It also planned refining at Saltend and other processing hubs. The company focuses on NdPr, neodymium and praseodymium. These two metals are key for high-strength magnets.

Pensana calls its approach “mine-to-magnet.” The aim is to link African ore through refined products to Western and allied manufacturers. This integrated plan sets Pensana apart from junior explorers.

Pensana: Details of the $100 Million Investment

On 9 December 2025, Pensana announced a US$100 million strategic equity subscription. The funding is aimed at advancing the company’s mine-to-magnet strategy. Part of the money will support Longonjo’s final financing and feedstock commitments.

Another part will accelerate construction and permit work tied to downstream processing. The investor subscribed for new ordinary shares, subject to due diligence and shareholder approvals. This injection follows prior tranches and debt packages Pensana has already secured for Longonjo.

Why This Funding Matters for Global Supply Chains

Rare-earth processing remains heavily concentrated in a few countries. That concentration raises supply risk for EV makers, defence firms, and wind-turbine producers. Pensana’s funding helps create an alternative supply route. Longonjo can supply mixed rare-earth carbonate that is then refined into NdPr. Having an allied-market source reduces single-market dependence. The US, UK and other partners are tracking these moves closely. This investment therefore has strategic as well as commercial value.

ESG Leadership: Low-Carbon and Responsible Production

Pensana highlights sustainable practices at Longonjo. The project has plans to use renewable power and to limit chemical waste. It also promises local job creation in Angola. The company stresses traceability from mine to market. That traceability appeals to customers who require audited supply chains. Pensana positions its output as a lower-carbon alternative to long, opaque supply routes. These ESG claims form part of the company’s pitch to investors and offtakers.

Economic and Industrial Impact

The Longonjo development could reshape downstream industry links. If built to plan, Longonjo can feed refineries and magnet makers in allied markets. That feedstock can support new manufacturing jobs and local beneficiation.

Angola could attract more investment in mineral processing. For buyers, a diversified pipeline reduces procurement risk. Financial markets have taken note as Pensana secures sequential funding packages. Institutional lenders and export credit agencies have also engaged with the project.

Competitive Positioning and Market Outlook

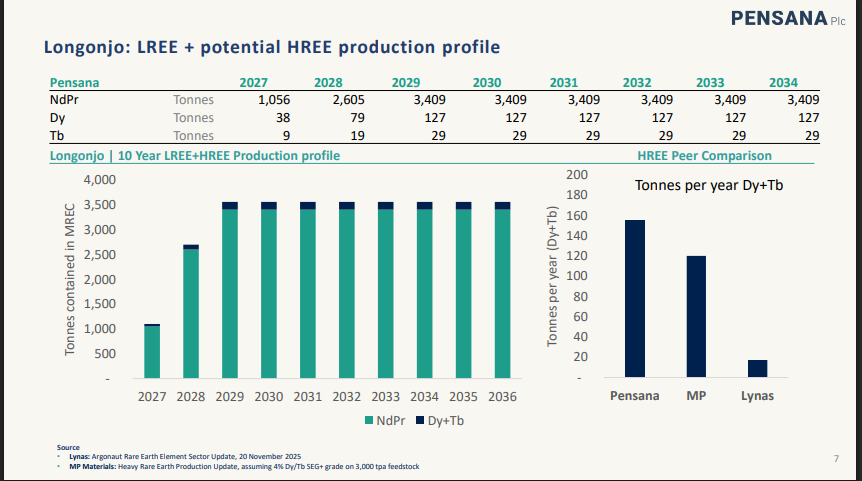

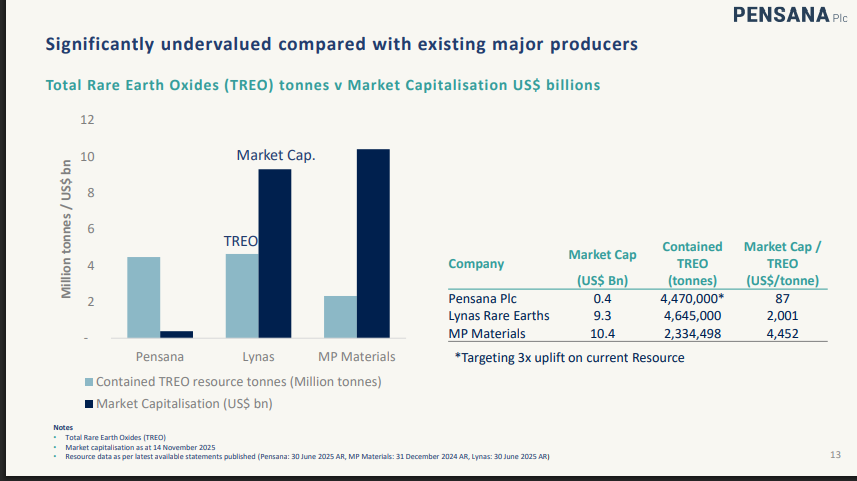

Pensana sits alongside other non-Chinese rare-earth players such as Lynas and MP Materials. Pensana’s claim to advantage is full integration from resource to refined product. Market demand for NdPr is set to rise as electrification and clean energy accelerate.

Forecasts point to tight supply for magnet metals by the end of the decade. That dynamic creates upward pressure on pricing and a premium for secure, traceable sources. Investors often use specialized research, including an AI research analysis tool, to gauge such long-term supply dynamics.

Challenges and Risk Factors for Pensana

Execution risk remains high for large mining and refining projects. Capital costs can climb. Timelines may slip. Commodity prices can swing sharply. Political and permitting risks exist in all jurisdictions. Pensana must also align its processing plans with partner nations and funders. Competition from low-cost producers can compress margins.

Finally, some announced projects in the sector have been delayed or reshaped by changing policy or finance conditions. These uncertainties will influence how quickly Longonjo and any downstream plants reach steady output.

Conclusion: A Strategic Milestone for the Future

The US$100 million equity subscription of 9 December 2025 is a clear vote of confidence in Pensana’s model. The funding helps bridge remaining finance gaps and supports next construction phases. If Pensana meets its milestones, Longonjo could become a major non-China source of NdPr. That outcome would ease supply risks for critical industries.

Yet delivery is not assured. The market will watch permits, construction progress, offtake agreements and any further debt packages. Pensana’s next updates will be decisive for investors and industrial buyers alike.

Frequently Asked Questions (FAQs)

Pensana announced a $100 million investment on 9 December 2025. The money will support its rare earth projects. It will help build facilities and move closer to commercial production.

Pensana plans to produce important metals like NdPr. These metals are used in EV motors and wind turbines. The company aims to give new supply options for global industries.

Pensana targets production after its projects are fully financed and built. The timeline depends on final approvals and construction progress. The company plans to begin supply in the coming years.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.