Aequs IPO News: Strong Listing Pushes Stock Up 13% on NSE & BSE

On December 10, 2025, shares of Aequs made a strong debut on the stock market. The stock opened at ₹140 on both the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE). That’s about a 13% jump above the IPO issue price of ₹124.

For many investors and market watchers, this was more than just a listing, it was a signal. It showed that there is real excitement around an Indian company working in aerospace and precision manufacturing. Aequs isn’t just another firm. It aims to build parts for aircraft and other complex systems. Its listing success suggests the stock market is warming up to firms linked to advanced manufacturing and global supply chains.

This debut could mark a turning point. For investors who backed the IPO, and for those watching India’s industrial future, Aequs’ strong opening is a moment worth paying attention to.

Company Overview: What Makes Aequs Different?

Aequs operates large precision factories in Belagavi. The company focuses on aerospace and high-value manufacturing. It builds complex aircraft parts and assemblies for global OEMs. Long ties with Airbus and other tier-1 suppliers make the business rare in India. The firm runs an integrated special economic zone. That gives scale and faster supply chain control.

Aequs also invests in specialized tooling and quality systems. These are needed for aerospace certifications. Such capabilities raise the barrier to entry for competitors. Expansion plans target higher value components, not just simple assemblies. This strategic move could lift margins if demand holds.

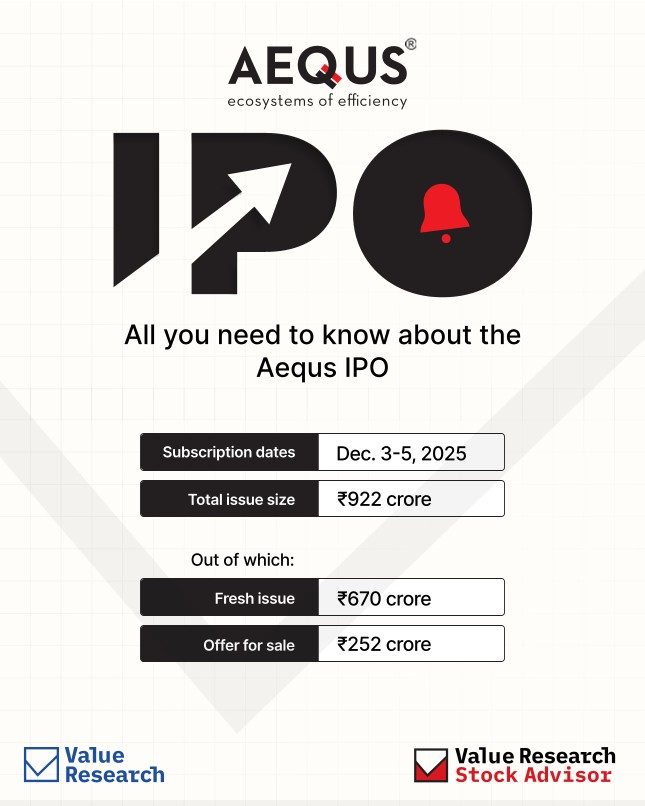

Aequs IPO Structure Breakdown: Beyond Just the Numbers

The IPO had two parts. A fresh issue raised around ₹670 crore. An offer-for-sale (OFS) added about ₹252 crore. The price band was ₹118-₹124. The lot size was 120 shares. Book running was handled by JM Financial, IIFL Capital and Kotak Mahindra Capital. Proceeds were aimed at capacity addition and debt reduction.

The mix of fresh capital plus OFS meant promoters partially monetized holdings while funding growth. That structure gave both liquidity and firepower for capex. Exact issue size and dates were published in the prospectus and market notes.

Listing Day Performance: How the 13% Jump Unfolded

Aequs listed on December 10, 2025. Aequs Shares opened at ₹140 on both NSE and BSE. This was roughly a 12.9% rise versus the ₹124 issue price. Trading volumes spiked on debut. Retail and institutional orders were visible in early trades. The listing missed some grey-market expectations but still delivered a solid premium. Market comment pointed to strong investor appetite for advanced manufacturing names. The listing set a market value in the small-cap to mid-cap band for Aequs.

Why Investors Rushed In: Real Drivers Behind the Strong Debut

Investor interest came from multiple trends. First, global OEMs are diversifying suppliers away from concentrated hubs. This shift favors Indian contract manufacturers. Second, India’s policy push for local aerospace sourcing added a demand tailwind. Third, the IPO showed clear order visibility and long-term contracts. Fourth, supply chain resilience is now a premium for institutional buyers.

Finally, the IPO drew heavy subscriptions across QIB, NII and retail categories. These elements combined to push early buying. The registrar reported overall subscription of over 100 times by the close on December 5, 2025.

Risks the Market is Ignoring: A Contrarian Angle

The company faces real risks. Aerospace is cyclical. Demand can fall when airlines cut orders. Large client dependence creates concentration risk. Aequs still requires steady capex to scale. High capital intensity can compress returns if growth slows. Margins are sensitive to certification costs and precision labour.

Currency swings and raw material inflation also matter. Finally, a strong listing does not erase operational risks on the ground. Investors must compare the listing pop against these medium-term vulnerabilities.

Aequs IPO Post-Listing Outlook: What Analysts Expect Next

Analysts expect to focus on two fronts now. One is execution of the planned capacity build-out at Belagavi. The other is moving up the value chain into higher-margin components. If Aequs converts pipeline orders to revenue, earnings can rebound. Inclusion in small-cap indices may follow if market cap and liquidity criteria are met. Short term, stock moves will track contract wins and quarter-on-quarter margins.

Long term, the play depends on sustained global sourcing to India and the company’s ability to meet stricter OEM demands. Broker notes suggest watching cash flow and order book updates closely. AI stock research analysis tool is relevant for investors seeking faster alerts on such triggers.

Should You Buy After the 13% Jump? A Balanced View

For long-term investors, the case rests on structural change in aerospace sourcing. If India wins more OEM work, Aequs could gain market share. For short-term traders, the maiden rally may be volatile. Key metrics to monitor include net order wins, conversion timelines, and margin recovery.

Also watch promoter pledge levels, cash burn, and quarterly revenue growth. Investors should avoid buying solely on listing momentum. Instead, compare post-listing valuation to future earnings potential. The company’s path depends more on execution than on sentiment.

Wrap Up

Aequs’ debut on December 10, 2025 marks a notable moment for Indian precision manufacturing. The 13% listing gain reflects appetite for aerospace plays. Fundamentals and policy tailwinds add support. Yet risks remain from cyclicality and heavy capex. The next chapters will unfold through order wins and cash-flow proof points. Investors should track concrete operational updates rather than headlines.

Frequently Asked Questions (FAQs)

Aequs listed on December 10, 2025 at ₹140 on both NSE and BSE. This was about 13% higher than the IPO issue price of ₹124.

Aequs may interest long-term investors, but the stock can move up and down after a strong debut. It is better to watch earnings, orders, and costs before deciding.

Aequs makes precision parts for aircraft and engines. These parts need strict quality checks. This work is important because global aerospace companies depend on reliable suppliers for safe aircraft production.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.