Ethereum Institutional Adoption and Network Upgrades Could Drive Price to $12,000 by 2026

As of December 2025, Ethereum is entering one of its most important phases since the 2021 bull run. The network is seeing steady growth in real use cases, and more investors are watching its progress with fresh interest. Big markets are shifting again, and this shift is helping Ethereum regain strong attention. Many analysts now believe that the next two years could reshape how the world views this asset.

The idea of Ethereum reaching $12,000 by 2026 no longer sounds wild. It is linked to actual changes in how the network works and how large investors are starting to use it. These changes are slow, but they are clear. You can see the impact in rising on-chain activity, growing demand for staking, and more companies testing blockchain systems.

This moment feels different. The market is moving with caution, but the long-term picture is getting brighter. Ethereum is building the kind of stability and utility that many thought would take much longer to achieve.

Ethereum Institutional Flows: Where the Real Demand Is Coming From

Large funds added meaningful Ethereum exposure through late 2024 and across 2025. Asset managers expanded offerings that combine price exposure with staking yield. This pushed more institutional money into custody solutions and fund wrappers. Institutional entries now include family offices, hedge funds, and growing ETF allocations. The trend is visible in filings and product launches from major managers, showing rising assets under management in ETH vehicles.

Asia shows strong demand for staking services. Singapore and Hong Kong custody desks now offer staking to qualified clients. These desks help lock ETH into protocols and reduce liquid supply. That locked supply tightens the market during periods of rising demand.

On-chain indicators confirm this shift. Long-term holder accumulation rose through 2025. Large wallets have increased balances during market dips. This behavior reduces short-term selling pressure and supports a structural bull case.

Network Upgrades That Actually Change Valuation

Ethereum’s Fusaka upgrade activated on December 3, 2025. Fusaka raises data capacity in each block. It reduces costs for rollups and speeds finality. The upgrade makes Ethereum a more attractive settlement layer for enterprises. Faster and cheaper settlement lowers operational friction for high-volume use cases.

Proto-danksharding and EIP-4844 earlier introduced “blobs.” These changes cut L2 data costs. Lower L2 costs translate into more dApp activity and more fee burn. That creates a feedback loop where higher usage reduces supply growth.

Additional tweaks improve developer ergonomics. New opcodes and transient storage reduce gas per transaction. Lower gas keeps users on-chain and helps decentralized finance projects scale without huge fee spikes. This matters for institutional adoption.

Staking Dynamics: The Real Supply Shock No One Is Pricing In

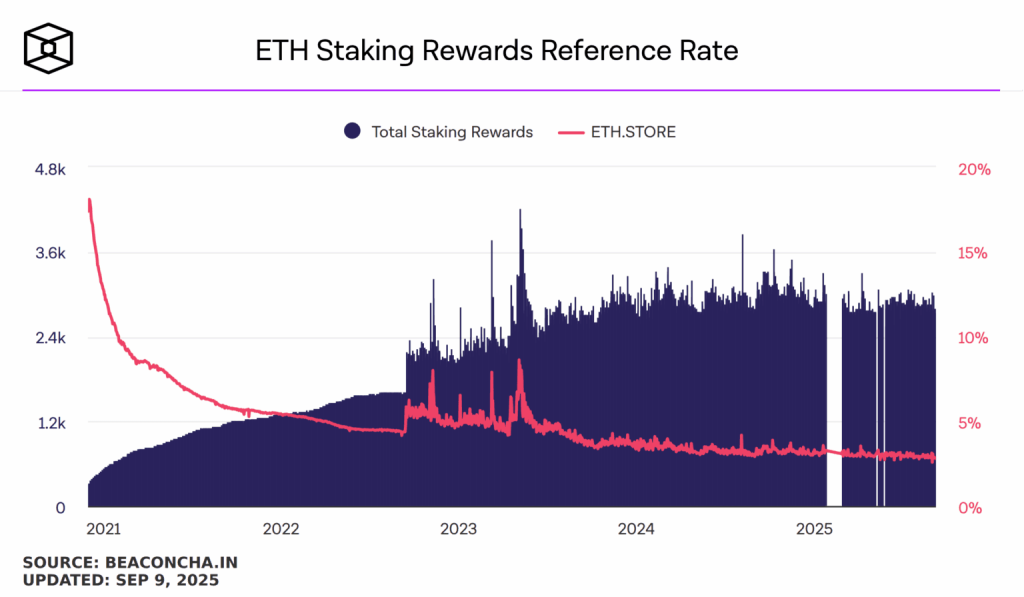

A large share of ETH sits in validators. By early December 2025, about 29-30% of circulating ETH was staked. That amount removes tokens from the active sellable supply. Staked ETH can stay illiquid for long stretches. This reduces float during demand surges.

Staking yields turned ETH into an income asset. Institutions view staked ETH like a digital bond that pays yield. That narrative attracts pension pilots and treasury allocations that seek steady income and diversification. New fund products also mix spot exposure and staking yields.

Liquid staking tokens (LSTs) add flexibility. LSTs let holders keep exposure while staking ETH. But LST concentration can create counterparty risk if one provider grows too dominant. Market participants watch major providers closely.

Rising Corporate & Government Use Cases Invisible to Retail

Large banks and corporate treasuries are testing tokenized assets on Ethereum. Tokenized treasuries and FX pilots use private or permissioned rollups that settle to Ethereum. These pilots reduce settlement time and lower costs compared with legacy rails. That increases real-world demand for blockspace and for ETH as the settlement currency.

Real-world assets (RWA) markets expanded in 2025. Tokenized bonds and short-term credit instruments started appearing on L2 rails. These products need ETH for gas and occasionally for collateral. As RWA growth continues, demand for ETH settlement rises.

Governments and public bodies are also running pilots on Ethereum. These include carbon markets and supply-chain audits. Such pilots favor chains with broad developer ecosystems and strong decentralization. Ethereum fits that profile.

Price Forecast Models That Support the $12,000 Scenario

Combine three variables, and the math becomes clearer. First, locked supply from staking reduces available ETH. Second, institutional inflows into ETFs and custody products raise demand. Third, Fusaka and other upgrades shrink per-transaction costs. Together, they create a supply-demand imbalance that can lift prices structurally.

Analysts use models that factor in fee burn, staking yields, and on-chain revenue like MEV. When base fee burn and MEV revenues are high, valuation models assign a larger present value to ETH. That raises fair-value estimates under bullish adoption scenarios. Conservative, base, and bullish bands show wide ranges. The $12,000 figure sits in the bullish band that assumes continued ETF flows and RWA growth.

Some investors supplement the work with an AI stock research analysis tool to run multiple scenarios quickly. That helps map probability bands and stress test assumptions under different market conditions.

Key Risks: What Could Delay or Break the $12,000 Thesis

Regulation remains the top systemic risk. Changes in U.S. or EU rules could limit staking products or restrict fund distribution. Such actions would reduce institutional demand and lower the bullish case.

Concentration risk is another major concern. If a few staking providers control a large share of validators, a slashing event or technical failure could spook markets. Centralization also raises regulatory scrutiny.

Competition from other chains and modular designs could siphon activity. Non-Ethereum L2s or rival L1s that lock up institutional deals may slow Ethereum’s adoption curve. The network must maintain interoperability, cost advantages, and developer momentum.

Conclusion: A Plausible But Not Assured Path to $12,000

Ethereum’s case for major appreciation rests on three facts. Upgrades like Fusaka (activated December 3, 2025) improved throughput and cut costs. Large sums flowed into ETH vehicles and staking products in 2024-2025.

A meaningful share of supply now sits locked in validators. If those trends continue, price models show a clear route to higher valuation. However, regulatory moves and concentration risks can derail that path. Investors should watch adoption metrics, staking rates, and regulatory headlines closely.

Frequently Asked Questions (FAQs)

It is possible. If more institutions buy ETH, staking stays high, and network upgrades work well, the price could rise. Much depends on demand and market events.

The upgrades may make Ethereum faster and cheaper to use. Lower fees and better speed can attract more users. That might boost ETH demand and support higher prices.

Yes. Big investors and funds adding ETH bring serious capital. Their long-term view and staking interest can reduce the liquidity supply and add support to the ETH value.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.