Mortgage Refinance Rates Today, Dec 10, 2025: Why Rates Jumped Ahead of the Fed

Mortgage refinance rates made a surprising jump on December 10, 2025, catching many homeowners off guard. The move came just two days before the Federal Reserve’s final policy meeting of the year, and the timing raised fresh questions about where borrowing costs are headed next. Markets reacted fast. Investors pulled back from mortgage-backed securities.

This shift didn’t happen in a vacuum. Traders were responding to new signals about inflation, year-end liquidity, and the Fed’s tone heading into its December 10 meeting. These factors pushed lenders to tighten margins and pass the pressure onto borrowers. For homeowners, the message is simple but important: rate moves like today show how quickly the market can change even before the Fed speaks.

Today’s jump sets the stage for a tense week. And for anyone thinking about refinancing, timing just became more important than ever.

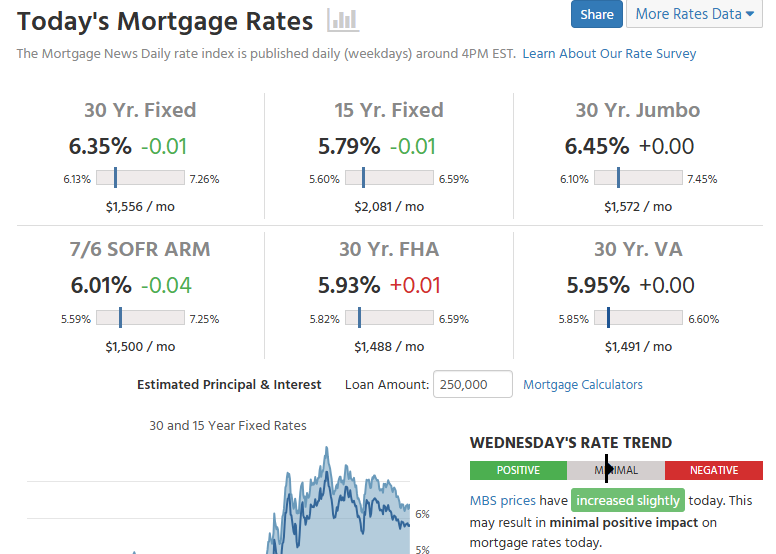

Today’s Mortgage Refinance Rates: Quick Market Snapshot

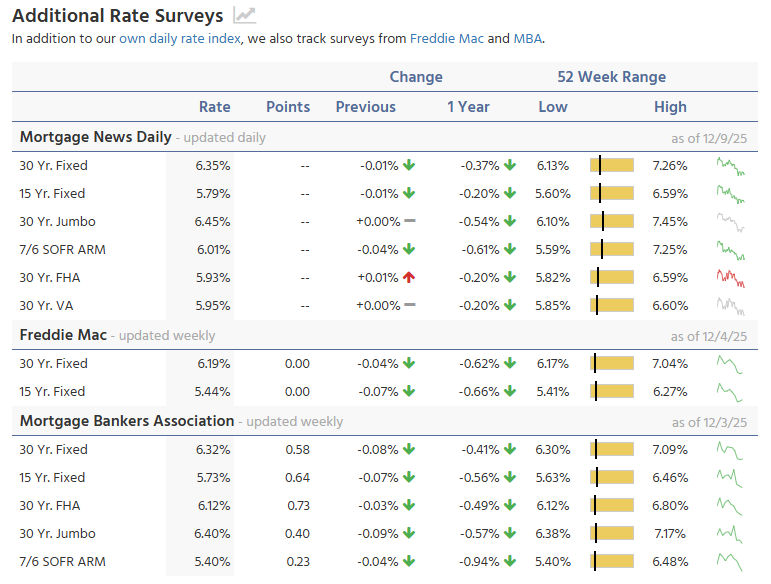

On December 10, 2025, average refinance rates rose across the board. The 30-year fixed refinance rate climbed into the mid-6% range. The 15-year fixed ticked up, though it stayed well below the 30-year level. Jumbo refis saw the sharpest widening as lenders reprice risk. Government-backed FHA and VA refis rose modestly as lender spreads widened. These moves match the day’s trading in mortgage-backed securities and Treasury yields.

Why Rates Jumped Today: The Real Drivers

Markets moved before the Federal Reserve spoke. Traders adjusted bets about the Fed’s path for 2026. That shifted the tone in fixed-income markets. The U.S. 10-year Treasury yield rose on December 10, putting upward pressure on mortgage pricing. When Treasuries sell off, mortgage lenders often raise refinance rates fast to protect margins.

Liquidity in the mortgage-backed securities (MBS) market also tightened. Dealers trimmed their bids as firms balanced year-end books. That left fewer buyers for MBS paper. With thinner demand, MBS yields moved higher. Lenders translated that move into higher refinance offers. Industry data show MBS trading volumes and spreads changed notably in early December.

Finally, loan pipelines swelled briefly. Many homeowners tried to lock in rates ahead of the Fed decision. Lenders faced more volume and less certainty. Some raised prices to slow demand. This operational squeeze helped the day’s rate jump. Reuters and Business Insider noted similar market positioning ahead of the December meeting.

What does this mean for Homeowners Considering a Refinance?

Higher daily rates make short windows important. If the goal is a lower monthly payment, today’s move can change the break-even math. For borrowers who closed or refinanced in 2023 or 2024, chasing a tiny additional drop may not pay off. For those with loans above 5.5% or variable-rate debt, refinancing might still help.

Cash-out refis cost more now. Lenders price cash-out options with wider spreads in volatile periods. Jumbo borrowers face the steepest extra cost because lenders price large loans to reflect both credit risk and market illiquidity.

For near-term closings, locking is a simpler choice. For plans months out, floating carries risk but might pay off if the Fed’s move calms markets. Some borrowers use rate re-lock clauses. Modeling scenarios with an AI stock research analysis tool or similar analytics can show when floating is reasonable versus when locking beats the gamble.

Should Borrowers Lock or Float Before the Dec 12 Fed Announcement?

The Fed’s two-day meeting began on December 9, 2025, with the policy decision due mid-week. Markets were pricing a high chance of a 25 basis-point cut. That outlook created mixed signals. If the Fed signals a clear easing path, Treasury and MBS yields could fall quickly. That would ease refinance rates. But if the Fed expressed concern about inflation persistence or signaled a slower easing schedule, yields could stay elevated or climb.

Practical rules: borrowers closing within seven days should lock. Volatility can hit at any hour. Those with 30+ days and flexible closings can consider a short float. Ask about re-lock options and fee caps. Lenders that offer a short lock with a rate review close to closing give the best middle ground.

Refinance Moves That Actually Matter Right Now

Focus on the loan structure, not just the headline rate. A 15-year fixed still offers faster principal paydown and lower rate volatility. Consider hybrid approaches: keep a core low fixed rate and add a HELOC for flexible cash access. Point buys make sense only if spreads narrow, and the borrower expects long tenure in the home.

No-cost refis can hide costs in higher rates or rolled fees. Compare true lifetime costs. Aggregated MBS supply and dealer balance-sheet moves are likely to matter more than the Fed’s short-term rhetoric. Sources tracking MBS holdings and dealer positions show that supply and dealer risk appetite drive intraday moves at year-end.

Bottom Line

On December 10, 2025, mortgage refinance rates rose because markets moved ahead of the Fed. Higher Treasury yields and thinner MBS liquidity pushed lenders to reprice loans. That created a narrower window for low-cost refis and made lock strategies more important.

For most borrowers, the best step is to compare accurate day-of quotes, confirm re-lock rules, and evaluate loan structure rather than chase tiny rate changes. For immediate decisions, treat a near-closing window as one where certainty trumps speculation.

Frequently Asked Questions (FAQs)

Refi rates rose on December 10, 2025, because Treasury yields moved higher and lenders priced in risk before the Fed meeting. Market trading pushed rates up fast.

Rates may ease after the December 12, 202,5, Fed meeting if the Fed signals slower inflation. But rates could stay high if the Fed sounds cautious about cuts.

Locking makes sense if you close soon because markets are volatile this week. Waiting may help only if the Fed delivers a clear, rate-friendly message on December 10.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.