SoftBank Shares Drop as Oracle Earnings as AI Doubts

On December 11, 2025, shares of SoftBank Group slid sharply after a disappointing report from Oracle triggered fresh doubts about the runaway growth of artificial-intelligence investments. The drop wasn’t just a blip. It tapped into growing unease that the AI boom, once hailed as the next tech gold rush, may be losing steam.

SoftBank, known for its aggressive bets on AI and related infrastructure, suddenly looked vulnerable. Market watchers began to ask: What happens if AI-juiced profits slow down? This fear sparked a wave of selling across AI-linked stocks.

The sell-off didn’t just hurt SoftBank. It shook confidence across the broader tech sector. And it served as a stark reminder: when the AI hype fades, even giants can wobble.

The Market Reaction: Why Investors Punished SoftBank?

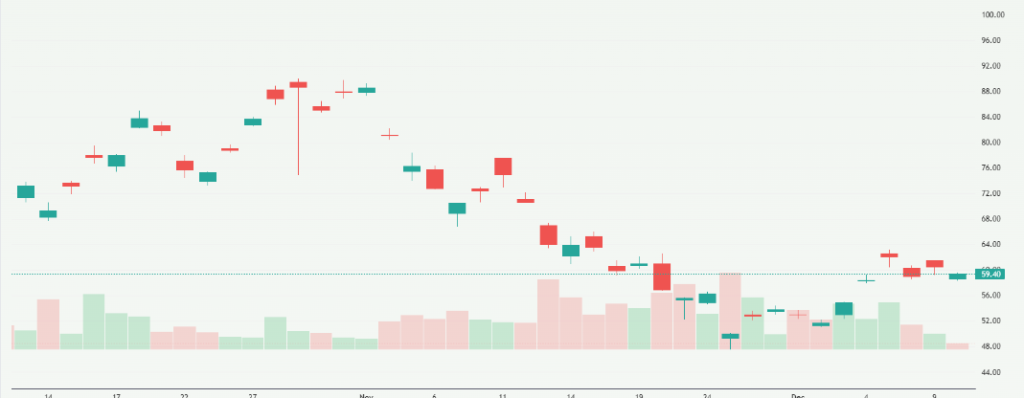

On December 11, 2025, shares of SoftBank Group dropped sharply. The price fell about 7.7% in Tokyo trading, making SoftBank the worst performer on the Nikkei 225 that day.

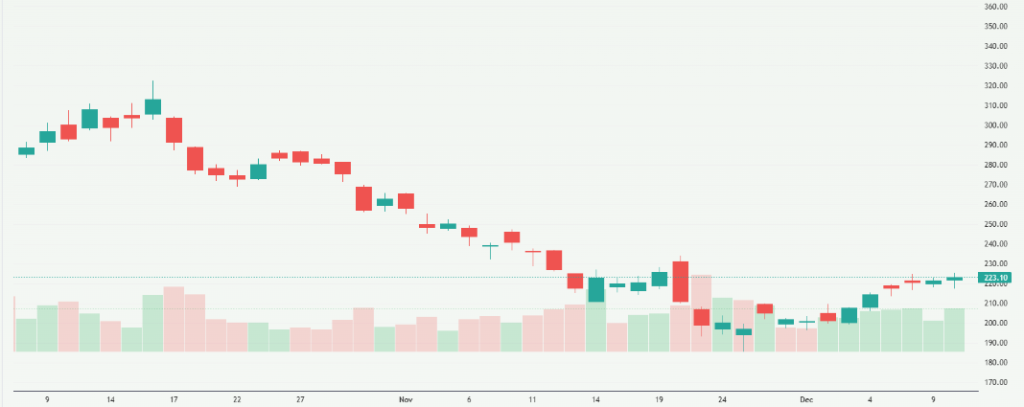

The plunge followed a steep drop in Oracle Corporation’s stock. Oracle’s disappointing earnings and cautious outlook triggered doubts among investors about the sustainability of lavish AI‑related spending.

Because SoftBank has heavily invested in AI‑linked companies, including those that supply AI infrastructure, the negative sentiment spread quickly. The drop in Oracle shares raised fears that demand for AI services and hardware could slow down. SoftBank’s stock became a target as market participants reassessed risk across the broader AI‑driven tech sector.

Trading volume surged as many investors scrambled to exit high‑growth bets. The mood changed from excitement over AI to cautious skepticism, especially around lofty valuations.

Oracle’s Earnings: The Real Trigger Behind the Fear

Oracle’s latest quarter ended November 30, 2025, delivered mixed results. Total revenue rose to roughly US$16.06 billion, up 14% year‑on‑year, yet narrowly missed analyst expectations.

Cloud infrastructure revenue, including AI‑related services via Oracle Cloud Infrastructure (OCI), increased by 68%. That seemed promising on paper.

But underneath those numbers lay growing concerns. Oracle raised its capital expenditure forecast for fiscal 2026 from US$35 billion to US$50 billion. That sudden jump to build data centers for AI firms alarmed investors. They questioned whether future returns would justify such heavy spending.

Even though Oracle’s backlog of future contracted commitments or orders rose to a record US$523 billion, many analysts warned that booking revenue today does not guarantee actual cash flow soon.

In short, the market saw a big bet on AI infrastructure and got nervous about timing, margins, and returns.

Why SoftBank Is Especially Sensitive to AI Sentiment?

SoftBank stands out among traditional Japanese conglomerates because of its aggressive push into AI. Its core investment arm, SoftBank Vision Fund, has poured large sums into AI startups, infrastructure, and related tech firms.

SoftBank also owns a controlling stake in Arm Holdings, the UK‑based chip designer whose technology powers many modern processors, including those meant for AI applications.

Because of that deep exposure, SoftBank’s fortunes rise and fall with the AI trade. When confidence in AI infrastructure and services is high, SoftBank may benefit. When doubts emerge, like after Oracle’s results, SoftBank often faces the first wave of selling.

The company’s financial structure adds to the risk. SoftBank often relies on mark‑to‑market valuations: when the share prices of its portfolio companies fall, its reported net asset value (NAV) may shrink. That amplifies volatility.

Arm’s Shadow Over the Sell-Off: Valuation vs Reality

Arm’s prominence makes SoftBank particularly vulnerable. The value of Arm shares and thus SoftBank’s stake depends heavily on continued demand for AI chips. If AI growth slows, Arm’s valuation may come under pressure.

After Oracle’s earnings and rising caution, investors re-evaluated the entire chain: from cloud providers to chip designers. Arm’s Nasdaq‑listed shares dropped sharply in tandem with SoftBank’s slide.

More broadly, the sell-off spread across related sectors. Semiconductor makers, equipment suppliers, and AI‑linked firms all saw stock declines. That shows how deeply interconnected these businesses are and how a wobble in one link can ripple across the chain.

Because SoftBank holds major investments beyond just Arm, including chip‑maker acquisitions and cloud‑AI infrastructure, any chill in AI demand could hurt its long‑term value.

The AI Slowdown Debate: Real Concern or Overreaction?

After Oracle’s report, markets split into two camps.

Bearish view: Some believe the AI boom may be cooling faster than expected. They argue that aggressive infrastructure spending needs time, and many of these investments may not pay off soon. With mounting debt and capital expenditures, companies like Oracle may struggle to generate strong profits. If cash flow lags, investors could remain wary. The sell-off across AI‑linked names suggests risk of a broader correction.

Optimistic view: Others think this is just a short‑term shake‑out. They point out that many AI contracts and data‑center builds take time to mature. The large backlog at Oracle (US$523 billion) might still translate into long-term revenue. They argue that today’s dip could be a buying opportunity for investors who believe in AI’s long game.

In this context, SoftBank becomes a proxy for global AI optimism and also global AI risk. If AI demand revives, SoftBank could bounce back. If not, its heavy bets may continue to weigh.

What Analysts are Saying About SoftBank’s Next Moves?

Some analysts believe SoftBank may need to diversify. Relying so heavily on AI infrastructure and chips introduces too much concentration risk, especially in a volatile sector. Diversifying into other tech or non‑tech sectors could stabilize returns.

Others expect SoftBank to double down. Given recent acquisitions (e.g., chip‑maker purchases) and its major stake in Arm, SoftBank may aim to control more of the AI supply chain from chip design to infrastructure to services. That could yield high rewards if AI demand surges again.

Many are watching closely for SoftBank’s next earnings call and any strategic updates. Upcoming results could indicate whether the firm plans to pivot or stay committed to the AI bet.

How This Drop Fits Into SoftBank’s 2025 Investment Narrative

2025 began with optimism for SoftBank. The firm had repositioned itself as a central player in the global AI boom. Investments in chip companies, cloud infrastructure, and startups made headlines.

For a while, this optimism paid off: SoftBank saw gains, and many of its holdings rose in value. Some observers even suggested the firm was rebounding after tough years. But the recent drop shows just how fragile that revival is. AI hype created momentum, but it also inflated expectations. When one big company stumbles, the ripple effects can be swift.

In essence, this sell‑off is a reminder: high rewards come with high risk, especially when many pieces of your portfolio hinge on the same theme.

What Investors Should Watch Next

There are several key signals to monitor in the coming weeks:

- Chip licensing data from Arm. If demand holds strong, that could stabilize confidence. But weak licensing numbers would signal trouble for AI chip demand and for SoftBank.

- Updates from major AI infrastructure players. Results from cloud providers or chip‑makers (for example, those allied with AI workloads) will show whether AI growth is continuing or slowing.

- SoftBank’s own disclosures. Watch for any commentary on debt levels, upcoming capital commitments, or portfolio restructuring.

- Macro factors: interest rates, global economic slowdown, and regulatory scrutiny can all affect tech valuations and, by extension, SoftBank’s investments.

- Adoption rates of AI tools by enterprises. Real revenue from AI services, not just hype or bookings, will determine whether the industry sustains long-term growth.

How these signals evolve could shape whether SoftBank navigates through turbulence or faces deeper pressure.

Conclusion: Oracle Exposed the Real Risk for SoftBank

Oracle’s mixed earnings and heavy AI infrastructure spending didn’t just shake its own stock. They exposed a fragile underbelly across the entire AI investment ecosystem.

Because SoftBank has placed big bets on that same ecosystem through Arm, chip‑makers, infrastructure, and AI ventures, it was among the first to suffer. The recent drop is more than a routine market correction. It is a wake‑up call. When AI hype fades, even giants can wobble.

For investors, the path forward matters. SoftBank’s next moves, whether to double down or diversify, could decide if this fall marks a temporary setback or the start of deeper challenges.

Frequently Asked Questions (FAQs)

On December 11, 2025, shares of SoftBank Group dropped sharply. The fall came after Oracle Corporation reported weak results and warned about heavy AI‑infrastructure spending. This spooked investors and hit AI‑linked stocks hard.

SoftBank holds big investments in AI from chip makers to cloud and robotics firms. If AI demand slows, many of its holdings may lose value fast. That makes SoftBank especially vulnerable when markets get shaky.

Yes. Oracle’s warning raised doubts about how fast AI spending will grow. That shook many AI‑related companies worldwide. Investors pulled back, hurting tech and AI stocks broadly.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.