Samsung Hub Vietnam Sees Sharp Drop in US Phone Imports Since 2020

In November 2025, the United States saw a sharp drop in phone imports from Vietnam’s Samsung hub. U.S. imports of telephones and parts fell to their lowest level since May 2020, with shipments under $410 million.

Vietnam has been one of Samsung’s largest manufacturing bases for phones. For years, many Galaxy models have been built there. But recent data show a steady decline in exports to the U.S. this year.

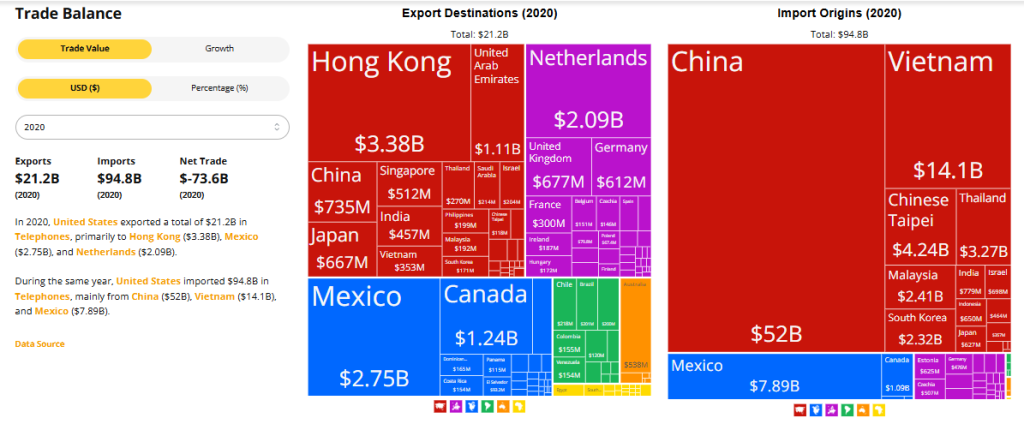

This change matters for trade and for workers in Vietnam. It also shows how global supply chains are shifting. Demand in the U.S. is weakening. Trade rules and tariffs have added new pressure on exporters.

Let’s explore why these imports have dropped and what it could mean for Samsung, Vietnam, and the global smartphone market.

Background: Why Vietnam Became Samsung’s Mega Hub?

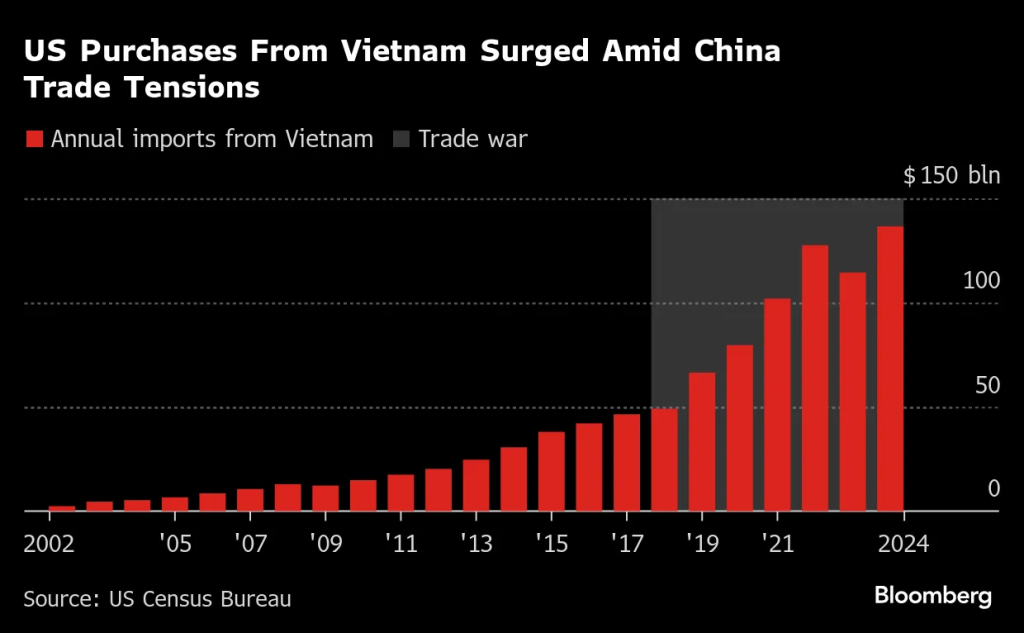

Vietnam turned into a global phone factory over the last decade. Samsung built large plants in Bac Ninh and Thai Nguyen. The country offered low labor costs, steady power, and a network of suppliers. Trade deals and easy shipping routes made Vietnam attractive to electronics firms.

For Samsung, Vietnam cut production time and kept costs down. The plants produced a wide range of Galaxy models, from budget phones to premium devices. This set Vietnam up as one of the world’s most important smartphone hubs.

Data Trend: How Much U.S. Imports Have Dropped Since 2020?

U.S. imports of telephones and parts from Vietnam fell sharply in late 2025. In November 2025, those imports dropped to under $410 million. That marked the lowest monthly level since May 2020. The fall was not a one-off. It was the fourth straight monthly decline.

Across 2025, exports had been high early in the year. Yet shipments to the U.S. slid after mid-year policy and demand changes. These moves hit exporters such as Samsung especially hard because it dominates Vietnam’s phone shipments.

The Real Reasons Behind the Decline

There is no single cause. Several factors combined and pushed volumes down.

First, production has moved partly to India. Samsung and other brands have expanded plants in India. These factories now supply more U.S. demand. India gained faster capacity during 2024-2025. That reduced pressure on Vietnam’s exports to the U.S. market.

Second, U.S. consumer demand cooled after the pandemic peaked. People hold phones longer. The upgrade cycle stretched. The used and refurbished market also grew. This change lowered new phone volumes shipped to the U.S.

Third, tariffs and trade moves changed trade math. Washington imposed higher duties on many Vietnamese goods in 2025. Those unexpected costs made U.S. shipments less competitive. Companies shifted routes or production to avoid tariffs. This dynamic directly affected phones moving from Vietnam to the U.S.

Fourth, logistics and risk rules forced diversification. The pandemic and geopolitical tensions taught firms to split supply lines. Some U.S.-bound stock now comes from Mexico or India to shorten transit and avoid disruption. Vietnam still supplies other regions, but its share of U.S. shipments fell.

Fifth, rising costs in Vietnam chipped away at the labor edge. Wages in the manufacturing sector rose. This made low-margin, entry-level models less profitable to build in Vietnam. Firms started to rethink which plants should make which models.

Impact on Vietnam’s Electronics Export Profile

The drop in U.S. phone shipments does not mean Vietnam is losing its tech edge. Electronics remain a key export. In 2024 and early 2025, electronics formed a large slice of total exports. Samsung still accounts for a large share of that category. But the balance of destinations is changing.

Shipments to South Korea, the EU, and the Middle East grew faster in parts of 2025. Local suppliers that feed the phone assembly feel the strain. PCB makers, camera module firms, and battery producers face tougher order books for U.S.-destined models. Policymakers now worry about the speed of these shifts and their effect on jobs and investment.

How Samsung Is Repositioning Its Vietnam Strategy

Samsung is not abandoning Vietnam. It is adapting. The group is shifting toward higher-value tasks inside the country. Some new work includes advanced component assembly and R&D testing. Hanoi and other hubs are getting more engineering and quality labs. The aim is to add value where Vietnam gives a competitive edge.

Samsung is also exploring moving some final assembly to other countries for U.S.-bound models. Reports in 2025 show active talks about boosting India’s capacity and using multiple supply points to avoid trade friction. At the same time, Vietnam may handle more niche and premium production, like foldables and testing for camera systems. Local suppliers could capture more component work if Samsung ramps up in-country value addition.

Forward Outlook: Will U.S. Imports from Vietnam Recover?

There are three likely scenarios. In the base case, shipments rebound moderately if U.S. demand picks up and tariffs ease. Vietnam keeps a sizable smartphone output but serves more global customers beyond the U.S.

In a bull case, Samsung retools Vietnam to make more high-margin devices for export to the U.S., pushing numbers up again. However, in a bear case, India and other hubs take a lasting share of U.S. orders while Vietnam pivots to components and R&D work.

Market watchers also highlight one wild card. Tech policy and future tariffs could swing decisions fast. Supply chains respond quickly to new rules. Companies often use an AI tool or in-house models to stress-test scenarios before shifting major capacity. The choice will depend on trade policy, cost trends, and how fast demand returns in the U.S.

Closing Note

Vietnam remains central to global electronics. Samsung’s plants there will not vanish overnight. But the role is evolving. Vietnam is moving from sheer volume production toward higher-value assembly and testing.

For U.S. imports, the era of Vietnam as the dominant supplier may be fading. That shift will reshape suppliers, local jobs, and the map of global phone manufacturing in the years ahead. The next moves by Samsung and policymakers will decide how quickly that new map takes shape.

Frequently Asked Questions (FAQs)

U.S. imports fell because demand slowed in 2025, costs rose, and some production moved. New U.S. tariffs in late 2025 also reduced shipments from Vietnam.

Yes, Samsung increased production in India during 2024-2025. India offers lower costs and new incentives. This shift reduced Vietnam’s share of phones sent to global markets.

Prices may change slightly if shipping costs rise or supply shifts. By late 2025, most models stayed stable, but future prices depend on demand and trade rules.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.