Hindustan Zinc Shares Jump 3%: Market Movers Explained

On December 12, 2025, Hindustan Zinc shares rose sharply in early trading. The stock climbed about 3 % in intraday deals and hit higher price points than the previous session. This move drew strong attention from traders and investors. It stood out as one of the better performances in the metal sector that day.

What makes this jump interesting is what lies beneath it. Zinc and silver prices have been rising around the world. These metals are core to the company’s business and profitability. That has pushed both traders and long-term holders to take fresh positions.

In a market where many big stocks move slowly, a 3 % rise signals real interest. This article will explain why Hindustan Zinc shares jumped, which forces pushed the price, and what it means for investors now.

Hindustan Zinc: Market Drivers Behind the 3% Rise

The immediate trigger was a sharp rise in precious-metal prices, especially silver. Traders moved quickly when futures and spot quotes hit fresh highs in early December 2025. That trend pushed Hindustan Zinc higher because silver forms a large part of the company’s earnings mix. Heavy trading and positive sector momentum added fuel. On December 12, 2025, the stock rose about 3% in active trade as markets digested these metal moves.

Zinc & Silver Prices: The Silent Force Shaping HZL’s Rally

Zinc remains the business core. Higher zinc prices lift revenue per tonne. Silver is the surprise booster. When silver rallies to record levels, Hindustan Zinc’s margins expand fast. Global supply tightness and stronger demand from industry and investment pools tightened the market in late 2025. China’s inventory shifts and seasonal demand patterns also supported prices. These commodity shifts explain much of the stock’s short-term strength.

Investor Positioning: Who Bought the Spike?

Activity shows both traders and larger players stepping in. Option volumes and open interest rose before the sharp moves. That suggests speculative positioning alongside longer bets. On several early-December sessions, the value traded in Hindustan Zinc spiked. Delivery volumes tell a mixed story; some sessions showed heavy trade but lower delivery percentages. That hints at intraday, momentum-driven flows as well as genuine accumulation by institutions.

Production & Operational Updates

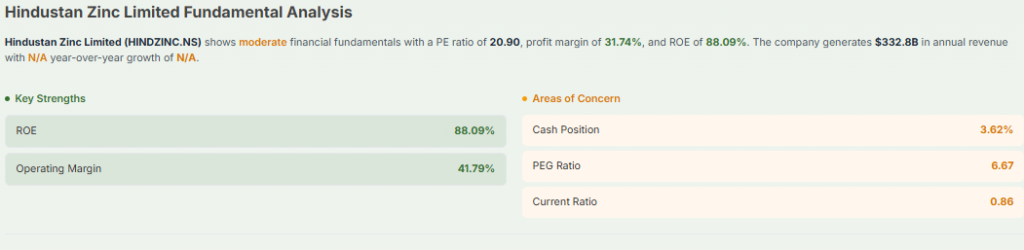

Operational numbers have been steady. Quarterly profit and revenue figures improved year-on-year in Q2 FY26. The company reported higher output and stable smelter performance. Management also flagged capacity expansions and recovery projects that can lift metal yield. These operational signals reduce execution risk and make higher commodity prices more profitable. Investors are pricing in stronger cash flow as production remains reliable.

Vedanta & Government Signals: Ownership Overhang Easing?

Hindustan Zinc remains part of the Vedanta group. Any talk about Vedanta’s balance sheet or stake moves influences sentiment. Recent regional projects and state investments drew government attention in December 2025. Announcements about industrial parks and a fertiliser plant also placed Hindustan Zinc in a broader strategic frame. That helped calm worries about ownership overhang and made some investors more comfortable holding the stock.

Dividend Magnet Effect: Why Traders Chase HZL Around Payout Cycles

Historically, Hindustan Zinc has returned sizable cash to shareholders. That makes the stock attractive to income funds. When metal prices rise, the chance of large dividend payouts grows. Some traders build positions ahead of expected payouts. That creates buying pressure that compounds price gains from commodity moves. The result is periodic rallies that are partly fundamental and partly calendar-driven.

Analyst Reactions on Hindustan Zinc 3% Surge

Brokerages reacted by revising near-term earnings per share and fair value bands. Many analysts increased profit forecasts, citing higher silver realisations and steady zinc output. Some research houses used an AI tool to run sensitivity checks on earnings under different metal price scenarios. The consensus view tilted positive, though target ranges still show variance across firms. Analysts cited higher EBITDA per tonne and improving free cash flow as reasons to lift estimates.

Risk Factors the Market Might Be Ignoring

There are real risks. Silver and zinc are volatile. A sudden drop in global demand, especially from China, would hurt prices. Energy or input cost spikes could squeeze margins. Political or regulatory changes tied to mining or environmental rules add execution risk. Also, a broad market correction could undo short-term gains even if fundamentals stay intact. Investors must remember these scenarios when chasing momentum.

What This Means for Investors: Short-Term vs Long-Term Outlook

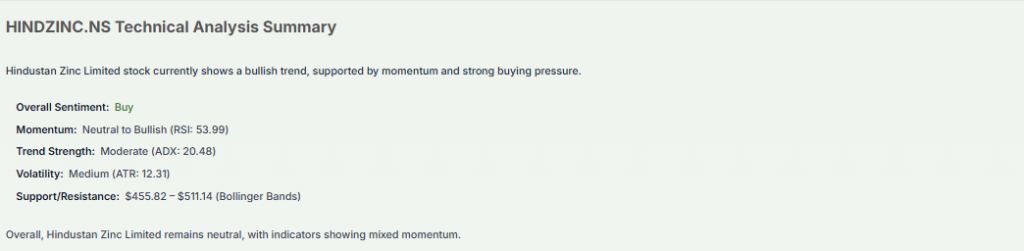

In the short term, momentum can carry the stock further. Traders will watch near-term support and resistance levels, and option flows. For long-term holders, the story rests on sustained commodity pricing and successful capacity expansion.

If silver and zinc stay strong and the reprocessing and capacity projects proceed, the firm’s free cash flow should rise materially over the next 12–24 months. Conversely, any slip in metal prices or execution issues could reset expectations quickly. Monitor production updates and quarterly numbers closely.

Conclusion: The Real Story Behind the Day’s Rally

The December 2025 rally reflects two forces. One is commodity strength, led by silver and supported by zinc. The other is operational stability and clear growth plans. Together, these forces create a favorable risk-reward mix for both traders and longer-term investors. Still, market watchers should keep an eye on metal prices and execution on planned projects. Those will determine whether the recent gains become a lasting trend or a short-lived swing.

Frequently Asked Questions (FAQs)

Hindustan Zinc rose on 12 December 2025 because silver and zinc prices moved higher. Traders reacted fast, and buying increased during early trade. Market mood also stayed positive.

Hindustan Zinc may look better when metal prices rise, but the choice depends on risk and goals. Prices can change fast. Investors should check recent trends before deciding.

The outlook depends on global zinc and silver demand. If prices stay strong, earnings may improve. But any slowdown can hurt growth. Watching quarterly results is important.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.