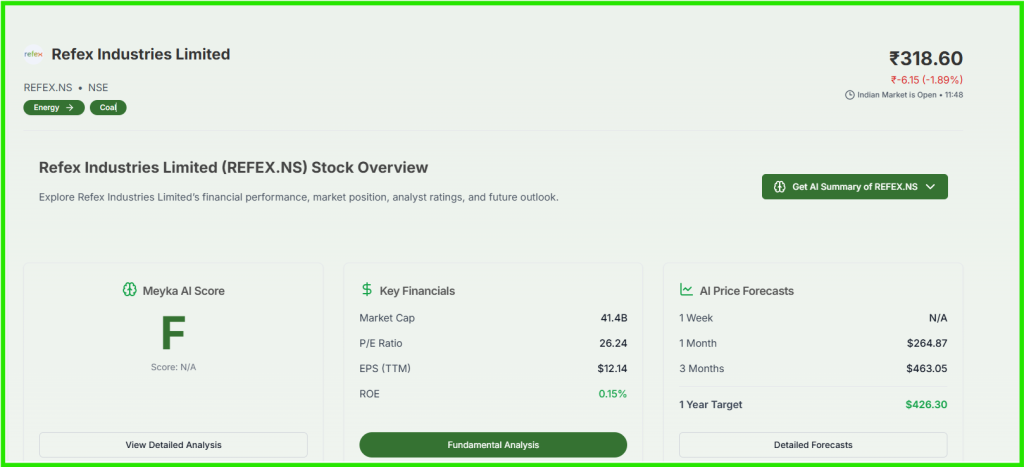

Refex Industries Drops to Intraday Lows on Persistent Selling Pressure

In a dramatic trading session on December 12, 2025, Refex Industries fell sharply to fresh intraday lows as persistent selling pressure gripped the stock, pushing it below recent support levels and resulting in heavy losses for traders.

The chemical sector company, which operates in refrigerant gases, ash handling, power trading, and related businesses, saw its share price dive sharply after a gap down at market open and unprecedented volatility throughout the day.

This detailed report explains why Refex Industries (REFEX.NS) dropped, how the intraday pressure evolved, what market indicators tell us about the current trend, and what investors should watch next. The article is structured to help both novice and experienced readers understand the key forces behind the decline while optimizing for search engines and featured snippets.

What Happened to Refex Industries Today

Refex Industries Ltd (REFEX.NS) experienced intense selling pressure on December 12, 2025, with its shares plunging over 19 percent and hitting the lower circuit limit during trading. The stock opened sharply lower and never recovered, ultimately settling near its intraday low of ₹254.9, marking a new 52-week low.

The selling pressure was not limited to a small dip. High trading volume, a widening price range, and a lack of buying interest at higher levels underlined the negative market sentiment around the stock.

Why is the drop significant?

Because a drop of this magnitude, combined with a fresh one-year low, often signals deeper market concerns rather than simple profit taking or technical correction.

Immediate Trading Pressure and Intraday Price Action

When the market opened on December 12, Refex Industries saw a gap-down opening, indicating that sellers aggressively priced their shares before the first bell.

The stock (REFEX.NS) then experienced persistent selling pressure throughout the session, with the price fluctuating within a wide band but mostly clustering near the lows.

Key intraday movements included:

- Opening sharply lower by more than 7 percent compared to the previous close.

- Intraday range of nearly ₹42, indicating high volatility.

- Stock closing near the lowest price of the day, a clear sign of seller domination.

What does an intraday low indicate?

An intraday low on strong volume often points to deteriorating investor confidence, especially when buyers are not stepping in to absorb selling pressure.

Technical Indicators Behind the Selling Pressure

Technical trends offer important clues about why Refex Industries (REFEX.NS) is under pressure.

- The stock is trading below all major moving averages, including short-term and long-term bands such as 5-day, 20-day, 50-day, and beyond.

- A decline below these moving average levels usually signals a bearish trend, meaning sellers have greater control than buyers.

- Over the past year, the stock has lost approximately 40 percent in value, starkly underperforming key benchmarks like the Sensex.

Analytical tools such as the Relative Strength Index (RSI) also suggest oversold conditions, although such readings can continue when heavy selling persists.

Broader Market and Sector Context

Even though Refex Industries (REFEX.NS) faced steep declines, broader markets showed resilience on the same days. While indices such as the Sensex and Nifty continued to trade with modest gains, Refex Industries’ performance diverged sharply.

This divergence points to company-specific pressures rather than a widespread market downturn.

What does this difference mean?

When a stock falls while the market rises, it often reflects negative sentiment unique to that company, such as concerns about fundamentals, news events, or earnings outlooks, rather than broader economic conditions.

What Market Participants Are Saying

Some traders on social platforms have raised concerns about the steep drop:

This reflects sharp market attention, particularly when a stock’s price meets the lower circuit limit, a technical threshold designed to prevent excessive volatility.

These reactions capture real-time trader sentiment and highlight anxiety among holders as prices continue to fall.

Is There a Trigger Behind Persistent Selling?

Possible Regulatory or News Catalyst

One notable development that may have contributed to selling pressure is the Income Tax department search and compliance news linked to Refex Group entities. A major news source reported the discovery of alleged tax evasion over ₹1,000 crore in transactions tied to the company and unexplained offshore investments.

This type of news often triggers risk-off behaviour from investors, especially in small-cap stocks where confidence is more fragile.

Can this explain the sharp drop?

Yes. Regulatory scrutiny and negative headlines can prompt both short-term traders and institutional investors to sell holdings, fearing legal or financial consequences.

How the Stock Performed Recently

Refex Industries (REFEX.NS) hasn’t just fallen suddenly. The stock has shown a downward trend over recent weeks, with multiple 52-week lows recorded:

- Around ₹330 on November 21, 2025.

- Near ₹315.25 on November 24, 2025.

- And the fresh low at ₹254.9 on December 12, 2025.

What does a series of fresh lows indicate?

A series of lower lows usually signals that sellers are consistently taking control and that confidence in the stock is weakening.

Investor Concerns and Company Fundamentals

Beyond immediate trading trends, investor concerns often tie back to company fundamentals. According to recent data:

- Refex Industries’ net sales and performance metrics showed signs of pressure in recent quarters.

- The Price to Book value and valuation measures reflected higher valuations compared to industry averages, which may have made the stock vulnerable to correction.

- Declining operating cash flows and net sales contraction are additional points that can alarm investors.

These indicators, combined with regulatory news, can make even fundamentally stable stocks behave erratically in the short term.

What Investors Should Watch Going Forward

Price and Volume Trends

Investors should watch whether the stock can hold above key support levels or if selling continues to push it lower.

Regulatory Updates

News related to regulatory actions or legal clarity could significantly impact sentiment and trading activity.

Sector Movement

Tracking how the Other Chemical products sector and comparable small caps trade can offer clues about sector-wide trends.

Historical Context of Refex Industries’ Performance

Refex Industries has experienced strong gains in prior years, with significant stock growth over longer horizons before recent declines. These patterns indicate the stock can be volatile, with periods of strong upside followed by extended corrections.

This historical context helps investors frame current drops within a longer timeline, rather than viewing them as isolated events.

Conclusion: Refex Industries Faces Heavy Selling and Investor Caution

In summary, Refex Industries dropped to intraday lows on persistent selling pressure, driven by a combination of gap down opening, sustained volatility, regulatory news and weakening technical signals. The stock’s behaviour reflects a complex mix of short-term sentiment and longer-term concerns about fundamentals and market confidence.

Investors tracking this stock should pay attention to price support levels, trading volumes, regulatory updates, and broader sector performance to understand whether the current negative trend might reverse or extend further.

This detailed look at the trading pressure, price movement and investor sentiment provides clarity on why Refex Industries fell sharply and what factors will matter most in the coming days and weeks.

FAQ’S

A combination of persistent selling pressure, gap-down opening, and negative news, including regulatory scrutiny, contributed to the decline.

No. The wider market showed resilience, but Refex Industries lagged, suggesting company-specific factors at play.

Partly. Recent performance data shows underperformance relative to peers and industry averages, raising concerns among investors.

Recovery could depend on improved news flow, stronger fundamentals, positive regulatory outcomes, and renewed investor confidence.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.