FTSE 100 Edges Higher Despite UK GDP Falling 0.1% Against Forecasts

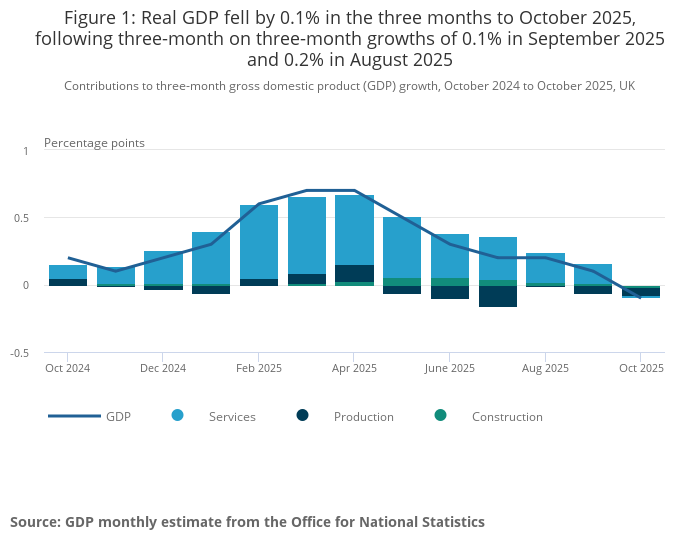

On 12 December 2025, new data showed the UK economy unexpectedly shrank by 0.1% in October. Economists had forecast slow growth or no change, but the output fell instead. This weak reading came from the Office for National Statistics and surprised many traders and analysts. At the same time, the FTSE 100 stock index edged higher in London.

The rise came even as the economy lost momentum. It may seem odd that the market went up when the economy went down. But investors looked past the bad data and focused on other forces. This reaction points to deeper trends inside the index and hints at what traders value right now.

This article explores that unusual move. It looks at why the FTSE 100 climbed despite the GDP drop, and what it means for investors and the wider UK economy.

What does the UK GDP Print show?

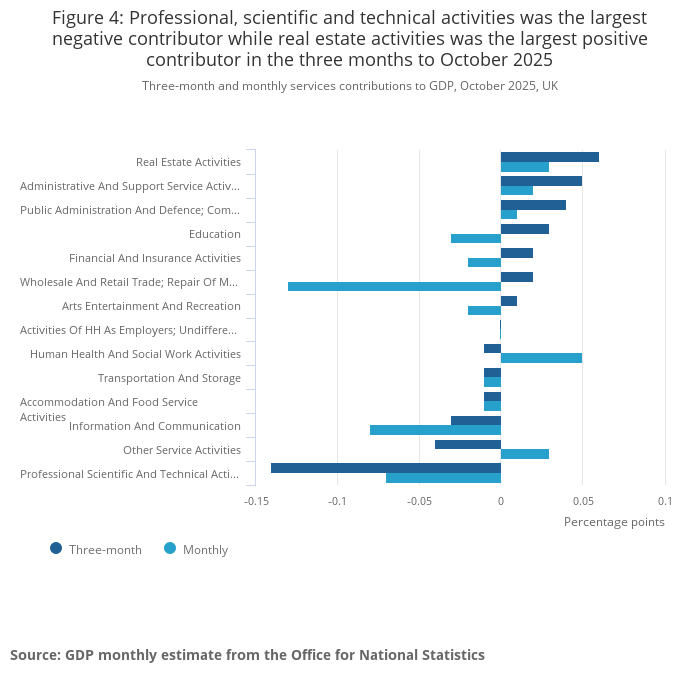

On 12 December 2025, the Office for National Statistics published the monthly GDP estimate for October. The economy contracted by 0.1% in October. That result surprised economists who had expected flat or slight growth. Services output was the main drag. Construction also fell, while production showed some pickup. The ONS noted the release is a monthly estimate and can be volatile.

Why the FTSE 100 Climbed Despite the Drop?

The FTSE 100 rose even as the GDP print disappointed. The index is heavy with global firms. Those companies earn much of their cash overseas. A weaker pound lifts sterling-equivalent profits when they are repatriated. In addition, commodity strength and positive global cues softened the hit from bad UK data. Investors treated the GDP miss as a local issue rather than a global shock. Markets often price in multiple drivers at once.

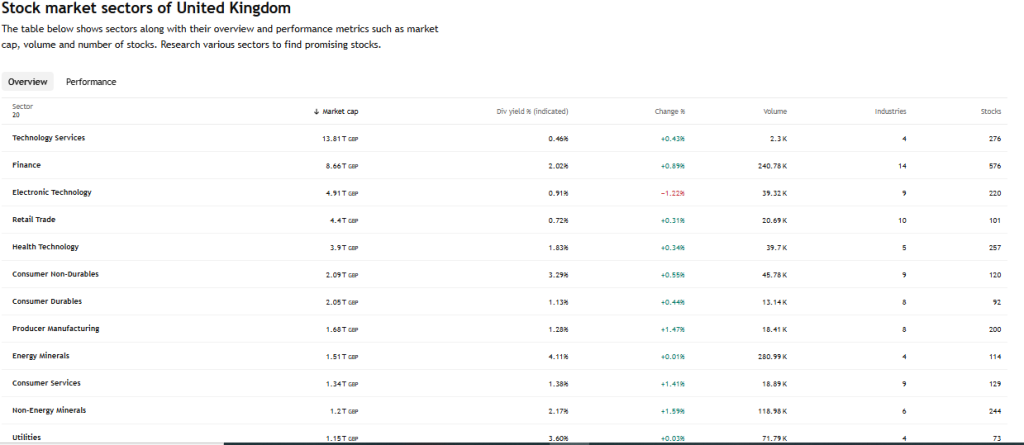

Sector Breakdown: Who Lifted the Index

On 12 December 2025, the FTSE 100 rose about 0.31% to around 9,736 points, with volume in the tens of millions showing active trading. Energy and mining stocks were among the biggest contributors that day. Higher oil and metal prices helped names like Anglo American and Antofagasta move up, supporting the index’s gains.

Energy and mining firms together account for a large slice of the FTSE 100’s total market value. Their gains lifted the index as a whole, even while some UK-focused sectors lagged. Healthcare and consumer staples also showed positive moves, attracting investors seeking stable earnings, while growth data disappointed. In contrast, domestically focused retailers and small UK stocks underperformed, reflecting continued concern over weak UK demand.

This mix of strong global earners and weaker domestic names shows how the FTSE 100 can climb on international strength even when local economic data weakens.

Currency Angle: Pound Weakness Helped Multinationals

Sterling dipped after the GDP print. The slide made overseas revenues worth more in sterling terms. This conversion effect helps big exporters and miners. Markets also priced a higher chance of the Bank of England easing, which pressured the pound further. That dynamic made foreign earnings more attractive and supported the index on 12 December 2025.

What does it mean for Monetary Policy?

The surprise contraction raised market odds of earlier rate cuts by the Bank of England. Policymakers face a trade-off. Growth is softening, but inflation remains a constraint. If weak prints persist, the BoE may tilt toward easier policy sooner than expected. However, a single monthly figure is not decisive. The central bank will weigh a wider set of data before shifting guidance.

Investor Sentiment and Flows

On the trading day, flows favoured size and stability. Big-cap stocks with global exposure attracted capital. That pattern often emerges when domestic data disappoints, but global liquidity stays intact. Some traders rotated out of FTSE 250 names and into top-tier blue chips. International factors, especially US economic signals and commodity moves, also shaped sentiment.

Risk Points to Watch Next

A few clear risks should be tracked. First, follow the next monthly GDP releases to see if weakness continues. Single months are noisy. Second, watch UK inflation and retail sales. Those will shape the BoE’s path. Third, monitor China’s demand and the US monetary signals. Both affect commodity-exposed FTSE names. Fourth, keep an eye on sterling. Further slides would keep supporting multinational earnings, while rebounds would remove that tailwind.

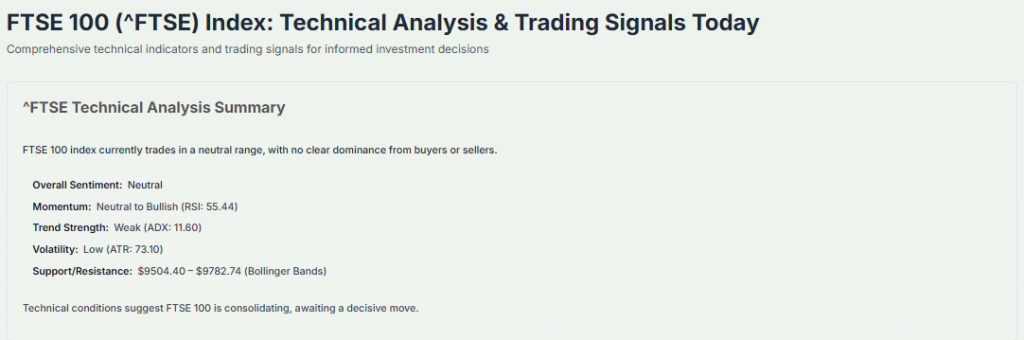

Technical and Tactical Snapshot

The FTSE 100 traded with modest intraday momentum after the data. It cleared short-term resistance levels and held support around recent ranges. For traders, this offered tactical space for momentum trades.

For longer-term holders, the key question is whether multinational earnings remain robust amid softer UK domestic demand. Earnings releases this season will be decisive for positioning. Market data on volumes and price action give useful context for short-term decisions.

How to Use Tools Without Overreach

An AI stock research analysis tool can speed screening for names most exposed to currency swings and commodities. Use it to identify specific constituents that convert foreign profits into sterling gains. But combine tool outputs with human judgment. Tools highlight candidates. Humans must read the narrative.

Takeaway

The FTSE 100’s rebound on 12 December 2025 shows the index’s global bias. A weak UK GDP print matters. Yet currency moves, sector composition, and commodity momentum can outweigh a single monthly miss. Investors should track the next data points and earnings updates. Those will reveal if markets are simply looking past a temporary slowdown or if a deeper trend is emerging.

Frequently Asked Questions (FAQs)

The FTSE 100 rose on 12 December 2025 because global stocks were strong, oil prices improved, and a weaker pound boosted big companies that earn most of their money overseas.

A weak UK GDP reading, like the 0.1% fall in October, can increase the chances of future rate cuts. But the Bank of England still watches inflation and other data before deciding.

Exporters and global companies usually gain when the pound drops. A weaker GBP makes their overseas profits worth more in sterling. This often helps energy, mining, and consumer giants.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.