Sensex Today (15 Dec 2025): Corona Remedies Share Price Debuts Over 38% Premium on NSE

The Sensex index in the Indian stock market opened on a strong note on 15 December 2025. Investor mood was upbeat from the first bell. One key reason was the much-awaited stock market debut of Corona Remedies. The pharmaceutical company made a powerful entry on the NSE. Its shares are listed at a premium of over 38% to the IPO price. This instantly caught market attention.

At the same time, the Sensex reflected this positive energy. Pharma stocks showed buying interest early in the session. Traders and investors closely tracked price moves, volumes, and sector trends. IPO listings often act as a mood indicator. Today was no different.

Corona Remedies’ listing came at a time when confidence in quality healthcare businesses is improving. Rising demand, stable earnings, and sector recovery have shaped expectations. For many retail investors, today’s listing was more than just a number. It was a signal.

As markets evolve through the day, the focus remains on what this debut means for sentiment, valuations, and near-term trading behaviour.

Corona Remedies Share Price Debut: Listing Day Performance

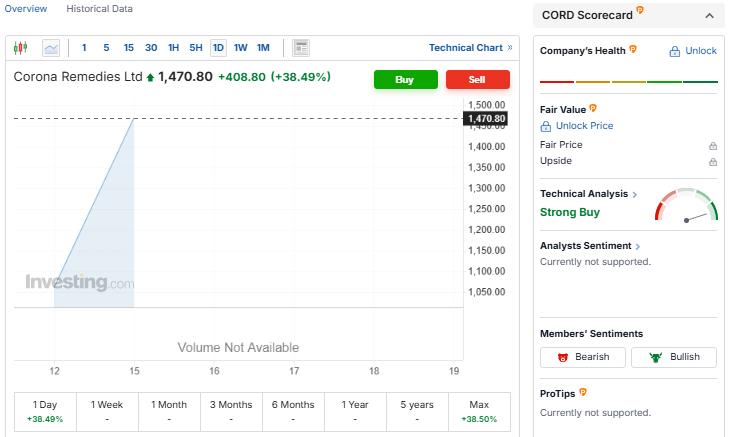

Corona Remedies made a strong stock market debut on 15 December 2025. The shares opened on the National Stock Exchange (NSE) at around ₹1,470, which was about 38% higher than the IPO issue price of ₹1,062 per share. On the Bombay Stock Exchange (BSE), the stock also listed strongly with similar gains. This premium on listing shows high investor interest in the company’s shares on day one of trading.

By mid-morning trading, Corona Remedies shares were still trading well above the IPO price, with recorded quotes around ₹1,493-₹1,469 on the NSE and BSE, reflecting a big jump from the issue price. These gains meant many investors who got allotment in the IPO booked immediate profits on the listing day.

GMP vs Actual Listing Price: What Changed?

Before listing, the Grey Market Premium (GMP) for Corona Remedies had suggested a healthy premium over the IPO price, often seen as a rough indicator of listing strength. In the days before 15 December 2025, the GMP was high, hinting at positive demand and strong expected listing gains. Real-time grey market quotes showed significant premiums as investors and traders anticipated this performance.

However, the actual listing premium on the NSE was about 38% higher than the IPO price, exceeding many earlier GMP projections. This means official stock market demand was even stronger than unofficial signals suggested. Such outcomes are not always guaranteed, as grey market rates can vary quickly. Still, in this case, the premium moved in the same direction as GMP.

Who Bought on Day One? Demand Patterns Explained

Institutional investors often drive early trading volume on listing day. For Corona Remedies, subscription data before listing showed strong interest across investor groups, especially Qualified Institutional Buyers (QIBs). The IPO was oversubscribed by multiples across categories, indicating wide participation from retail and institutional segments alike.

With strong buying pressure from institutions and retail investors on listing day, the stock opened at a premium. Many retail investors who were allotted shares saw quick gains. Some traders likely booked profits soon after the opening jump, while medium-term holders may continue to watch fundamentals and sector outlook for future moves.

Impact on Sensex and Market Mood

The broader Indian markets, including the Sensex and Nifty 50, showed mixed moves on 15 December 2025. While the Corona Remedies listing added positive sentiment in the healthcare space, other sectors saw pressure that offset some gains. Overall, the Sensex reflected a complex mix of buying and selling across sectors during the session.

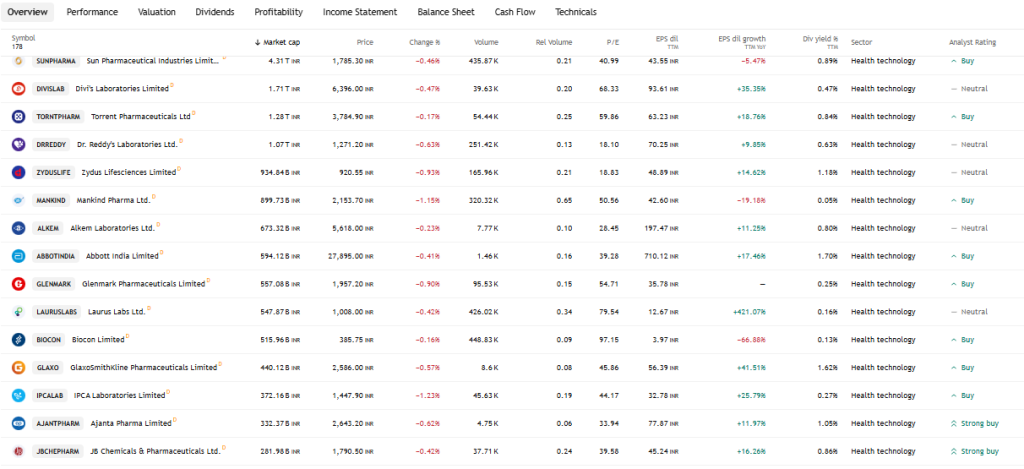

Pharma and healthcare stocks gained attention as investors rotated capital into defenders amid broader volatility. The strong debut of Corona Remedies signaled renewed interest in quality pharma names, especially those with diversified portfolios and consistent demand. However, this single IPO listing did not dominate market direction; rather, it added a sector-specific boost alongside broader index performance.

Pharma Sector Context: Why Corona Remedies Stood Out?

Corona Remedies belongs to the branded pharmaceutical formulations segment, a space that has seen steady growth and resilience in India. Its products span therapeutic areas like women’s health, cardio-diabetes, and pain management. This broad product range supports steady revenue streams and investor confidence in long-term demand.

The company operates manufacturing units and sales forces across key states, driving market penetration. Prior to listing, the IPO attracted strong bids, pushing oversubscription levels very high across investor categories. This suggested that both retail and institutional players saw value in a proven pharma franchise with solid fundamentals and growth metrics.

Analyst Views and Valuation Signals

Analysts tracking the IPO noted that strong subscription and high GMP trends often point to a good listing outcome, especially in stable sectors like healthcare. Research professionals highlighted that a premium listing usually means greater confidence in a company’s profit outlook and competitive position.

Some brokerages also pointed out risks tied to broader market volatility, sector-specific headwinds, or pricing pressures in the pharma market. But on listing day, the strength of demand helped push the price above early forecasts. Many investors saw this as a sign of premium valuation acceptance at current price levels.

Investor Takeaways After Listing

For those who received Corona Remedies shares in the IPO allotment, the 38% premium on 15 Dec 2025 offered immediate gains. Long-term investors will watch financials, growth drivers, and sector trends to decide further actions. Those seeking short-term profits may choose to sell, while others may hold based on future performance indicators like earnings growth and market expansion.

The listing also reinforces that well-received IPOs in strong sectors can still offer value, especially when backed by solid demand and robust subscription activity. However, past listing performance does not guarantee future price moves, so investors should consider valuation, risk tolerance, and broader market conditions before making decisions.

What’s Next for Corona Remedies Stock?

After the strong debut, attention will shift to the stock’s trading behavior in the coming days. Market watchers will track price stability, daily volume, and sector sentiment for further clues on where the stock may head next. Broader indices like Sensex and Nifty will continue to shape investor mood alongside individual stock performance.

Corona Remedies’ fundamental metrics, expanding brand portfolio, and market position will remain key focus areas. As investors digest the listing day premium and assess long-term prospects, the stock’s movement beyond the debut will reveal how much momentum it can sustain in a competitive marketplace.

Closing Note

Corona Remedies’ debut on 15 December 2025 sent a strong signal to the market. Listing at a 38% premium reflects high investor confidence in the pharma sector. While retail and institutional investors enjoyed early gains, the stock’s future will depend on fundamentals and sector trends.

The listing highlights the growing appetite for quality healthcare IPOs in India. Investors will now watch how the stock performs in the days ahead, balancing short-term opportunities with long-term growth potential.

Frequently Asked Questions (FAQs)

Corona Remedies shares were listed on the NSE and BSE on 15 December 2025 at around ₹1,470, which was much higher than the IPO issue price of ₹1,062.

On its debut on 15 December 2025, Corona Remedies shares rose over 38% from the IPO price. Both NSE and BSE showed strong buying interest on the first trading day.

The Corona Remedies IPO was fully subscribed before 15 December 2025. Strong demand came from retail, institutional, and anchor investors across all subscription categories.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.