New Zealand Shares Rise on December 15 Ahead of Central Bank Rate Decisions; PGG Wrightson Boosts Fiscal 2026 EBITDA Forecast

On 15 December 2025, New Zealand shares moved higher in a careful but positive trading session. Investors were active, but not aggressive. The reason was clear. Major central banks were close to making fresh interest rate decisions. Markets do not like surprises. So traders chose balance over risk.

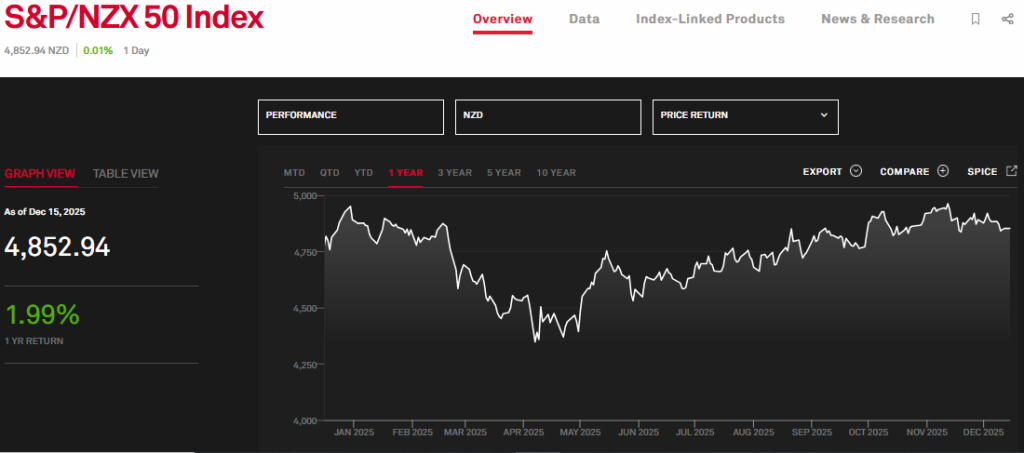

The NZX 50 Index gained ground as buyers focused on strong local signals instead of global noise. Bond yields stayed steady. The New Zealand dollar showed limited movement. This helped calm equity markets. Rate-sensitive stocks held firm. Export and agriculture names attracted attention.

One company stood out. PGG Wrightson updated its outlook and lifted its fiscal 2026 EBITDA forecast. That news added confidence to the wider market. It also highlighted a key theme. Earnings strength still matters, even when rates are uncertain.

This session was not about big rallies. It was about positioning. Investors showed they are thinking ahead, not just reacting. The day reflected cautious optimism in New Zealand’s equity market.

Market Snapshot: NZX Gains in a Cautious Global Environment

On 15 December 2025, New Zealand equity markets moved with caution. The S&P/NZX 50 finished marginally higher after a soft session. Trading volumes were mixed. Agriculture and exporter stocks led interest. Domestic investors watched global central bank moves.

The mood was steady rather than euphoric. Markets priced in near-term policy moves from major central banks. Footnote: the NZX showed narrow breadth, with more small declines than big gains.

Investor Positioning Ahead of Key Central Bank Rate Decisions

Traders entered the day in a wait-and-see stance. The US Federal Reserve, the ECB, and the Bank of England had meetings this week. The Reserve Bank of New Zealand’s tone was also under close review. Investors reduced big bets. They rebalanced toward firms with clear earnings. Rate-sensitive sectors saw lighter flows. Equity moves reflected hedging and preservation. Short-dated bond yields and swap rates reacted to shifting expectations.

Reserve Bank of New Zealand: What Markets are Pricing In?

The RBNZ cut the OCR to 2.25% on 26 November 2025 and signalled a cautious stance. Markets now expect a period of steady policy, but also watch for signs of future tightening. Governor Anna Breman emphasised that the policy path is not preset. That reduced the chance of an immediate hike. The NZ dollar showed modest weakness as traders digested the outlook. This backdrop supports exporters but tightens the outlook for high-debt sectors.

Stock in Focus: PGG Wrightson Lifts FY2026 EBITDA Forecast

PGG Wrightson raised its FY2026 EBITDA guidance in company updates earlier in 2025. The guidance lifts followed stronger demand for farm services and resilient commodity prices. The firm’s operating units reported firmer margins and improved trading in core rural supplies. The guidance revision prompted extra interest in the stock on 15 December 2025.

Volume spiked as funds adjusted positions. Investors noted that clearer earnings paths can outweigh macro uncertainty. For reference, PGG Wrightson’s guidance update was published in company filings on 13 October 2025.

Why are Agricultural Stocks Outperforming in New Zealand?

Agriculture is central to the Kiwi economy. Commodity prices for dairy and red meat stayed firm through 2025. That strengthened cash flows for rural suppliers and exporters. Farmers booked income and sought inputs. This lifted revenues for agribusiness firms. Investors prize visible earnings when rates are unclear.

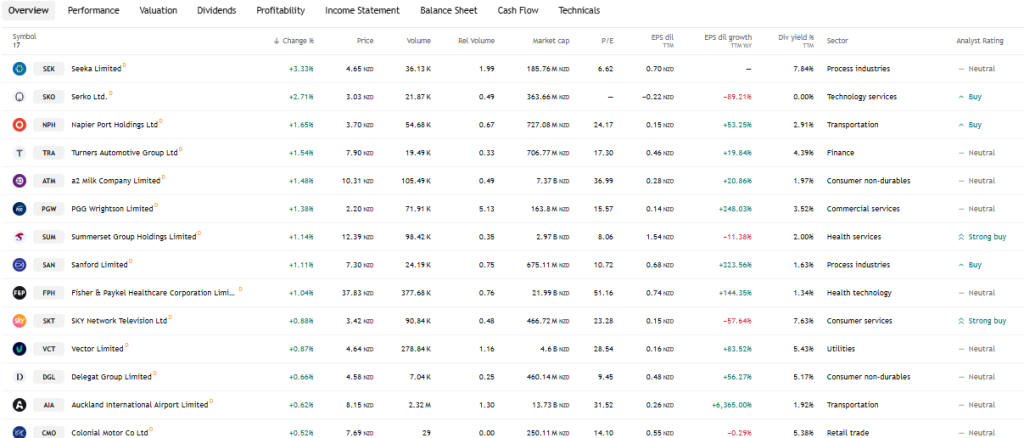

The sector also benefits from a weaker NZ dollar at times. PGG Wrightson and Seeka were among the names drawing attention on 15 December 2025. The primary sector’s relative stability offered a safe harbour for many traders.

Broader NZX Movers and Laggards on the Day

Beyond agriculture, industrial and export-oriented firms posted gains. Some financials underperformed amid mixed futures for lending margins. Utilities showed resilience on dividend safety. Small caps displayed more volatility than large caps. Foreign investor flows were muted. Domestic funds did modest rebalancing toward cash-generating names. Market breadth suggested selective confidence. The session did not show broad risk-on behaviour.

What does this mean for New Zealand Investors Going Forward?

Short-term outlook depends on central bank guidance and US data this week. If major banks signal patience, risk assets may hold gains. A hawkish surprise would pressure yields and weigh on rate-sensitive stocks. Investors should watch earnings revisions and balance sheet strength.

Focus on firms with steady cash flows and clear guidance. Use valuation discipline. Analysts are increasingly using AI stock research analysis tool outputs to scan earnings signals, but those should complement, not replace, fundamental checks. Keep time horizons clear. Plan for volatility around policy dates and big data releases.

Conclusion: Fundamentals Matter in a Tight Policy Window

The 15 December 2025 session showed that earnings news still moves markets. PGG Wrightson’s guidance upgrade provided a real anchor. The RBNZ’s recent rate cut to 2.25% and its cautious messaging shaped investor caution. Markets chose selective buying over broad risk-taking. That pattern may continue until the central bank paths clear. Investors who pick firms with transparent earnings and strong cash flow stand a better chance of navigating the next policy-driven swings.

Frequently Asked Questions (FAQs)

New Zealand shares rose on 15 December 2025 as investors waited for central bank rate decisions and responded to improved earnings outlooks, especially from large agriculture-linked companies.

Interest rate decisions change borrowing costs and bond returns. This affects company profits, investor risk appetite, and stock prices, especially in rate-sensitive sectors like property, utilities, and banks.

PGG Wrightson matters to the NZX because it reflects farm sector health. Its earnings guidance often signals trends in agriculture, exports, and rural demand across New Zealand’s economy.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.